Get the free Building Our Tax Base Outstanding Infrastructure Cost Rebate ...

Show details

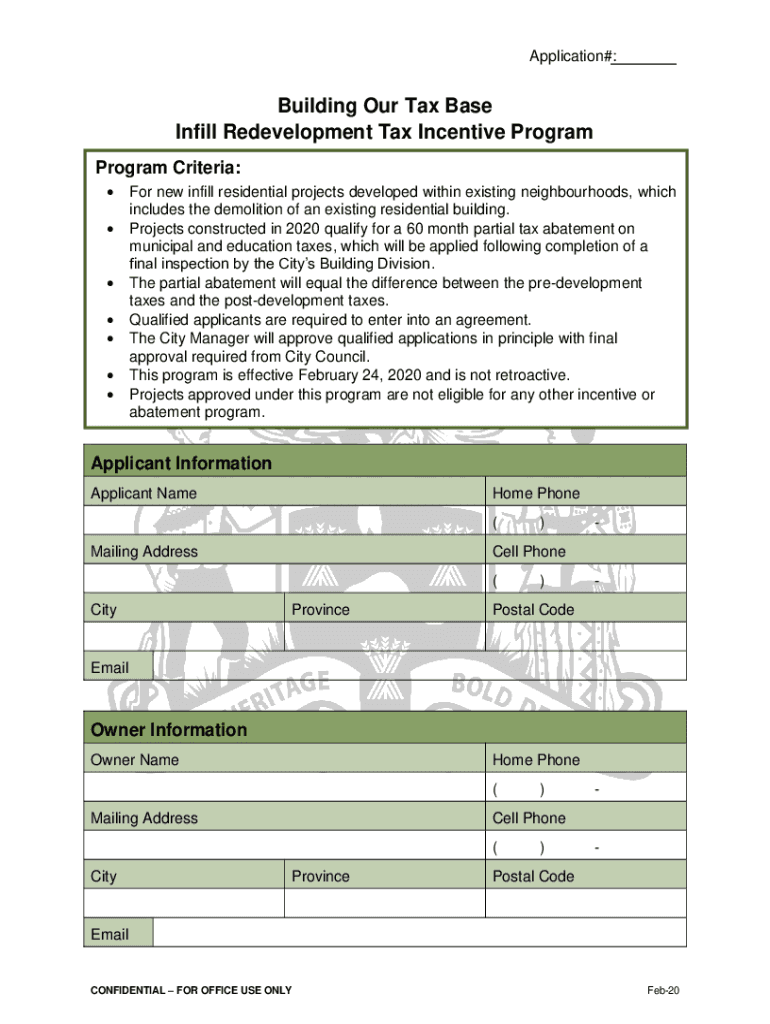

Application#:Building Our Tax Base Infill Redevelopment Tax Incentive Program Criteria: For new infill residential projects developed within existing neighborhoods, which includes the demolition of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign building our tax base

Edit your building our tax base form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your building our tax base form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing building our tax base online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit building our tax base. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out building our tax base

How to fill out building our tax base

01

Research and identify potential tax base expansion opportunities

02

Engage with stakeholders and community members to gather input and support

03

Develop a strategic plan outlining goals and objectives for expanding the tax base

04

Implement targeted marketing and outreach efforts to attract new businesses and residents

05

Monitor progress and adjust strategies as needed to ensure success

Who needs building our tax base?

01

Local governments looking to increase revenue streams

02

Community organizations interested in supporting economic development initiatives

03

Residents who benefit from improved public services funded by tax revenue

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send building our tax base to be eSigned by others?

When you're ready to share your building our tax base, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in building our tax base?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your building our tax base to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit building our tax base straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing building our tax base, you need to install and log in to the app.

What is building our tax base?

Building our tax base refers to increasing the revenue generated through taxation by expanding the tax system and increasing the number of taxpayers.

Who is required to file building our tax base?

All individuals and businesses that have taxable income or assets are required to file building our tax base.

How to fill out building our tax base?

To fill out building our tax base, individuals and businesses must gather all relevant financial information, report their income and deductions accurately, and submit the completed form to the taxing authority.

What is the purpose of building our tax base?

The purpose of building our tax base is to ensure a stable source of revenue for government services and programs by broadening the tax base and increasing tax compliance.

What information must be reported on building our tax base?

Information such as income, assets, deductions, and credits must be reported on building our tax base.

Fill out your building our tax base online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Building Our Tax Base is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.