Get the free Profit Sharing Plan Establishment Kit - Ascensus

Show details

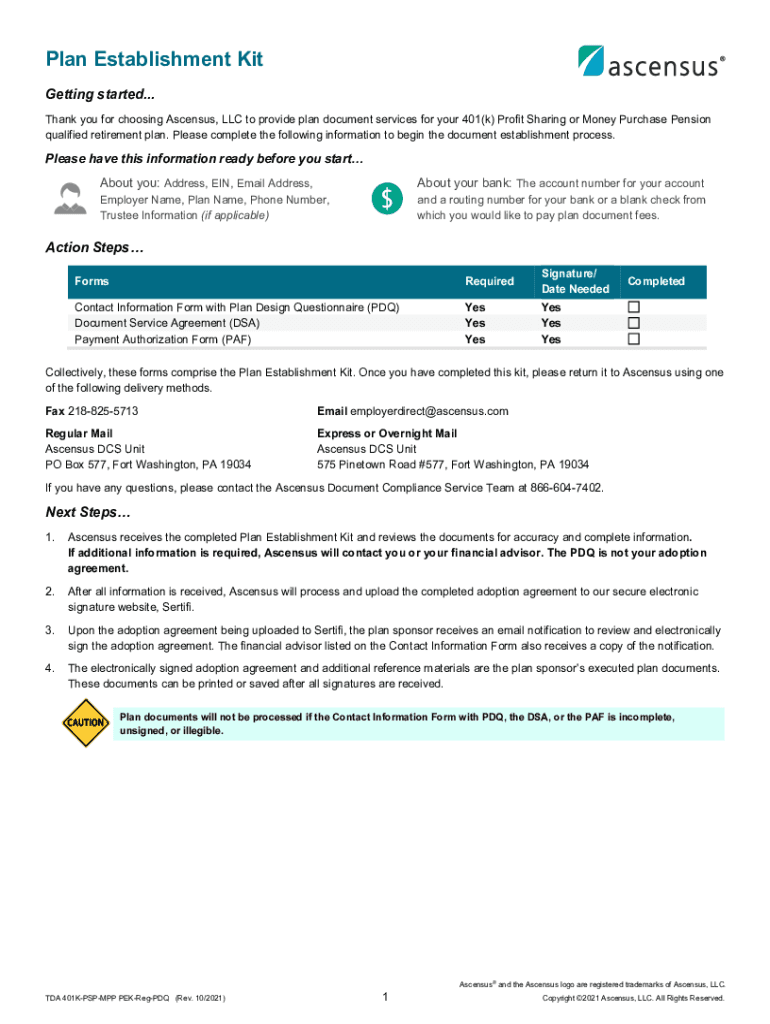

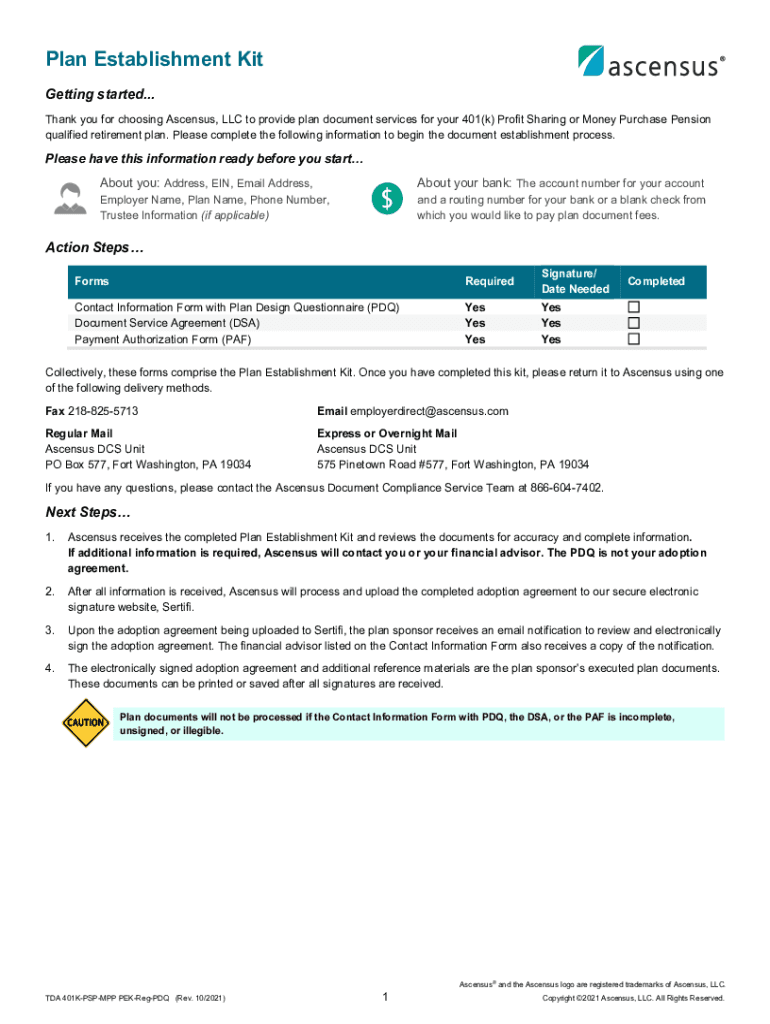

As census Plan Establishment Because delivering a quality plan shouldn't be a second job. Plan Establishment Kit Getting started... Thank you for choosing As census, LLC to provide plan document services

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign profit sharing plan establishment

Edit your profit sharing plan establishment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your profit sharing plan establishment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit profit sharing plan establishment online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit profit sharing plan establishment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out profit sharing plan establishment

How to fill out profit sharing plan establishment

01

Determine the eligibility criteria for participation in the profit sharing plan.

02

Choose a profit sharing plan design that aligns with your company's goals and objectives.

03

Calculate the contribution levels and allocation formula for distributing profits to employees.

04

Review and finalize the legal documentation outlining the terms and conditions of the profit sharing plan.

05

Communicate the details of the profit sharing plan to employees and provide any necessary training or guidance on how to participate.

Who needs profit sharing plan establishment?

01

Companies looking to incentivize and reward employees for their contributions to the company's success.

02

Employers seeking to promote a culture of teamwork and collaboration among their workforce.

03

Business owners who want to align employee interests with the financial performance of the company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send profit sharing plan establishment to be eSigned by others?

Once you are ready to share your profit sharing plan establishment, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete profit sharing plan establishment online?

Easy online profit sharing plan establishment completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the profit sharing plan establishment in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your profit sharing plan establishment.

What is profit sharing plan establishment?

A profit sharing plan establishment is the setting up of a program where a company distributes a portion of its profits to its employees.

Who is required to file profit sharing plan establishment?

Employers who offer profit sharing plans to their employees are required to file the establishment with the appropriate regulatory authorities.

How to fill out profit sharing plan establishment?

Filing out a profit sharing plan establishment involves providing details about the plan, including eligibility requirements, contribution limits, and distribution rules.

What is the purpose of profit sharing plan establishment?

The purpose of a profit sharing plan establishment is to incentivize employees by providing them with a share of the company's profits.

What information must be reported on profit sharing plan establishment?

Information such as the plan's name, eligibility criteria, contribution limits, distribution rules, and the employer's contact information must be reported on a profit sharing plan establishment.

Fill out your profit sharing plan establishment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Profit Sharing Plan Establishment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.