Get the free SCHEDULE NRH 1040ME 2014

Show details

SCHEDULE NRH SCHEDULE for CALCULATING the NONRESIDENT CREDIT FOR MARRIED PERSON ELECTING TO FILE SINGLE FORM 1040ME This schedule must be enclosed with your completed Form 1040ME. Also attach a COMPLETE

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule nrh 1040me 2014

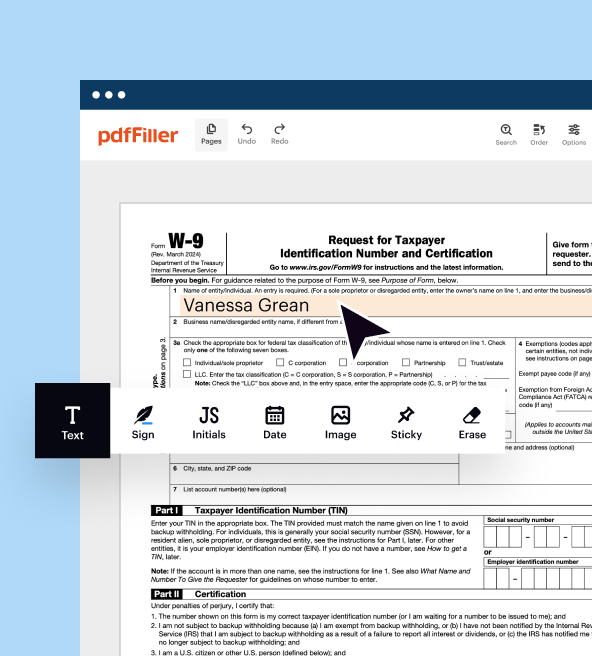

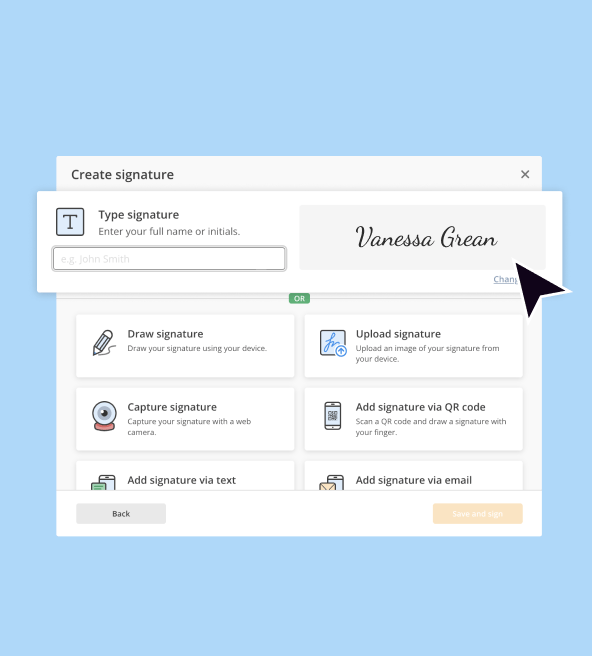

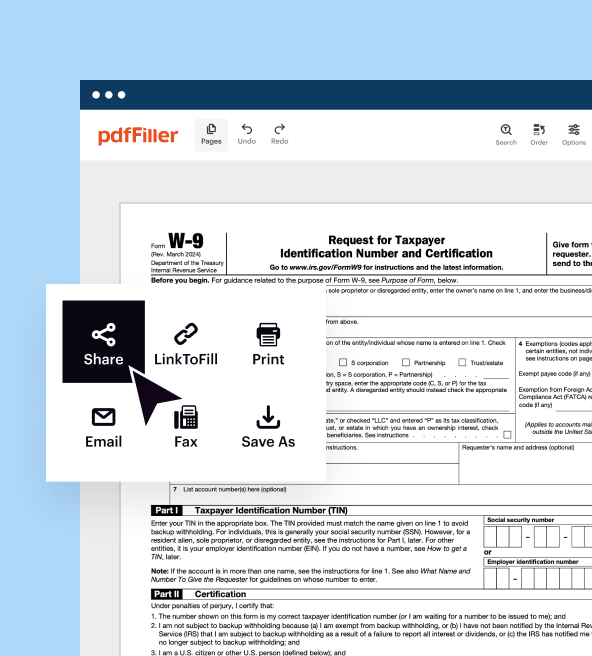

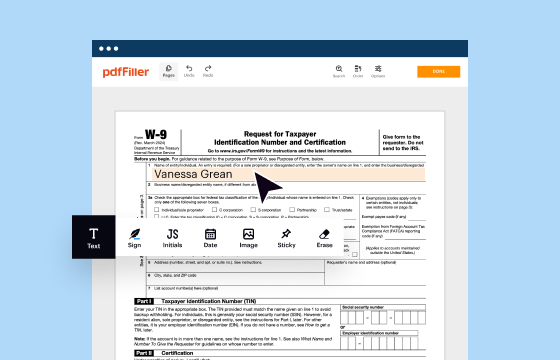

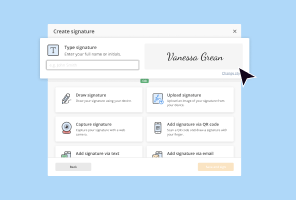

How to edit schedule nrh 1040me 2014

How to fill out schedule nrh 1040me 2014

Instructions and Help about schedule nrh 1040me 2014

How to edit schedule nrh 1040me 2014

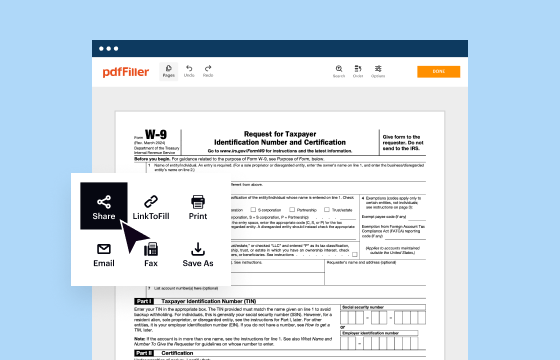

To edit Schedule NRH 1040ME 2014, you can use pdfFiller, which allows users to upload the form and make necessary changes easily. Start by accessing the file in pdfFiller, and use the editing tools to input or modify information. Ensure that any changes remain accurate and compliant with IRS regulations to avoid issues during submission.

How to fill out schedule nrh 1040me 2014

To fill out Schedule NRH 1040ME 2014, follow these steps:

01

Obtain a copy of the schedule from the IRS website or your tax preparation resources.

02

Gather all necessary financial documents, such as income statements, deduction receipts, and previous tax returns.

03

Carefully read the instructions provided with the schedule to understand each section.

04

Use your gathered documents to fill in the required fields systematically, ensuring accuracy.

05

After completing the form, review for any errors or omissions before submission.

Latest updates to schedule nrh 1040me 2014

Latest updates to schedule nrh 1040me 2014

