Get the free MW508

Show details

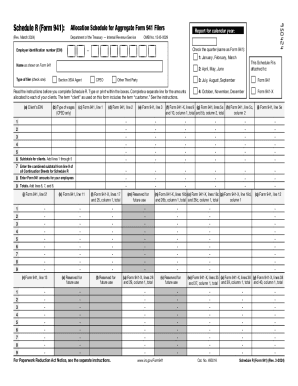

This form is used by employers to reconcile their withholding tax for the calendar year, reporting totals and submitting necessary attachments like W-2 and/or 1099 forms to the Comptroller of Maryland.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mw508

Edit your mw508 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mw508 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mw508 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mw508. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mw508

How to fill out MW508

01

Begin by gathering all necessary information, such as your personal identification details and income information.

02

Visit the official website of your local tax authority to download the MW508 form or obtain a hard copy.

03

Fill out your name, address, and Social Security number at the top of the form.

04

Enter your employment information, including details about your employer and your earnings.

05

Complete the tax withholding sections accurately based on your current financial situation.

06

Review the entire form for any errors or missing information.

07

Sign and date the form once you have double-checked everything.

08

Submit the form to your employer to ensure your withholdings are updated accordingly.

Who needs MW508?

01

Individuals who are employed and need to adjust their state income tax withholding.

02

Employees who have recently changed their marital status or number of dependents.

03

Workers who wish to increase or decrease their withholding to better match their expected tax liability.

Fill

form

: Try Risk Free

People Also Ask about

How much Maryland state tax should be withheld?

Specifically, counties in Maryland collect income taxes with rates ranging from 2.25% to 3.20%. Additionally, there is a statewide income tax in Maryland, with a top rate of 5.75%. These combined state and local taxes place Maryland in the top half of U.S. states for income taxes.

Where to mail mw508a?

If you have questions with regard to filing your MW508 Withholding Reconciliation return, contact Taxpayer Services Division at 410-260-7980. Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001. Enter the total gross Maryland payroll for the calendar year 2023 on the line provided.

How do I edit my tax withholding?

Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments. Then submit it to the organization paying you.

What is mw508a?

Form MW508 is an Annual Employer Withholding Reconciliation used to report the total income taxes withheld from employees/contractors and taxes remitted to the state. It is filed annually to ensure compliance with Maryland's withholding tax requirements.

How do I amend my tax return in Maryland?

You must file your Maryland Amended Form 502X electronically to claim, or change information related to, business income tax credits from Form 500CR. Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.

What are the four types of taxes withheld from Maryland paychecks?

When it comes to processing payroll, Maryland-based organizations must handle the following taxes in addition to those required by the federal government: Personal Income (a.k.a. State Income Tax) State Unemployment Insurance (SUI) Paid Family and Medical Leave (PFML) Local Taxes.

What is the Maryland form MW506?

Form MW-506 is Maryland's reporting form for Return of Income Tax Withheld. In other words, it documents that you withheld your employees' estimated income tax liability and remitted these funds to the state.

What percentage of state tax should be withheld?

State income tax (SIT) withholding StateWithholding rate Alaska No income tax Arizona No supplemental rate Arkansas 3.9% California 6.6–10.23%47 more rows • Feb 26, 2025

What does it mean to claim exemption from Maryland withholding?

This year you do not expect to owe any Maryland income tax and expect to have a right to a full refund of all income tax. withheld. If you are eligible to claim this exemption, complete Line 3 and your employer will not withhold Maryland income tax from your. wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MW508?

MW508 is a tax form used in Maryland for reporting and remitting withholding tax on wages paid to employees.

Who is required to file MW508?

Employers who have withheld Maryland income tax from their employees' wages are required to file MW508.

How to fill out MW508?

To fill out MW508, employers must provide information such as their employer identification number, total wages paid, total withholding tax withheld, and any other required details as outlined in the form instructions.

What is the purpose of MW508?

The purpose of MW508 is to ensure that employers report and remit the correct amount of income tax withheld from employees' wages to the Maryland State government.

What information must be reported on MW508?

MW508 must report information such as the employer's name and ID number, total wages paid, total state income tax withheld, and any adjustments or special information required by the state.

Fill out your mw508 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

mw508 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.