IRS Publication 915 2022 free printable template

Instructions and Help about IRS Publication 915

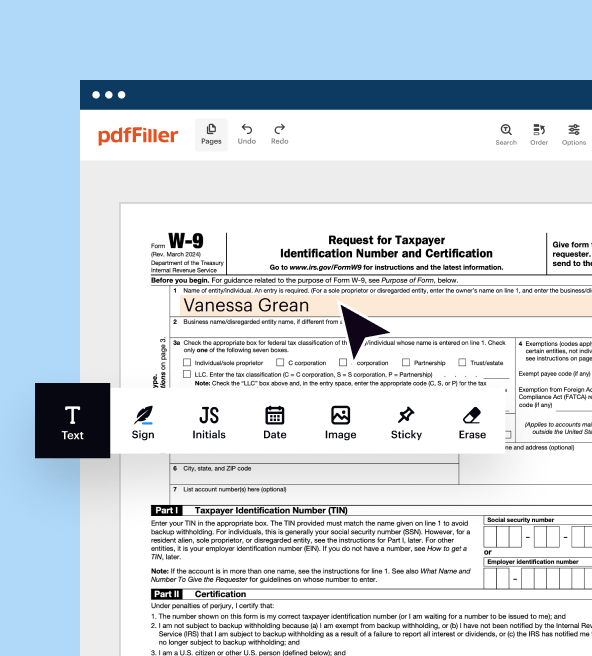

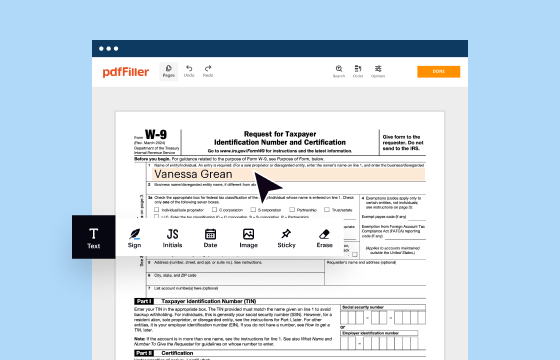

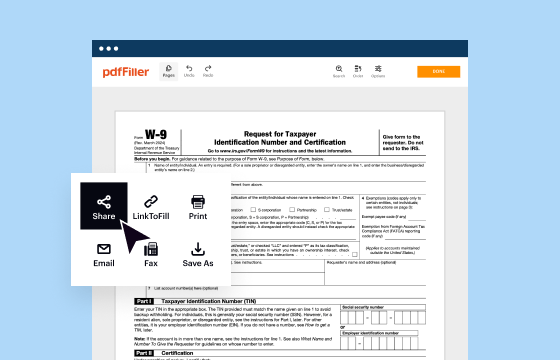

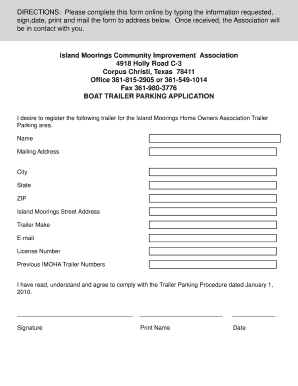

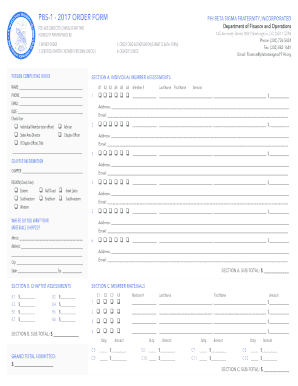

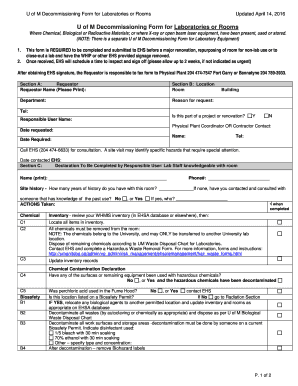

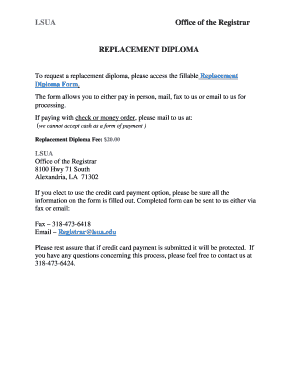

How to edit IRS Publication 915

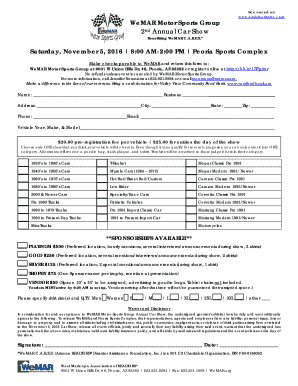

How to fill out IRS Publication 915

About IRS Publication previous version

What is IRS Publication 915?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

