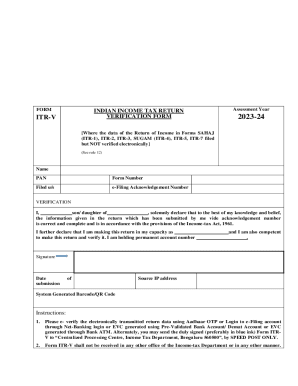

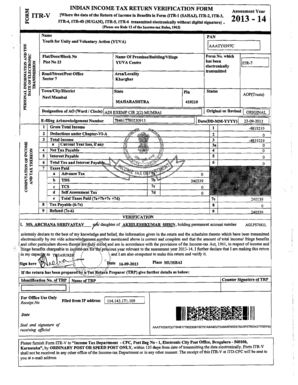

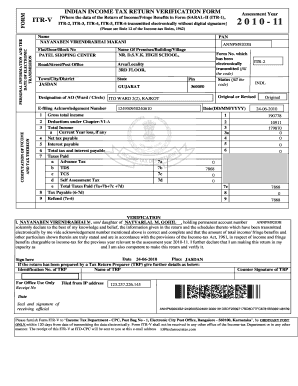

India ITR-V 2014 free printable template

Show details

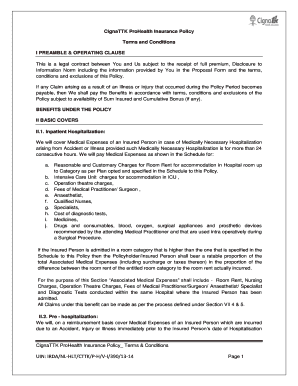

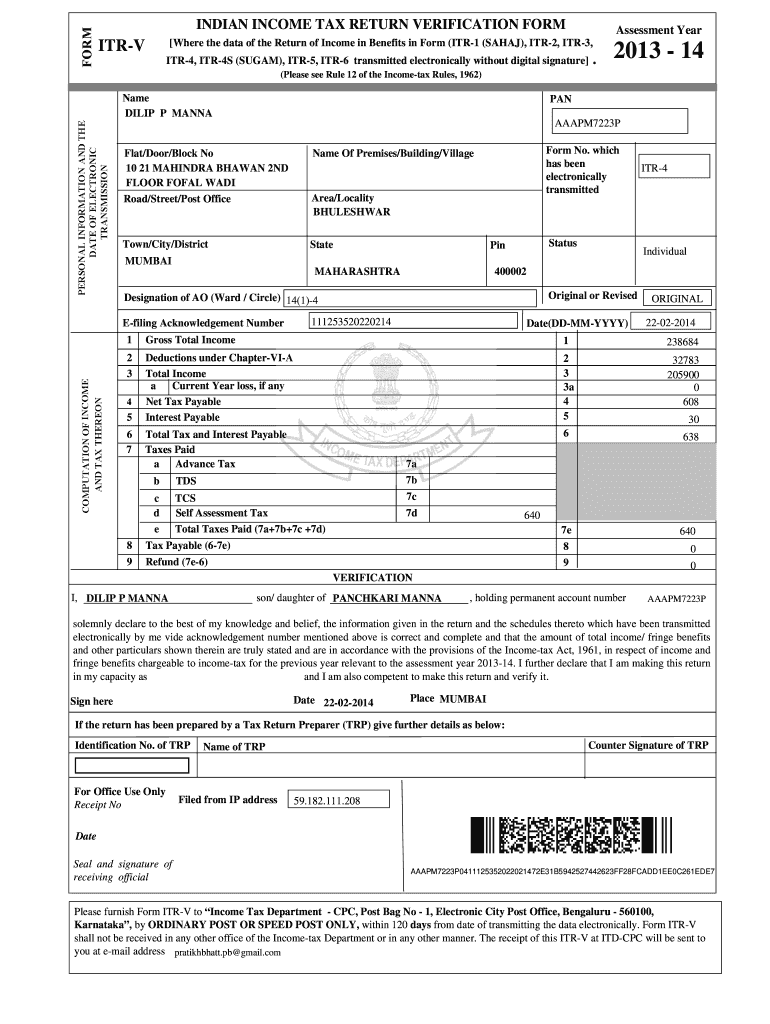

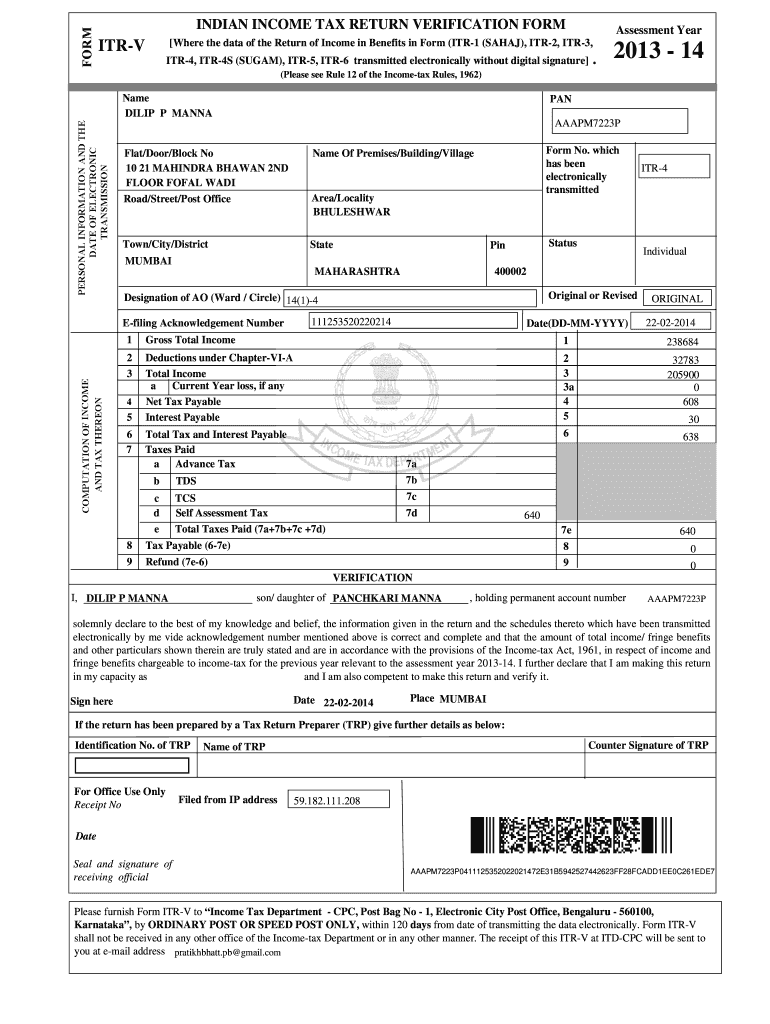

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year Where the data of the Return of Income in Benefits in Form ITR-1 SAHAJ ITR-2 ITR-3 ITR-V ITR-4 ITR-4S SUGAM ITR-5 ITR-6 transmitted electronically without digital signature. 2013 - 14 Please see Rule 12 of the Income-tax Rules 1962 Name DILIP P MANNA PAN AAAPM7223P Flat/Door/Block No 10 21 MAHINDRA BHAWAN 2ND FLOOR FOFAL WADI Road/Street/Post Office Town/City/District Form No. which has been electronically transmitted Name Of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India ITR-V

Edit your India ITR-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India ITR-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India ITR-V online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit India ITR-V. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India ITR-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India ITR-V

How to fill out India ITR-V

01

Obtain your income tax return (ITR) filed through the e-filing portal.

02

After successful submission, download the ITR-V (Acknowledgment) from the e-filing website.

03

Print the ITR-V form on A4 size paper. Ensure that all details are clearly legible.

04

Sign the ITR-V form in the designated space provided. Do not forget to sign it; unsigned forms will not be accepted.

05

Prepare an envelope for postal submission and address it to the Centralized Processing Centre (CPC) in Bangalore.

06

Send the signed ITR-V to the CPC address within 120 days of e-filing your ITR.

