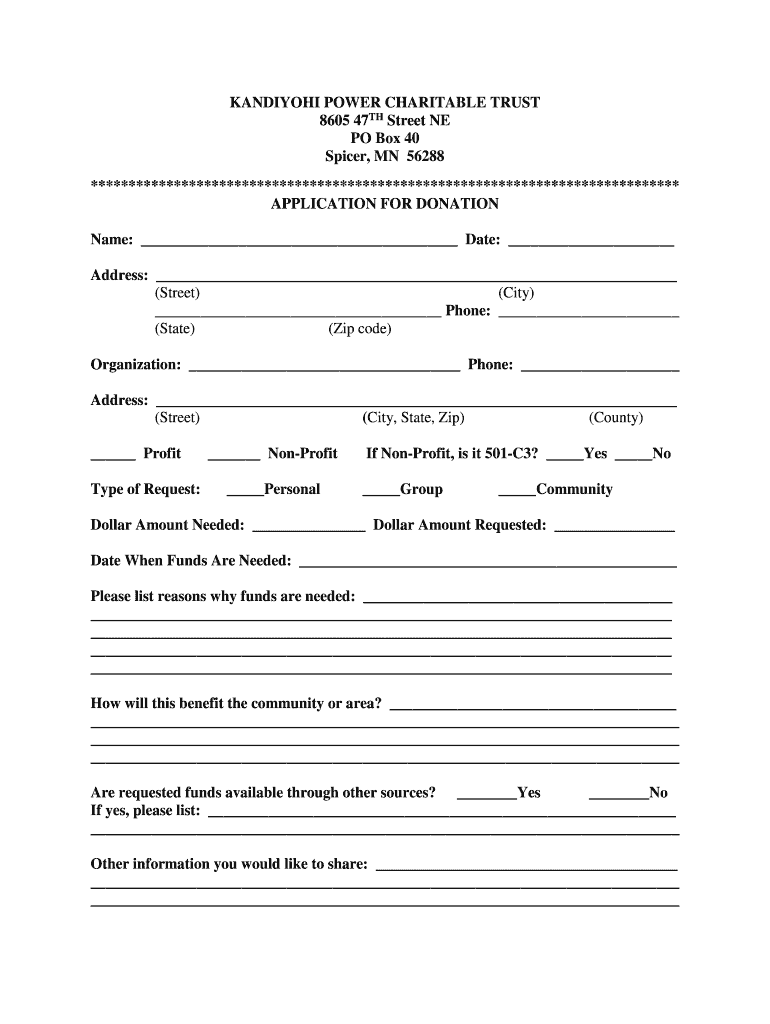

Kandiyohi Power Charitable Trust Application for Donation free printable template

Get, Create, Make and Sign charitable trust 56288 form

How to edit trust 8605 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kandiyohi trust yes form

How to fill out Kandiyohi Power Charitable Trust Application for Donation

Who needs Kandiyohi Power Charitable Trust Application for Donation?

Video instructions and help with filling out and completing power charitable trust for

Instructions and Help about charitable 8605 fillable

The Charitable Trusts is simply a trust which has a charitable beneficiary it may be a trust that has only charitable beneficiaries, so that is only charitable organizations may receive assets from the trust but more commonly it's what it is something referred to as a charitable split interest trust in which the charity has an interest but the trust creator and or the trust creators spouse has an interest, so typically we see that in the form of a charitable remainder trust or a charitable lead trust and there are different kinds of those but suffice it to say that in a charitable remainder trust the granter or trust creator enjoys income or payments from the trust during his or her lifetime or perhaps his or her spouse enjoys those payments and then at the end of a period of time the remainder goes to charity and with the charitable lead trust the charity actually gets paid every year or perhaps more frequently for a period of time and at the end of that time period the remainder will go to family you

People Also Ask about kandiyohi power charitable trust

What is the new Ontario energy Rebate?

What is the residential energy tax credit in Minnesota?

What is Ontario rebate program?

What is the electricity rate in Grant County WA?

Who has the cheapest rate for electricity?

Who has the cheapest electricity rates in Texas?

What is the electric rate in Kandiyohi?

What is the kandiyohi power rebate?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send charitable 56288 printable to be eSigned by others?

How do I make changes in power charitable trust?

Can I edit kandiyohi charitable download on an Android device?

What is Kandiyohi Power Charitable Trust Application for Donation?

Who is required to file Kandiyohi Power Charitable Trust Application for Donation?

How to fill out Kandiyohi Power Charitable Trust Application for Donation?

What is the purpose of Kandiyohi Power Charitable Trust Application for Donation?

What information must be reported on Kandiyohi Power Charitable Trust Application for Donation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.