Get the free CONDITIONS OF TAX SALE - Montour County

Show details

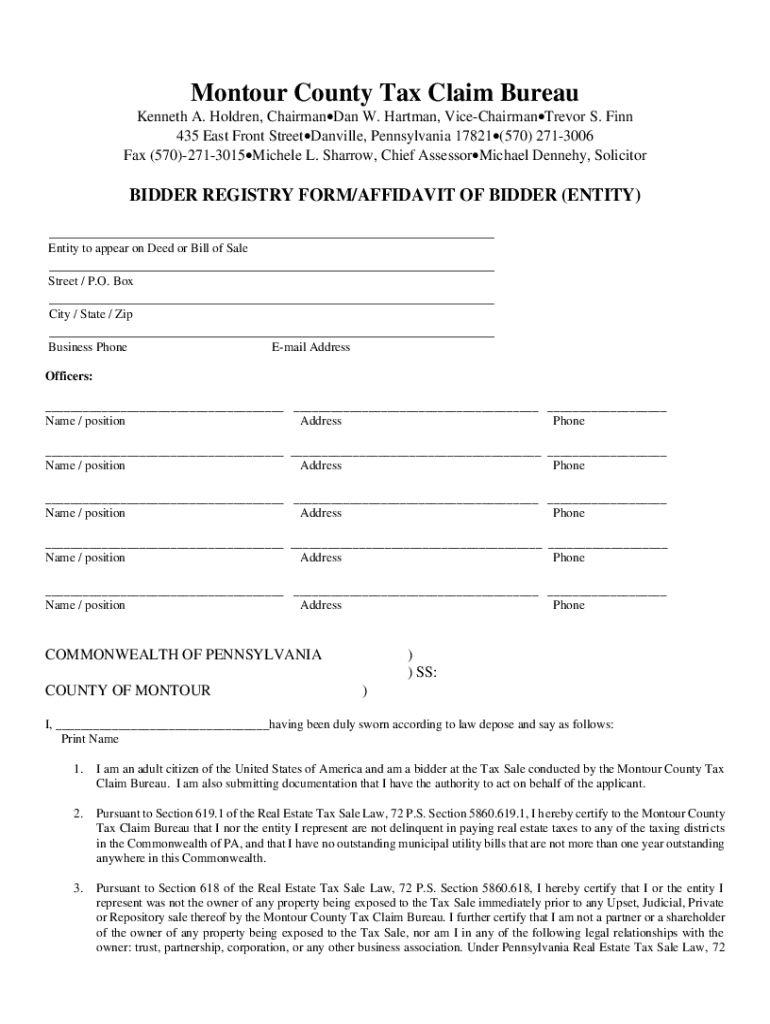

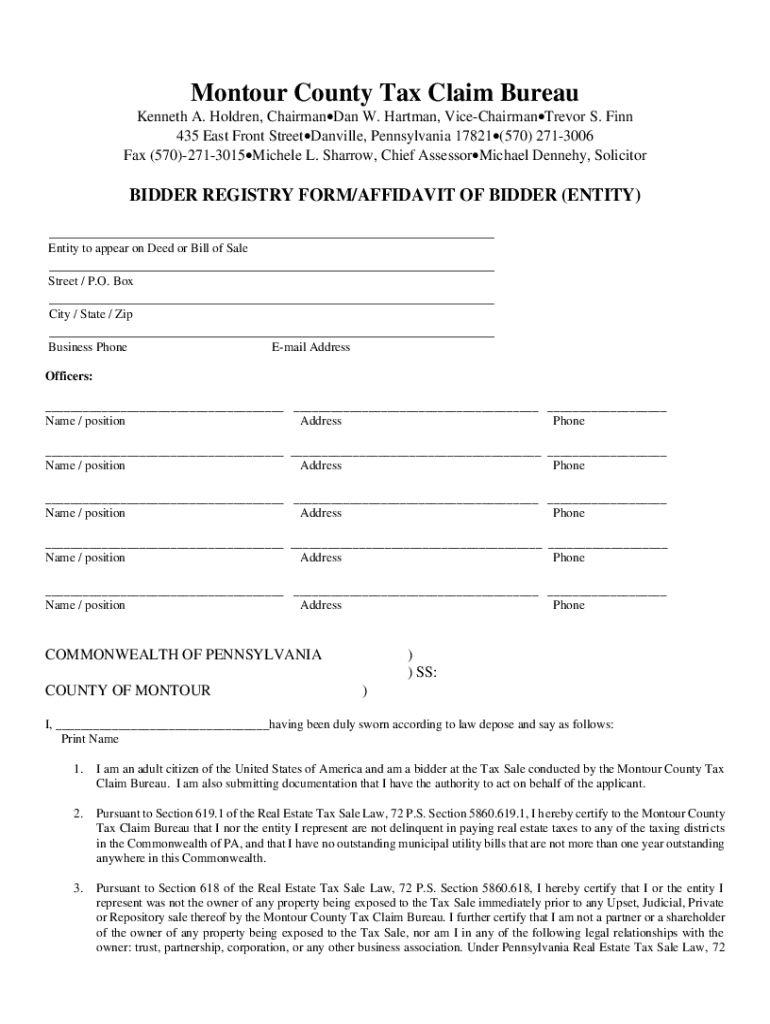

Contour County Tax Claim Bureau

Kenneth A. Holden, Chairman Dan W. Hartman, ViceChairmanTrevor S. Finn

435 East Front Street Danville, Pennsylvania 17821(570) 2713006

Fax (570)2713015Michele L. Sparrow,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conditions of tax sale

Edit your conditions of tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conditions of tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing conditions of tax sale online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit conditions of tax sale. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conditions of tax sale

How to fill out conditions of tax sale

01

Research the specific requirements for participating in a tax sale in your area.

02

Obtain a list of the properties up for auction and review the conditions for each property.

03

Complete any necessary registration or pre-registration forms with the designated tax sale office.

04

Prepare the required deposit or payment method for the auction.

05

Attend the tax sale auction at the designated time and location.

06

Place bids on properties that meet your criteria and be prepared to pay the full amount if your bid is successful.

07

Follow up with the necessary paperwork and payment to complete the purchase of the property.

Who needs conditions of tax sale?

01

Individuals interested in purchasing properties at a discounted rate through a tax sale.

02

Real estate investors looking to acquire properties for investment or resale purposes.

03

Homeowners or businesses seeking to expand their real estate holdings through tax sales.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete conditions of tax sale online?

pdfFiller has made it easy to fill out and sign conditions of tax sale. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit conditions of tax sale on an iOS device?

Use the pdfFiller mobile app to create, edit, and share conditions of tax sale from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit conditions of tax sale on an Android device?

You can make any changes to PDF files, like conditions of tax sale, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is conditions of tax sale?

Conditions of tax sale is a document that outlines the terms and conditions of a tax sale, typically including information such as the property being sold, the amount owed in taxes, and the deadline for payment.

Who is required to file conditions of tax sale?

The government entity responsible for collecting property taxes is typically required to file conditions of tax sale.

How to fill out conditions of tax sale?

Conditions of tax sale can typically be filled out online or in person through the appropriate government agency. It usually requires information about the property being sold and the amount owed in taxes.

What is the purpose of conditions of tax sale?

The purpose of conditions of tax sale is to provide transparency and information about properties being sold due to unpaid taxes, and to ensure that the tax sale process is conducted fairly and legally.

What information must be reported on conditions of tax sale?

Information such as the property description, the amount owed in taxes, the deadline for payment, and any additional terms and conditions of the sale must be reported on conditions of tax sale.

Fill out your conditions of tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conditions Of Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.