Get the free Home Equity & Mortgage Refinance Loans Lender, High ...

Show details

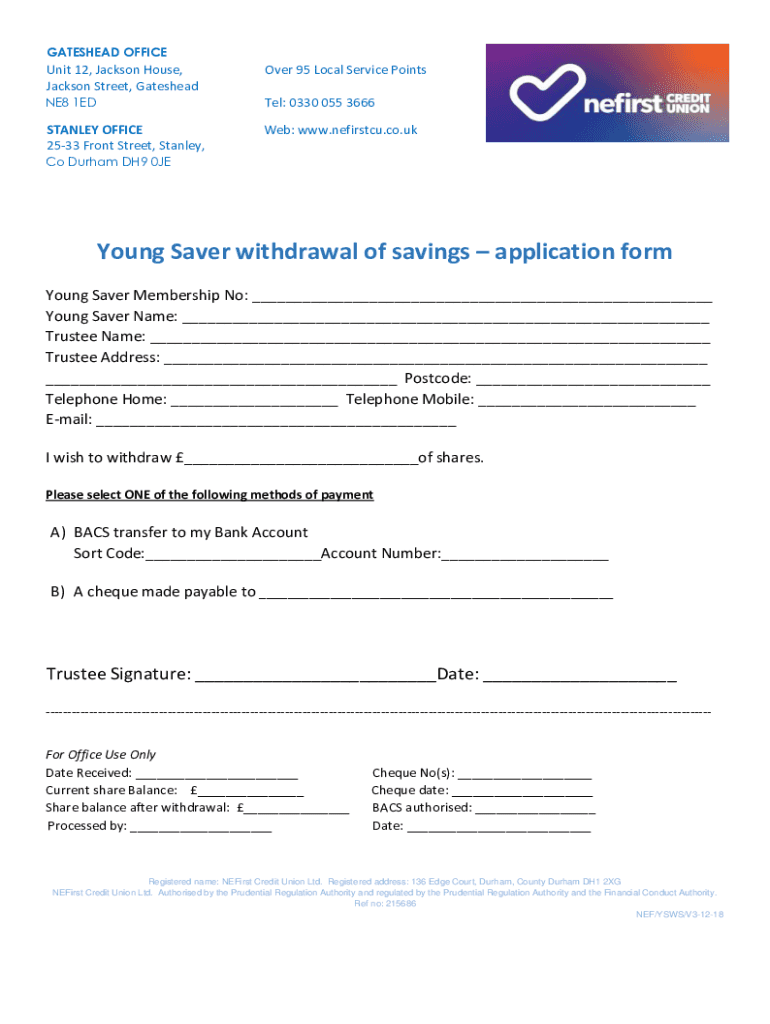

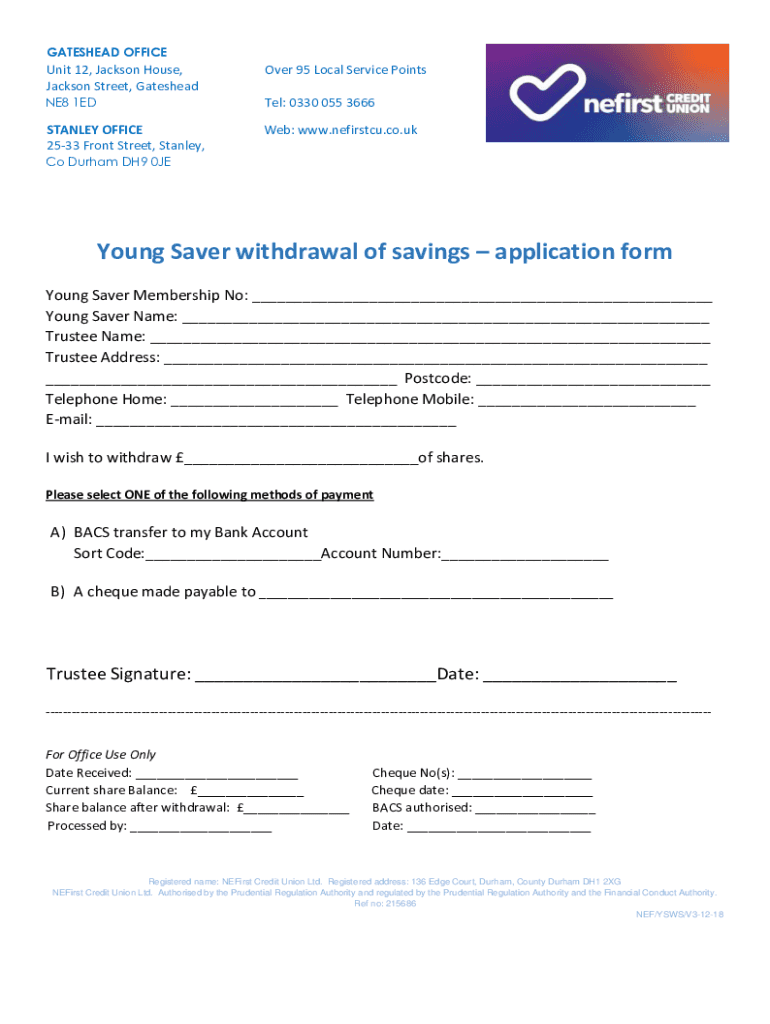

WATERSHED Officiant 12, Jackson House, Jackson Street, GatesheadOver 95 Local Service PointsNE8 1EDTel: 0330 055 3666STANLEY OFFICE 2533 Front Street, Stanley, Web: www.nefirstcu.co.ukCo Durham DH9

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity ampamp mortgage

Edit your home equity ampamp mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity ampamp mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home equity ampamp mortgage online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit home equity ampamp mortgage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home equity ampamp mortgage

How to fill out home equity ampamp mortgage

01

Gather all necessary financial documents such as income statements, credit reports, and debt information.

02

Research different lenders and compare interest rates and terms for home equity and mortgage loans.

03

Calculate how much equity you have in your home by subtracting the remaining balance on your mortgage from the current market value of your property.

04

Determine how much you want to borrow and assess if you meet the eligibility criteria set by lenders.

05

Fill out the loan application form accurately and provide all requested documentation to the lender.

06

Wait for the lender to review your application, conduct an appraisal of your property, and make a decision on your loan.

07

If approved, sign the loan agreement and complete any additional paperwork required by the lender.

08

Use the funds from the home equity or mortgage loan as needed, whether for home improvements, debt consolidation, or other expenses.

09

Make timely monthly payments on your loan to avoid defaulting and potentially losing your home.

Who needs home equity ampamp mortgage?

01

