Get the free Manufactured Home Late-Payment Penalties (R - treasurer franklincountyohio

Show details

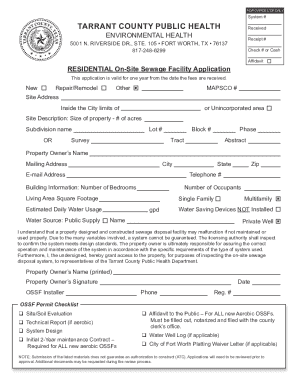

County Reset Form DUE 23A Rev. 5/11 Case no. Application for the Remission of Real Property and Manufactured Home Late-Payment Penalties (R.C. 5715.39) Date Received by Treasurer Taxpayer Instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manufactured home late-payment penalties

Edit your manufactured home late-payment penalties form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manufactured home late-payment penalties form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manufactured home late-payment penalties online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit manufactured home late-payment penalties. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manufactured home late-payment penalties

How to fill out manufactured home late-payment penalties:

01

Gather all the necessary information: Start by collecting all the relevant documents related to the manufactured home loan, including loan agreements, payment schedules, and any correspondence regarding late payments or penalties.

02

Understand the terms and conditions: Read through the loan agreements and payment schedules carefully to understand the specific terms and conditions related to late-payment penalties. Make note of any specific deadlines, interest rates, or additional fees that may apply.

03

Calculate the penalties: Determine the amount of the late-payment penalties based on the information provided in the loan agreements. This may involve calculating a percentage of the overdue payment or a fixed fee as specified in the terms.

04

Fill out the necessary forms: Use the information gathered to complete any required forms or documents related to the late-payment penalties. This may include a separate penalty calculation form or an amendment to the loan agreement.

05

Submit the paperwork: Once the necessary forms are completed, submit them to the appropriate party, such as the loan provider or a designated department within your manufactured home loan organization. Ensure that all required documentation is included to avoid any delays or complications.

Who needs manufactured home late-payment penalties?

01

Borrowers with overdue payments: Manufactured home late-payment penalties are typically applicable to borrowers who fail to make their loan payments on time. These penalties are designed to encourage timely payments and compensate the lender for the additional administrative costs and potential risks associated with late payments.

02

Lenders or loan providers: Manufactured home late-payment penalties are necessary for lenders or loan providers to maintain appropriate cash flow and financial stability. These penalties help mitigate potential losses caused by delays in loan repayments and cover any additional expenses incurred as a result of managing late payments.

03

Loan administration departments: The loan administration departments within lending organizations are responsible for enforcing and managing late-payment penalties. They need these penalties to ensure compliance with loan agreements, track and calculate penalties accurately, and communicate penalties to borrowers in a timely and transparent manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my manufactured home late-payment penalties in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your manufactured home late-payment penalties as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit manufactured home late-payment penalties online?

The editing procedure is simple with pdfFiller. Open your manufactured home late-payment penalties in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit manufactured home late-payment penalties on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing manufactured home late-payment penalties.

Fill out your manufactured home late-payment penalties online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manufactured Home Late-Payment Penalties is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.