Get the free Client Tax Organizer

Show details

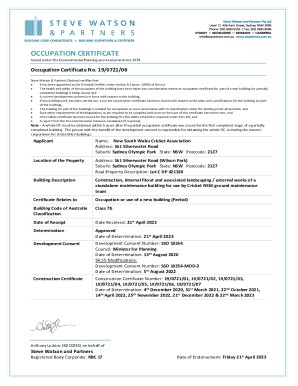

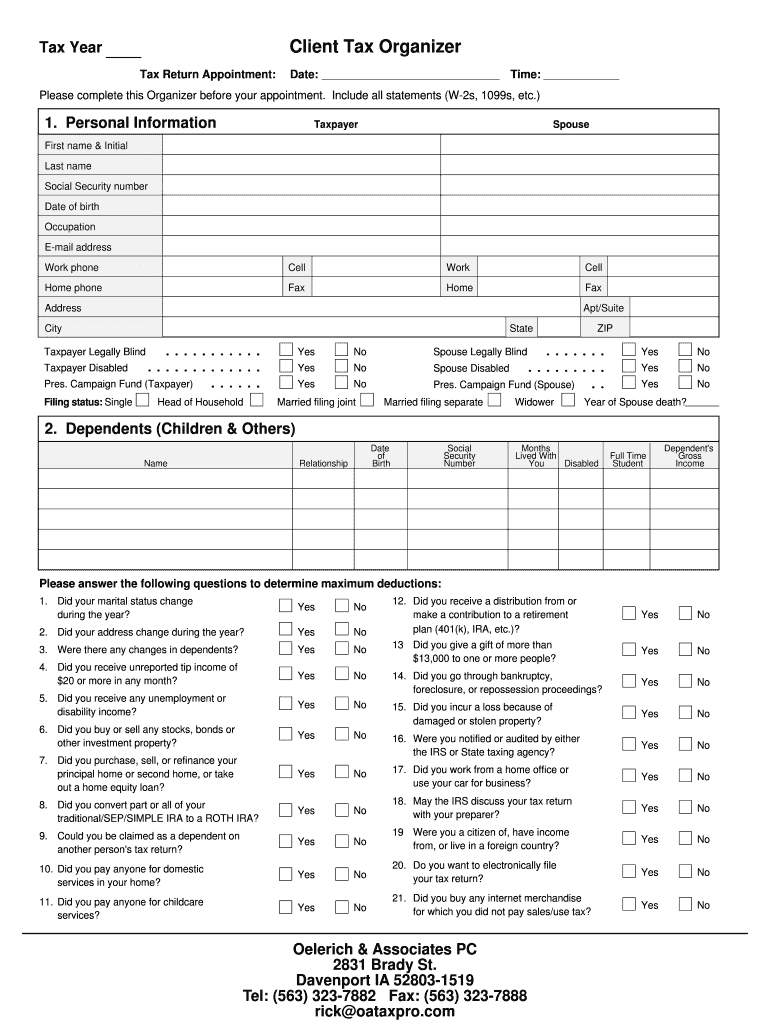

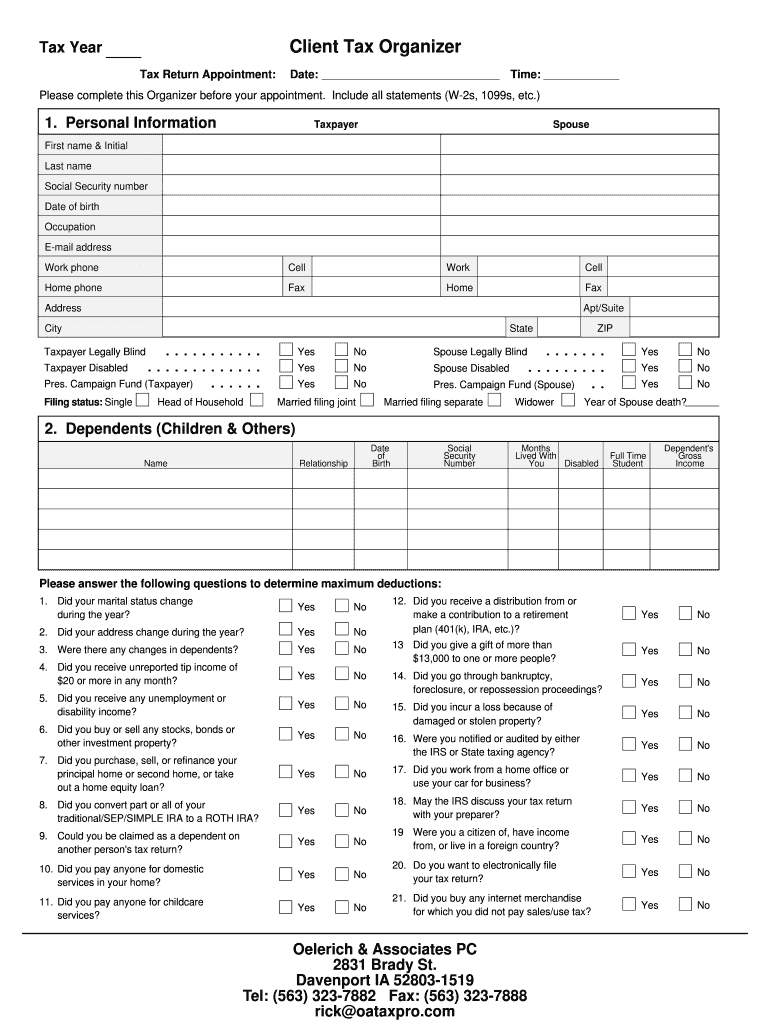

This document is a comprehensive tax organizer designed to collect essential personal and financial information from clients in preparation for their tax return appointment. It includes prompts related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign client tax organizer

Edit your client tax organizer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your client tax organizer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing client tax organizer online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit client tax organizer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out client tax organizer

How to fill out Client Tax Organizer

01

Start with your personal information: Fill out your name, address, Social Security number, and filing status.

02

Report your income: List all sources of income, including wages, interest, dividends, and any other income.

03

Document your deductions: Gather information on your deductible expenses, such as mortgage interest, charitable contributions, and medical expenses.

04

Include tax credits: Identify any tax credits you may qualify for, such as education credits or energy-efficient home credits.

05

Provide additional information: If applicable, include any information regarding dependents, investments, or foreign income.

06

Review and finalize: Go over the completed organizer to ensure accuracy and completeness before submission.

Who needs Client Tax Organizer?

01

Individuals and families who are filing their taxes.

02

Self-employed individuals or freelancers who need to report business income.

03

Tax professionals who gather necessary information from clients to prepare their tax returns.

04

Anyone who wants to ensure they have all relevant tax information organized for filing.

Fill

form

: Try Risk Free

People Also Ask about

How do I upload documents to TaxDome?

How to upload documents Click New on the top left. Drag the documents or folders from your desktop to the Docs / Recent tab on the Documents page and drop them anywhere on the screen. Click Upload Documents or Upload Folder in the Docs tab on the Documents page or in the Docs tab for the account.

How do I send an organizer to Taxdome?

Click the Organizer Template list to select a template, preview your questionnaire, then click Create and send to send the organizer to the selected client. That's it! The client will automatically receive an email notifying them that an organizer has been sent to them to fill out.

How to send an organizer in TaxDome?

Click the Organizer Template list to select a template, preview your questionnaire, then click Create and send to send the organizer to the selected client. That's it! The client will automatically receive an email notifying them that an organizer has been sent to them to fill out.

How do I import contacts into TaxDome?

