Get the free Nonprofit Formation & Tax Exemption - Bromberger Law

Show details

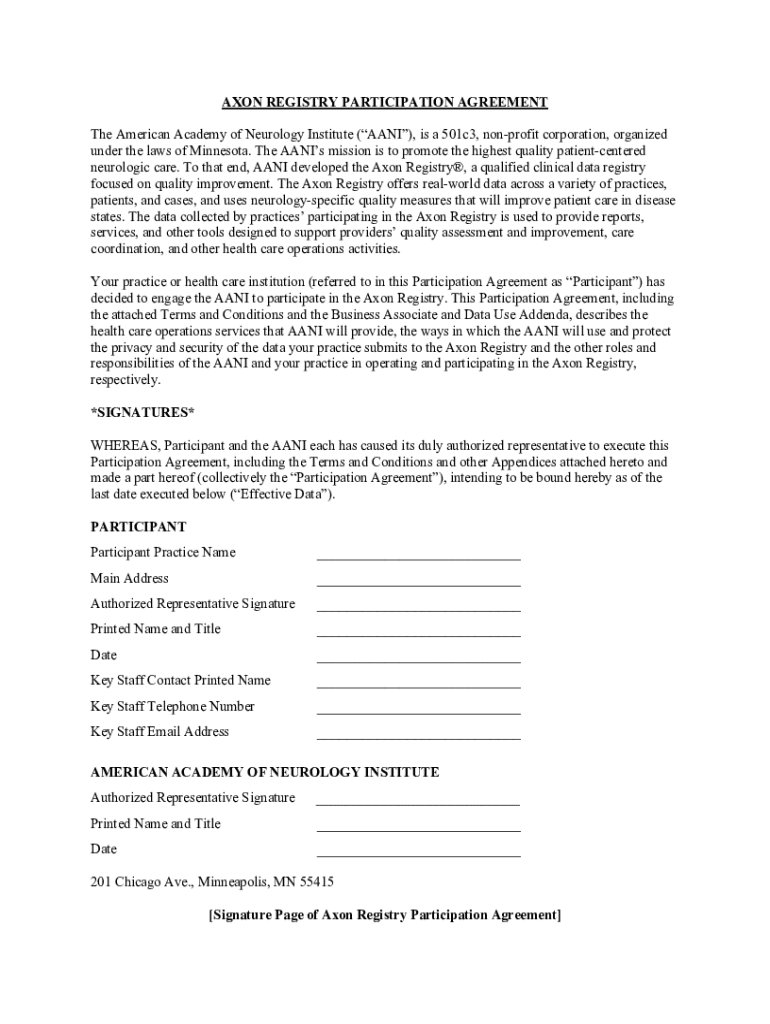

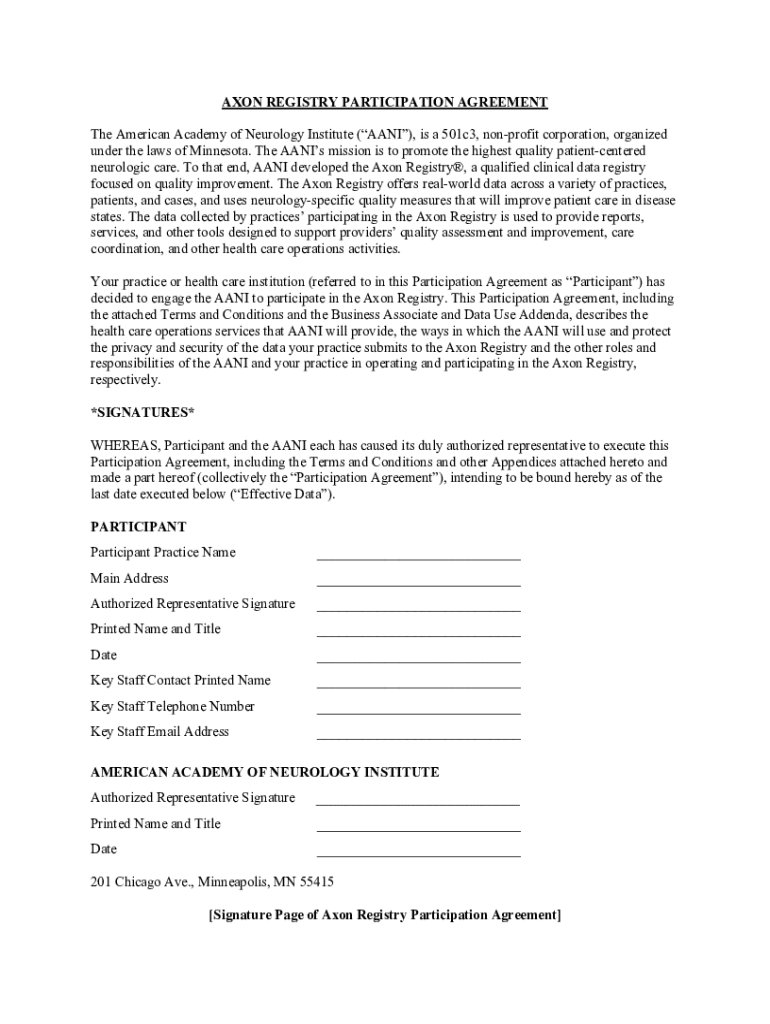

AXON REGISTRY PARTICIPATION AGREEMENT The American Academy of Neurology Institute (MANI), is a 501c3, nonprofit corporation, organized under the laws of Minnesota. The Janis mission is to promote

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit formation ampamp tax

Edit your nonprofit formation ampamp tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit formation ampamp tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonprofit formation ampamp tax online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nonprofit formation ampamp tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit formation ampamp tax

How to fill out nonprofit formation ampamp tax

01

Determine the type of nonprofit organization you want to form (such as a charitable organization, social welfare organization, or trade association).

02

Choose a unique name for your nonprofit and check its availability.

03

Create articles of incorporation that outline the purpose, structure, and operating procedures of the nonprofit.

04

File the articles of incorporation with the appropriate state agency.

05

Obtain an employer identification number (EIN) from the IRS.

06

Apply for tax-exempt status with the IRS by completing Form 1023 or Form 1023-EZ.

07

Develop a comprehensive record-keeping system to track financial transactions and donations.

08

Comply with any state and federal tax laws and reporting requirements applicable to nonprofit organizations.

Who needs nonprofit formation ampamp tax?

01

Nonprofit organizations that want to operate for charitable, educational, religious, scientific, or other tax-exempt purposes.

02

Individuals or groups seeking to make a positive impact in their communities or address social issues through organized and structured activities.

03

Donors and supporters who want to contribute to causes and receive tax deductions for their charitable contributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete nonprofit formation ampamp tax online?

With pdfFiller, you may easily complete and sign nonprofit formation ampamp tax online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit nonprofit formation ampamp tax in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing nonprofit formation ampamp tax and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the nonprofit formation ampamp tax electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your nonprofit formation ampamp tax in minutes.

What is nonprofit formation ampamp tax?

Nonprofit formation and tax refers to the process of establishing a tax-exempt organization and ensuring compliance with tax regulations.

Who is required to file nonprofit formation ampamp tax?

Nonprofit organizations are required to file for nonprofit formation and tax if they want to maintain their tax-exempt status.

How to fill out nonprofit formation ampamp tax?

Nonprofit organizations can fill out nonprofit formation and tax forms by providing accurate financial and operational information to the IRS.

What is the purpose of nonprofit formation ampamp tax?

The purpose of nonprofit formation and tax is to ensure that tax-exempt organizations are operating in line with their charitable mission and complying with tax regulations.

What information must be reported on nonprofit formation ampamp tax?

Nonprofit formation and tax forms typically require information about the organization's finances, activities, and governance structure.

Fill out your nonprofit formation ampamp tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Formation Ampamp Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.