AU PSSap F6 2022-2025 free printable template

Show details

F6

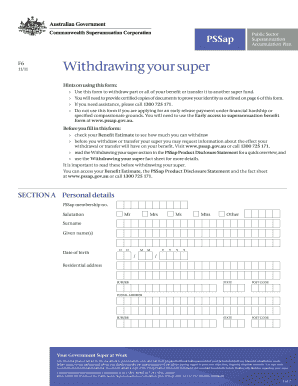

01/22PSSap: Withdrawing your superImportant information about this form

What this form is forces this form to withdraw part or all of your benefit or transfer it to another super fund.

For more

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU PSSap F6

Edit your AU PSSap F6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU PSSap F6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU PSSap F6 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU PSSap F6. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU PSSap F6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU PSSap F6

How to fill out AU PSSap F6

01

Gather all necessary personal and financial information, including your Tax File Number (TFN) and superannuation details.

02

Download the AU PSSap F6 form from the official PSSap website or obtain a physical copy from the relevant office.

03

Carefully read the instructions provided on the form to understand what is required.

04

Complete the personal details section, ensuring that all information is accurate and matches your official identification.

05

Fill in the financial information, including your contribution details and any relevant superannuation data.

06

Review the completed form for accuracy and completeness, correcting any mistakes.

07

Sign and date the declaration at the end of the form, verifying the information provided.

08

Submit the form according to the instructions, whether electronically or via mail, ensuring it reaches the correct department.

Who needs AU PSSap F6?

01

Members of the Australian Public Service who wish to make contributions to their superannuation fund.

02

Individuals who are eligible for membership in the PSSap scheme and need to provide their details for contribution purposes.

03

Employees seeking to transfer their superannuation funds into the AU PSSap for better management.

Fill

form

: Try Risk Free

People Also Ask about

Can I withdraw my super and put in bank?

A lump sum withdrawal is a cash payment from your super to your bank account. You can request to withdraw a lump sum if you've met certain conditions set by the Government.

How do I withdraw money from Superfund?

You need to contact your super provider to request access to your super due to severe financial hardship. You may be able to withdraw some of your super if you are experiencing severe financial hardship. There are no special tax rates for a super withdrawal because of severe financial hardship.

What is PSSap redemption?

PSSap is a scheme in which members and employers pay money into the fund, and investment returns are calculated as a compound average rate of return after fees and taxes have been deducted.

How do I withdraw from super PSSap?

You can withdraw your super benefit*: • when you permanently leave the workforce on or after age 60 • if you retire on or after your preservation age as set out in Table 1 • if we have approved your invalidity retirement and certified that you are entitled to receive invalidity benefits under PSSap • if you suffer

How much can you withdraw from super?

Each year you can withdraw as much as you like through your account-based super income stream (unless you're receiving a transition to retirement income stream). You must withdraw a minimum amount each year – based on your age and account balance.

What is the preservation age for PSSap?

Preservation age is between the age of 55–60, depending on when you were born.

Is there a fee for PSSap withdrawal?

Is there a fee for withdrawing? There are no fees for withdrawing funds from your PSSap account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the AU PSSap F6 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your AU PSSap F6 in seconds.

Can I create an electronic signature for signing my AU PSSap F6 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your AU PSSap F6 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit AU PSSap F6 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing AU PSSap F6 right away.

What is AU PSSap F6?

AU PSSap F6 is a specific tax form used in Australia for reporting the taxable income and financial details of certain superannuation funds.

Who is required to file AU PSSap F6?

Entities managing superannuation funds that meet certain criteria, such as size or type, are required to file the AU PSSap F6 form.

How to fill out AU PSSap F6?

To fill out AU PSSap F6, gather all required financial information, complete the relevant sections pertaining to income and deductions, and ensure accuracy before submission.

What is the purpose of AU PSSap F6?

The purpose of AU PSSap F6 is to provide the tax authorities with information regarding the financial position and obligations of a superannuation fund for compliance purposes.

What information must be reported on AU PSSap F6?

Information that must be reported on AU PSSap F6 includes details of income, tax deductions, fund expenses, and member contributions.

Fill out your AU PSSap F6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU PSSap f6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.