Get the free Student(s) 2010 Tax Return Request - sfa ufl

Show details

Este formulario se debe completar electrónicamente utilizando Adobe Reader. Se requiere adjuntar una copia completa y firmada de la declaración de impuestos de 2010 junto con todos los W-2 y formularios

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign students 2010 tax return

Edit your students 2010 tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your students 2010 tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing students 2010 tax return online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit students 2010 tax return. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out students 2010 tax return

How to fill out Student(s) 2010 Tax Return Request

01

Gather necessary documents, including W-2 forms, 1098-T forms, and any other income statements.

02

Complete the top section of the Student(s) 2010 Tax Return Request form with your personal information.

03

Fill out the tax year and indicate whether you are a full-time or part-time student.

04

List any dependents you have and their information, if applicable.

05

Provide details about your income, including wages, scholarships, and grants.

06

Sign and date the form to affirm the information provided is accurate.

07

Submit the completed form to the appropriate tax authority as per the instructions provided.

Who needs Student(s) 2010 Tax Return Request?

01

Students seeking to file their tax returns for the 2010 tax year.

02

Individuals claiming education-related tax credits or deductions.

03

Parents or guardians filing on behalf of their dependent students.

Fill

form

: Try Risk Free

People Also Ask about

Can you get a tax refund from 10 years ago?

Generally, you must file a claim for a credit or refund within three years from the date you filed your original tax return or two years from the date you paid the tax, whichever is later.

How to get a 1098 form from college?

Your college or career school will provide your 1098-T form electronically or by postal mail if you paid any qualified tuition and related education expenses during the previous calendar year. Find information about the 1098-E form, which reports the amount of interest you paid on student loans in a calendar year.

Can I get a copy of my 2010 tax return?

Get a copy of your federal tax return You can get copies of your last 7 years of tax returns. Each copy is $30. It may take up to 75 days to process your request.

How many years back can I file to get a refund?

If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

Can the IRS collect taxes from 10 years ago?

The IRS generally has 10 years – from the date your tax was assessed – to collect the tax and any associated penalties and interest from you. This time period is called the Collection Statute Expiration Date (CSED). Your account can include multiple tax assessments, each with their own CSED.

Why didn't my college send me a 1098?

Some schools don't qualify to administer Education Dept funds and therefore can't issue a 1098-T. And if financial aide wipes out all tuition then a 1098-T isn't required, but if you did pay tuition that shouldn't apply.

Does a student need to file a tax return?

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to "Dependents" under "Who Must File" in Publication 501, Dependents, Standard Deduction and Filing Information.

What happens if my school doesn't give me a 1098-T form?

Form 1098-T should be sent for anyone who had education expenses or received scholarships, fellowships, or grants. If you, your spouse, or your dependent had education expenses and did not receive Form 1098-T, you may need to still report the amounts on the return.

Does every college student get a 1098?

Not all students are eligible to receive a 1098-T. Forms will not be issued under the following circumstances: The amount paid for qualified tuition and related expenses* in the calendar year is less than or equal to the total scholarships disbursed that year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

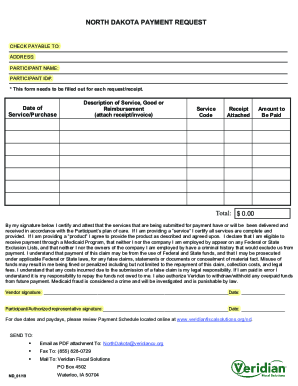

What is Student(s) 2010 Tax Return Request?

The Student(s) 2010 Tax Return Request is a form that students use to request copies of their tax returns from the IRS for the year 2010, typically needed for financial aid applications or for personal records.

Who is required to file Student(s) 2010 Tax Return Request?

Students who need to report their prior year income for financial aid purposes, or who need verification of their tax information, are required to file this request.

How to fill out Student(s) 2010 Tax Return Request?

To fill out the request, students must provide their personal information such as name, Social Security number, and address, along with details about their tax filing status and the specific tax year for which they need the return.

What is the purpose of Student(s) 2010 Tax Return Request?

The purpose of the request is to obtain a copy of the tax return for the year 2010 to fulfill requirements for federal financial aid, secure student loans, or to resolve discrepancies in financial information.

What information must be reported on Student(s) 2010 Tax Return Request?

The information that must be reported includes the student's full name, Social Security number, date of birth, mailing address, and signature, along with any other relevant identification and details about the tax return being requested.

Fill out your students 2010 tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Students 2010 Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.