Get the free Tax and Earnings Statement for Verification - usm

Show details

Este documento se utiliza para verificar los ingresos y la situación fiscal de un estudiante que no está obligado a presentar una declaración de impuestos federales debido a no cumplir con los

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax and earnings statement

Edit your tax and earnings statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax and earnings statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax and earnings statement online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax and earnings statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

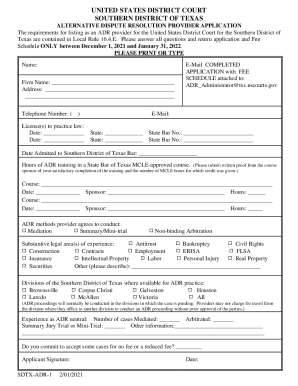

How to fill out tax and earnings statement

How to fill out Tax and Earnings Statement for Verification

01

Gather all necessary financial documents including W-2 forms, 1099 forms, and any personal income records.

02

Complete the Tax section by entering your total annual income as reported on your tax return.

03

Fill in the Earnings section with details about your current employment, including employer name, address, and your role.

04

Provide any additional income sources in the appropriate sections, ensuring accuracy in reporting.

05

Review all entered information for discrepancies or errors before submission.

06

Sign and date the statement where required to validate its authenticity.

Who needs Tax and Earnings Statement for Verification?

01

Individuals applying for loans or mortgages who need to verify their income.

02

Applicants for rental agreements that require proof of income.

03

Job seekers who need to present income verification for employment considerations.

04

Students applying for financial aid or scholarships that necessitate income information.

05

Any person undergoing a financial assessment for government aid programs.

Fill

form

: Try Risk Free

People Also Ask about

What if I lost my IRS verification letter?

If the letter cannot be located, taxpayers should check their IRS online account or call the Taxpayer Protection Program (TPP) phone line at 800-830-5084. (If a taxpayer lives outside the U.S., they should call 267-941-1000.)

What can I use as a tax verification document?

Social Security Number Verification A copy of the individual's Social Security Statement (SSA- 7005) Proof of wages earned. Photo identification.

How do employers verify income?

Some companies verify income using pay stubs, tax returns and other documents. Others use consumer-permissioned verification, which makes the process more efficient.

How do I get proof of income from the IRS?

Ways to get transcripts If you're unable to register, or you prefer not to use Individual Online Account, you may order a tax return transcript and/or a tax account transcript through Get transcript by mail or by calling the automated phone transcript service at 800-908-9946.

How can I get income verification?

Earned Income: Employer Wages Pay stub. Most recently filed Federal Income Tax Form 1040, with any appropriate Schedules. Wage/Income Tax Statement (such as a W2, 1099MISC, 1099G, 1099R, 1099SSA, 1099DIV, 1099SS, 1099INT, or 1099NEC, or other form displaying your income and taxes). Employer statement.

What if I lost my IRS verification letter?

If the letter cannot be located, taxpayers should check their IRS online account or call the Taxpayer Protection Program (TPP) phone line at 800-830-5084. (If a taxpayer lives outside the U.S., they should call 267-941-1000.)

How to get income verification from IRS?

Mail or fax the completed IRS Form 4506-T to the address (or FAX number) provided on page 2 of Form 4506-T. If the 4506-T information is successfully validated, tax filers can expect to receive a paper Wage and Income Transcript at the address provided on their request within 5 to 10 days.

How do I know if my income statement is correct?

Big profits on an income statement while small on the cash flow statement may indicate a red flag in earnings. Decreasing Non-operating income which is easy to identify because it's stated separately from operating income on the income statement.

How to verify an income statement?

How to Provide Proof of Income Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

How do you verify proof of income?

Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax and Earnings Statement for Verification?

The Tax and Earnings Statement for Verification is a document that provides a detailed summary of an individual's income, tax withholdings, and other relevant earnings information, typically used for verification purposes in processes like loan applications or financial assessments.

Who is required to file Tax and Earnings Statement for Verification?

Individuals who need to verify their income for purposes such as loans, rental applications, or financial aid are generally required to file the Tax and Earnings Statement for Verification. This may include employees, self-employed individuals, and freelancers.

How to fill out Tax and Earnings Statement for Verification?

To fill out the Tax and Earnings Statement for Verification, an individual should provide personal information, report total earnings from all sources, indicate any tax deductions and withholdings, and ensure that all information is accurate and supported by documentation.

What is the purpose of Tax and Earnings Statement for Verification?

The purpose of the Tax and Earnings Statement for Verification is to provide an official record of an individual's income and tax contributions, helping institutions to assess financial reliability, eligibility for programs, or approval for loans.

What information must be reported on Tax and Earnings Statement for Verification?

The information that must be reported includes the individual's name, Social Security number, total earnings for the year, tax withholdings, any additional income sources, and details of deductions or exemptions claimed.

Fill out your tax and earnings statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax And Earnings Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.