Get the free IRS Wage Levy Release Package

Show details

This document provides essential information for individuals looking to release an IRS wage levy. It includes company guarantees, fee schedules, service details, payment methods, and necessary forms

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs wage levy release

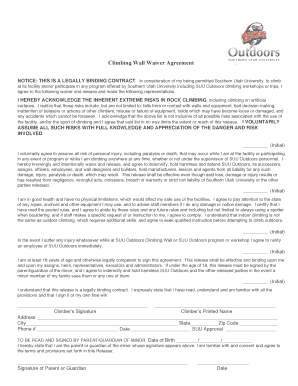

Edit your irs wage levy release form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs wage levy release form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs wage levy release online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs wage levy release. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

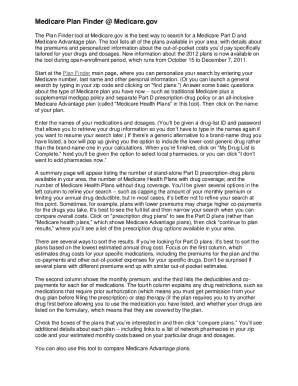

How to fill out irs wage levy release

How to fill out IRS Wage Levy Release Package

01

Gather all relevant documentation, including the original notice of levy and any related correspondence.

02

Complete Form 668-D, 'Notice of Levy and Release of Levy', ensuring all required fields are filled out accurately.

03

Check for any outstanding tax liabilities that may require additional consideration in the release.

04

Attach any necessary supporting documents, such as proof of payment or dispute resolution paperwork.

05

Sign and date the form, making sure to include any required information such as your taxpayer identification number.

06

Submit the completed form to the appropriate IRS office indicated in the instructions.

07

Follow up with the IRS after submission to confirm the release has been processed.

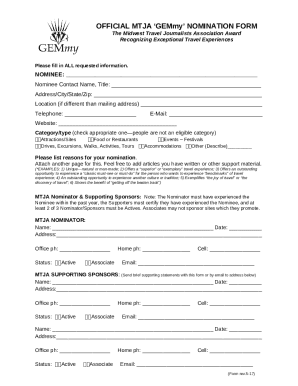

Who needs IRS Wage Levy Release Package?

01

Taxpayers who have had their wages levied by the IRS and wish to request a release of the levy due to reasons such as payment of the owed amount or financial hardship.

02

Individuals or businesses seeking to dispute the levy and require official documentation to support their case.

03

Tax filers who are compliant with their tax obligations and meet specific criteria set by the IRS for releasing the levy.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact the IRS to release a levy?

Contact us toll-free at 800-829-7650 or 800-829-3903 to resolve the issue by paying the tax bill, entering into an installment agreement, or proposing an Offer in Compromise. Please do not contact the BFS, OPM, SSA, or any other federal agency.

Who qualifies for the IRS hardship program?

To be eligible for the IRS Hardship Program, taxpayers must demonstrate that they are facing significant financial hardship and are unable to pay their tax debts. Taxpayers must provide documentation and evidence supporting their financial situation.

How do I remove an IRS levy?

When the IRS takes money out of your bank account (levy) or your paycheck (wage garnishment), you have options. You can get the IRS to remove the levy, but only after you pay off all the back taxes you owe, or set up a payment agreement with the IRS.

How long does it take for the IRS to release a levy?

The time it takes to remove an IRS tax levy varies depending on your specific circumstances and the complexity of the case. In some situations, our attorneys can secure a levy release within a few days by negotiating with the IRS. However, more complex cases may take longer to resolve.

How do I get my money back from a levy?

If you act quickly, you may be able to get some or all of the money back. You have only 10 days from the date of the levy to file a claim of exemption (plus 5 days if the notice was sent by mail) with the sheriff. You must show that the funds taken came from a source of income that is exempt from collection.

What happens if the IRS puts a levy on you?

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

How to get IRS levy release?

"Levies can be released as soon as you provide financial information and Form 433-A," explains Stephen Weisberg, a tax professional at The W Tax Group. "For bank levies, you only have 21 days, so proving financial hardship quickly is key." Pay in full - Once you pay in full, the IRS must immediately stop the levy.

How do I respond to IRS levy notice?

If you receive an IRS bill titled Final Notice, Notice of Intent to Levy and Your Right to A Hearing, contact the IRS right away. Call the number on your billing notice, or individuals may contact the IRS at 800-829-1040; businesses may contact us at 800-829-4933.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Wage Levy Release Package?

The IRS Wage Levy Release Package is a set of documents and forms that an individual must complete to request the release of a wage levy placed by the IRS. This package includes necessary information and forms that demonstrate the taxpayer's compliance with IRS requirements or resolution of their tax issues.

Who is required to file IRS Wage Levy Release Package?

Any taxpayer who has had a wage levy imposed by the IRS and wants to request its release is required to file the IRS Wage Levy Release Package. This typically includes individuals who have resolved their tax debts or are seeking a financial hardship exemption.

How to fill out IRS Wage Levy Release Package?

To fill out the IRS Wage Levy Release Package, taxpayers must complete the appropriate forms, provide detailed information about their financial situation, and include any necessary documentation that supports their request. It is advisable to carefully read the instructions for each form and ensure all sections are accurately filled out.

What is the purpose of IRS Wage Levy Release Package?

The purpose of the IRS Wage Levy Release Package is to formally request the IRS to lift a wage levy applied to a taxpayer's earnings. It serves as a means for taxpayers to show that they have resolved their tax issues or are experiencing financial difficulties that warrant the release of the levy.

What information must be reported on IRS Wage Levy Release Package?

The information that must be reported on the IRS Wage Levy Release Package includes the taxpayer's personal identification details, the reason for the request, documentation of financial circumstances (such as income, expenses, and assets), and any relevant tax information or agreements with the IRS.

Fill out your irs wage levy release online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Wage Levy Release is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.