Get the free SELF-EMPLOYMENT VERIFICATION FORM

Show details

Este formulario se utiliza para verificar el empleo por cuenta propia de un solicitante o miembro, con el fin de procesar las solicitudes para el Pool de Seguro de Salud de Texas. Incluye secciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-employment verification form

Edit your self-employment verification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employment verification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-employment verification form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit self-employment verification form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

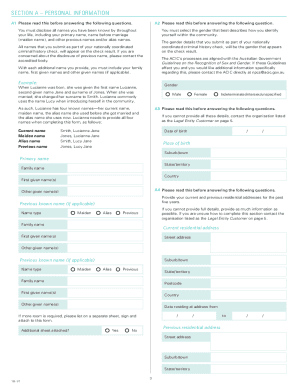

How to fill out self-employment verification form

How to fill out SELF-EMPLOYMENT VERIFICATION FORM

01

Begin by downloading the SELF-EMPLOYMENT VERIFICATION FORM from the relevant website or institution.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about your business, such as the name, address, and type of business.

04

Indicate the start date of your self-employment and any relevant business registration numbers or licenses.

05

Include a brief description of the services or products you provide as a self-employed individual.

06

List your average monthly income from your self-employment, along with any fluctuations if applicable.

07

Sign and date the form to certify that the information provided is accurate and complete.

08

Submit the completed form to the requesting institution or agency as instructed.

Who needs SELF-EMPLOYMENT VERIFICATION FORM?

01

Self-employed individuals who need to verify their income for loan applications, rental agreements, or government assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What form to use for self-employment income?

Schedule SE (Form 1040), Self-Employment Tax. In most cases, self-employed people who earned at least $400 in net self-employment income have to pay self-employment tax (SE tax). You can do this by filing Schedule SE with your Form 1040.

How do lenders verify self-employed income?

Many people who take out mortgages are self-employed. In this situation, lenders often require an Internal Revenue Service (IRS) Form 4506-T. This form is a request for "Transcript of Tax Return" and allows the lender to receive a copy of the borrower's tax returns directly from the IRS.

How do you verify self-employed employment?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

What is an income statement for self-employed?

A self-employed profit and loss statement is a report that summarizes your business's revenues, expenses, gains, and losses over a given period. Also commonly referred to as an income statement, it's one of two essential financial statements for self-employed people, along with the balance sheet.

How do I get an employment verification form?

How to request an employment verification letter Find out who sends employment verification letters on behalf of your employer. Follow your employer's procedures for requesting employment verification letters. Be specific about details you need. Provide the recipient's mailing address. Give your employer plenty of notice.

How do landlords verify income for self-employed?

Bank statements Like a 1099, this proof of income is useful if an applicant is self-employed or a gig worker. You can also request a bank statement if the applicant is currently unemployed. As a general best practice, ask for at least two or three months of statements.

How do I write a self-employment verification letter?

I, [name] attest that from [month/year] to [month/year or present] I have been self employed as the owner of [name of company/organization]. During this time I have worked [number] hours per week as owner of this business and the nature of the business is [short description of the nature of the business].

What is the income verification form for self-employed?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SELF-EMPLOYMENT VERIFICATION FORM?

The SELF-EMPLOYMENT VERIFICATION FORM is a document used to confirm an individual's self-employment status and income for various purposes, such as loan applications, government assistance, or tax reporting.

Who is required to file SELF-EMPLOYMENT VERIFICATION FORM?

Individuals who are self-employed and need to verify their income or business activities for financial institutions, government agencies, or tax purposes are required to file the SELF-EMPLOYMENT VERIFICATION FORM.

How to fill out SELF-EMPLOYMENT VERIFICATION FORM?

To fill out the SELF-EMPLOYMENT VERIFICATION FORM, one must provide personal identification information, details about the business, income figures, and any necessary supporting documents that prove self-employment status.

What is the purpose of SELF-EMPLOYMENT VERIFICATION FORM?

The purpose of the SELF-EMPLOYMENT VERIFICATION FORM is to provide a formal declaration of self-employment status and detailed income information, which is often required to qualify for loans, assistance programs, or for tax filing.

What information must be reported on SELF-EMPLOYMENT VERIFICATION FORM?

Information that must be reported on the SELF-EMPLOYMENT VERIFICATION FORM includes the name and address of the business, the nature of the business activities, gross income, net income, and any relevant tax identification numbers.

Fill out your self-employment verification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Employment Verification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.