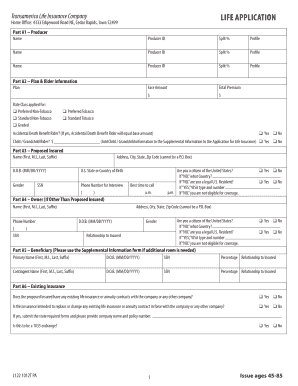

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

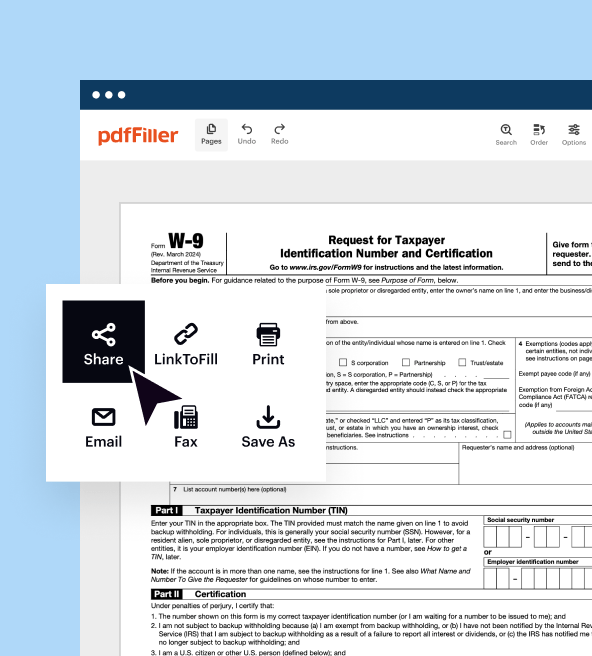

Where do I send the form?

FAQ about IRS Publication 915

What should I do if I need to correct a mistake on my IRS Publication 915 submission?

If you discover an error after submitting your IRS Publication 915, you should file an amended return using Form 1040-X, which allows you to correct information. Ensure you indicate the specific changes made and attach the corrected information to the amended form.

How can I track the status of my IRS Publication 915 submission?

To track your IRS Publication 915 submission, use the IRS 'Where's My Refund?' tool or call the IRS directly. Be sure to have your submission details handy, as they help the IRS representative assist you more efficiently.

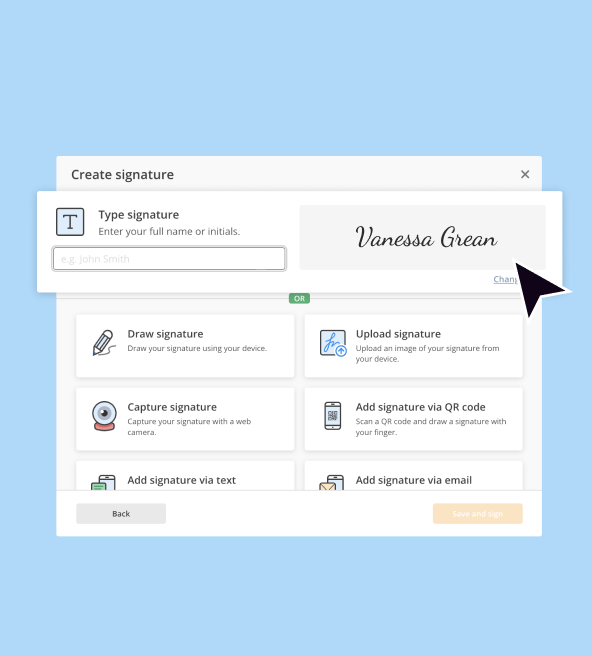

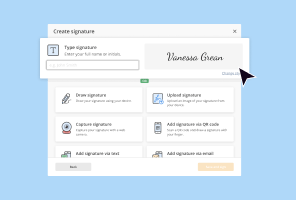

What should I be aware of concerning e-signature when submitting IRS Publication 915?

When filing IRS Publication 915 electronically, an e-signature is acceptable provided it adheres to IRS regulations. This can help streamline the e-filing process, but make sure to retain copies of all signed forms for your records.

Are there common errors I should watch out for when filing my IRS Publication 915?

Yes, common mistakes include incorrect Social Security Numbers or not including all relevant income. Double-check all entries and ensure that the information is accurate to avoid delays or rejections in processing your IRS Publication 915.

What happens if my IRS Publication 915 submission is rejected?

If your IRS Publication 915 is rejected, you will receive a notification indicating the reason. Address the issue outlined in the rejection notice and submit the corrected form promptly to ensure compliance and avoid potential penalties.

See what our users say