Homeowners who are looking to tap into the equity they have built up in their property for various financial needs.

02

Individuals or families who are looking to purchase a new home and need financing through a mortgage loan.

03

Those who want to consolidate debt or fund major expenses such as home renovations or college tuition.

04

Investors who see opportunities to leverage their home equity for further investment or financial growth.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find home equity ampamp mortgage?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific home equity ampamp mortgage and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete home equity ampamp mortgage on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your home equity ampamp mortgage, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit home equity ampamp mortgage on an Android device?

The pdfFiller app for Android allows you to edit PDF files like home equity ampamp mortgage. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is home equity ampamp mortgage?

Home equity and mortgage are both types of loans secured by the value of a home.

Who is required to file home equity ampamp mortgage?

Individuals who have taken out a home equity loan or mortgage are required to file.

How to fill out home equity ampamp mortgage?

Home equity and mortgage information can usually be filled out online through the lender or by submitting paperwork directly to the lender.

What is the purpose of home equity ampamp mortgage?

The purpose of home equity and mortgage loans is to provide homeowners with access to funds based on the value of their homes.

What information must be reported on home equity ampamp mortgage?

Information such as loan amount, interest rate, terms of repayment, and property address must be reported on home equity and mortgage documents.

Fill out your home equity ampamp mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Ampamp Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.