Get the free Gifts & Donations - Foundation - East Georgia State College

Show details

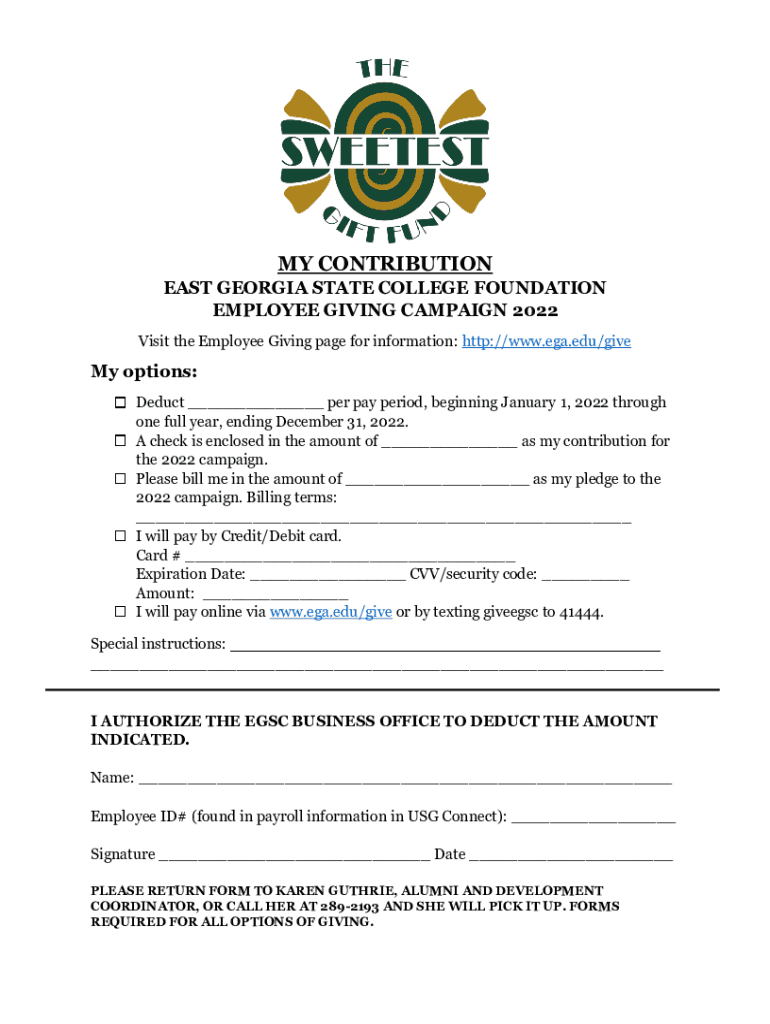

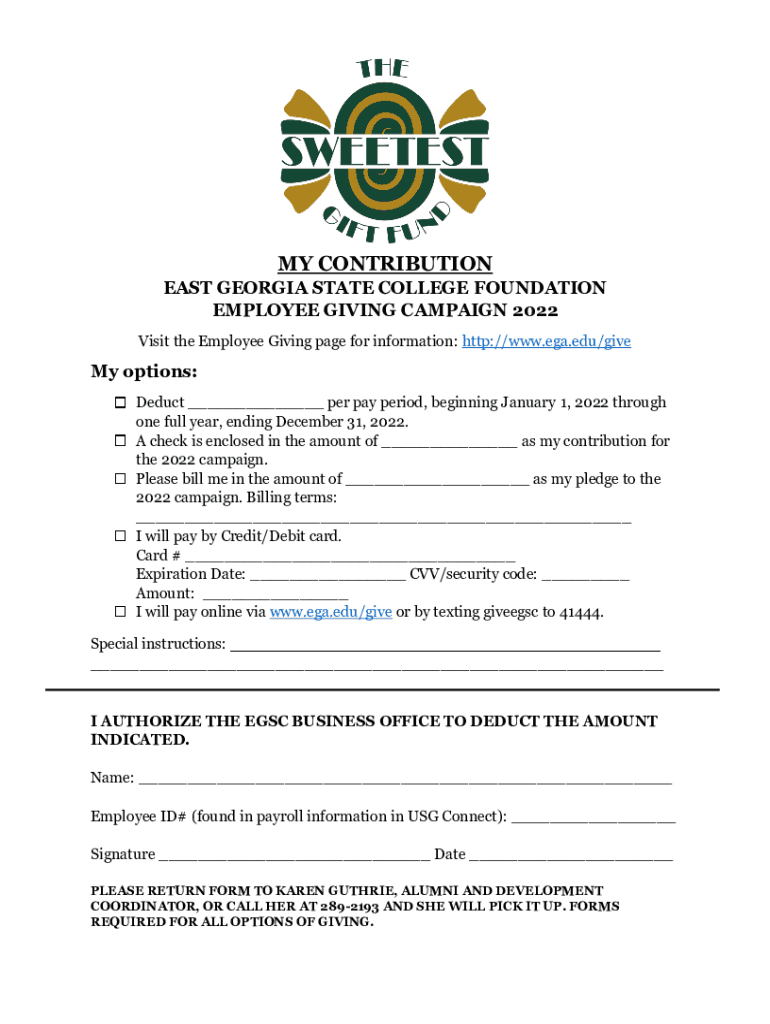

MY CONTRIBUTION EAST GEORGIA STATE COLLEGE FOUNDATION EMPLOYEE GIVING CAMPAIGN 2022 Visit the Employee Giving page for information: http://www.ega.edu/giveMy options: Deduct ___ per pay period, beginning

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts ampamp donations

Edit your gifts ampamp donations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts ampamp donations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts ampamp donations online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gifts ampamp donations. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts ampamp donations

How to fill out gifts ampamp donations

01

Determine the purpose of the gift or donation.

02

Research organizations or individuals in need of gifts or donations.

03

Check the guidelines and requirements for giving gifts or donations.

04

Decide on the type and amount of gift or donation to give.

05

Fill out any required forms or paperwork accurately and completely.

06

Deliver the gift or donation to the intended recipient in a timely manner.

Who needs gifts ampamp donations?

01

Non-profit organizations

02

Charitable foundations

03

Individuals facing financial hardship

04

Community projects in need of funding

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get gifts ampamp donations?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific gifts ampamp donations and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the gifts ampamp donations in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your gifts ampamp donations right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit gifts ampamp donations on an iOS device?

You certainly can. You can quickly edit, distribute, and sign gifts ampamp donations on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is gifts ampamp donations?

Gifts and donations refer to voluntary transfers of assets or funds from one party to another without the expectation of anything in return.

Who is required to file gifts ampamp donations?

Individuals or organizations who receive gifts or donations above a certain threshold set by the tax authorities are required to file gifts and donations.

How to fill out gifts ampamp donations?

To fill out gifts and donations, one must accurately report the details of the gift or donation received, including the value, date received, and information about the donor.

What is the purpose of gifts ampamp donations?

The purpose of gifts and donations is to show appreciation, provide financial support, or contribute to a cause or organization.

What information must be reported on gifts ampamp donations?

The information that must be reported on gifts and donations include the value of the gift or donation, date received, donor's details, and any conditions or restrictions attached to the gift.

Fill out your gifts ampamp donations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts Ampamp Donations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.