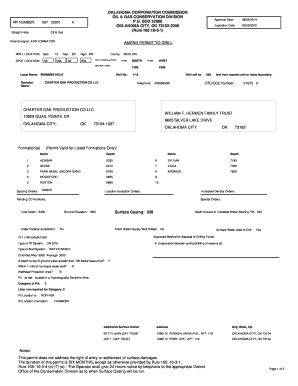

Get the free 2011 Tax Organizer

Show details

Este organizador de impuestos ayuda a los contribuyentes a recopilar la información necesaria para preparar su declaración de impuestos de 2011, incluyendo detalles sobre ingresos, deducciones y

We are not affiliated with any brand or entity on this form

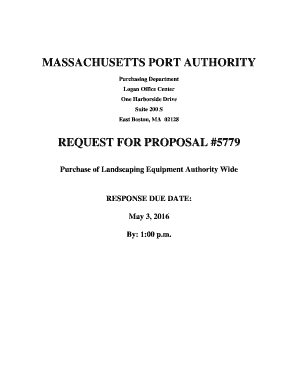

Get, Create, Make and Sign 2011 tax organizer

Edit your 2011 tax organizer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 tax organizer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 tax organizer online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2011 tax organizer. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 tax organizer

How to fill out 2011 Tax Organizer

01

Gather all necessary financial documents such as W-2 forms, 1099 forms, and any other relevant income statements.

02

Fill out personal information at the top of the organizer, including your name, address, and social security number.

03

List all sources of income for the year, including wages, interest, dividends, and any side business income.

04

Document all potential deductions by providing information about mortgage interest, property taxes, medical expenses, and charitable contributions.

05

Include any credits you may qualify for, such as education credits or child tax credits.

06

Summarize any investment gains or losses, ensuring to categorize them accurately.

07

Review the completed organizer for accuracy before submitting it to your tax professional.

Who needs 2011 Tax Organizer?

01

Individuals and families who need to prepare their taxes for the 2011 tax year.

02

Tax professionals who require an organized summary of a client's financial information to complete their tax returns.

03

Anyone who wants to ensure they capture all relevant income and deductions effectively for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax organizer document?

A tax organizer is a client-facing document to help with the collection and submission of client information necessary to prepare a tax return. The individual income tax return organizer should be used with the preparation of Form 1040, U.S. Individual Income Tax Return.

How many years can you legally not file taxes?

In conclusion, not filing taxes can have serious consequences, including penalties, interest, and legal action by the IRS. While there's technically no limit on how many years a taxpayer can go without filing taxes, the IRS typically focuses on the most recent six years for enforcement purposes.

Can the IRS go back more than 10 years?

HOW FAR BACK CAN THE IRS GO FOR UNFILED TAXES? The IRS can go back six years to audit and assess additional taxes, penalties, and interest for unfiled taxes. However, there is no statute of limitations if you failed to file a tax return or if the IRS suspects you committed fraud.

How many years back can you file back taxes?

If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

How many years back can you electronically file taxes?

The current year and 2 previous years of returns are available. tax periods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 Tax Organizer?

The 2011 Tax Organizer is a financial document designed to help individuals and businesses gather and organize their financial information required for filing taxes for the year 2011.

Who is required to file 2011 Tax Organizer?

Individuals and businesses who need to file tax returns for the year 2011 are required to use the 2011 Tax Organizer to ensure all necessary information is included.

How to fill out 2011 Tax Organizer?

To fill out the 2011 Tax Organizer, gather all relevant financial documents such as income statements, receipts, and previous tax returns, and input the required information in the designated sections of the organizer.

What is the purpose of 2011 Tax Organizer?

The purpose of the 2011 Tax Organizer is to simplify the tax preparation process by providing a structured format for organizing financial information needed to accurately complete tax returns.

What information must be reported on 2011 Tax Organizer?

The 2011 Tax Organizer requires reporting personal information, income details, deductions, credits, and any other financial data relevant to the individual's or business's tax situation for that year.

Fill out your 2011 tax organizer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Tax Organizer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.