Settings Upload CSV file to TaxDome. Go to Clients > Accounts, then click Import. Create accounts (optional) Here's how to create accounts: Define settings (Optional) In this step, apply settings in bulk to the newly imported accounts. Create contacts. Review.

What is the tax organizer letter?

The Tax Organizer can be used to remind you of the information needed and to allow you time to organize. Be sure to note any changes over the prior year to your address, marital status, number of dependents, job changes, etc.

How do I find tax prep clients?

11 Ways to Find Clients When Starting a New Tax and Accounting Create a website. Tell your family, friends, and existing network. Ask people in your target market for advice on landing clients like them. Start building reviews from the start. Maintain active professional social media from the start.

What is the client tax organizer?

*These client tax organizers help us gather and organize the information that will best help us prepare client returns accurately and efficiently. The forms and the information inputted is and will remain secure at all times*.

What is a tax organizer document?

A tax organizer is a client-facing document to help with the collection and submission of client information necessary to prepare a tax return. The individual income tax return organizer should be used with the preparation of Form 1040, U.S. Individual Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Client Tax Organizer?

The Client Tax Organizer is a document designed to help clients gather and organize their financial information for tax preparation. It typically includes sections for income, deductions, credits, and other relevant tax information.

Who is required to file Client Tax Organizer?

Clients who need to prepare their taxes, including individuals and businesses with taxable income or deductions, should fill out the Client Tax Organizer to ensure that all necessary information is collected accurately.

How to fill out Client Tax Organizer?

To fill out the Client Tax Organizer, clients should collect all relevant financial documents, such as W-2s, 1099s, and receipts for expenses. They should then complete each section of the organizer, providing accurate information and checking for completeness before submission.

What is the purpose of Client Tax Organizer?

The purpose of the Client Tax Organizer is to streamline the tax preparation process by allowing clients to systematically document their income, deductions, and credits, ensuring they have all necessary information for accurate filing.

What information must be reported on Client Tax Organizer?

The information that must be reported on the Client Tax Organizer typically includes personal identification details, income sources, tax deductions, tax credits, and any other financial information relevant to the client's tax situation.

Fill out your client tax organizer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Client Tax Organizer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.