07

Track the status of your ITR-V to confirm receipt and processing.

Who needs India ITR-V?

01

Individuals who have e-filed their income tax returns and opted not to verify their returns digitally.

02

Taxpayers who need to submit their ITR-V to complete the verification process for their tax returns.

03

Anyone who has received an acknowledgment slip without digital verification and needs to finalize their ITR.

Fill

form

: Try Risk Free

People Also Ask about

How do I download ITR-V on new portal?

0:48 1:48 How to download ITR V - YouTube YouTube Start of suggested clip End of suggested clip On view file returns page you are required to click on download receipt. Button against theMoreOn view file returns page you are required to click on download receipt. Button against the assessment here for which you want to download the itr-v. The itr-v will be downloaded. In the downloads.

How can I download ITR Acknowledgement without login?

The feature 'e-Verify Return' can be accessed on the home page of the portal under 'Our Services'. Step 2: Enter your PAN, select the relevant Assessment Year, enter Acknowledgment Number of the ITR filed and Mobile Number and Continue. Step 3: Enter six-digit OTP number received on the mobile number and submit.

Can I download my ITR online?

Downloading your ITR copies is now quite straightforward. You can follow the steps below to get a copy of your ITR online: Visit the official income tax e-filing portal here, and click on 'Login'. Here, enter your user ID, password, and security access message, if any to sign in.

How can I download ITR-V without login?

The feature 'e-Verify Return' can be accessed on the home page of the portal under 'Our Services'. Step 2: Enter your PAN, select the relevant Assessment Year, enter Acknowledgment Number of the ITR filed and Mobile Number and Continue. Step 3: Enter six-digit OTP number received on the mobile number and submit.

Where do I get ITR-V?

Form ITR-V shall not be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-filing account.

Is ITR-V and ITR Acknowledgement same?

ITR-V stands for 'Income-tax Verification' form. If an e-filing is done without digital signature, it generates an acknowledgment called ITR-V. This form needs to be signed in manually and posted to CPC, Bangalore within 120 days of e-filing of return.

How do you get ITR-V in new portal?

ITR-V Acknowledgement Download Step 1: Log in to the Income Tax E-Filing website and click on “View Returns / Forms” link. Step 2: Select the option “Income Tax Return” and “Assessment Year”. Click “Submit”. Step 3: Click on acknowledgement number of the income tax return for which you want to download ITR-V.

How can I download ITR-V Acknowledgement?

ITR-V Acknowledgement Download Step 1: Log in to the Income Tax E-Filing website and click on “View Returns / Forms” link. Step 2: Select the option “Income Tax Return” and “Assessment Year”. Click “Submit”. Step 3: Click on acknowledgement number of the income tax return for which you want to download ITR-V.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send India ITR-V for eSignature?

When you're ready to share your India ITR-V, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit India ITR-V straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing India ITR-V right away.

How can I fill out India ITR-V on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your India ITR-V, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is India ITR-V?

India ITR-V is the Income Tax Return Verification Form that taxpayers are required to file after submitting their income tax return electronically. It serves as a confirmation that the return has been submitted and allows taxpayers to authenticate their returns.

Who is required to file India ITR-V?

Any individual or entity who has filed their income tax return electronically without a digital signature is required to file ITR-V. This includes salaried individuals, self-employed individuals, and businesses.

How to fill out India ITR-V?

To fill out India ITR-V, taxpayers must download the form from the Income Tax Department's website after filing their return. They need to provide their details, sign the document, and then send it to the Centralized Processing Center (CPC) within 120 days of e-filing.

What is the purpose of India ITR-V?

The purpose of India ITR-V is to serve as a declaration of the income tax return filed electronically. It verifies the authenticity of the return, ensuring that the taxpayer confirms their submission and allows the tax authorities to process the return.

What information must be reported on India ITR-V?

India ITR-V must report information such as the taxpayer's name, PAN (Permanent Account Number), the assessment year, the acknowledgment number from the filed return, and the signature of the taxpayer. Additional details may include the address and other identification information.

Fill out your India ITR-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India ITR-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.