No significant updates have been announced for Schedule NRH 1040ME 2014. It's important to check the IRS website for the most current information regarding any potential changes or updates for tax forms.

All You Need to Know About schedule nrh 1040me 2014

What is schedule nrh 1040me 2014?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule nrh 1040me 2014

What is schedule nrh 1040me 2014?

Schedule NRH 1040ME 2014 is a tax form used by individuals to report specific information related to non-resident housing. It is utilized to claim deductions or credits related to housing expenses that may apply to certain taxpayers.

What is the purpose of this form?

The purpose of Schedule NRH 1040ME 2014 is to allow non-residents to report their housing expenses and potentially receive tax benefits based on those expenses. The form assists the IRS in understanding the taxpayer’s eligibility for housing-related deductions and credits, thus ensuring proper tax compliance.

Who needs the form?

Taxpayers who are classified as non-residents and have incurred housing expenses that may qualify for deductions or credits are required to complete Schedule NRH 1040ME 2014. This typically includes individuals who have lived in the United States for a limited duration and are subject to specific housing-related tax regulations.

When am I exempt from filling out this form?

You may be exempt from filling out Schedule NRH 1040ME 2014 if you have no housing expenses to report, or if your residency status does not require the disclosure of housing-related information. Additionally, those who do not meet the IRS criteria for deductions related to non-resident housing may also be exempt.

Components of the form

Schedule NRH 1040ME 2014 consists of several key components that include personal identification information, sections for detailing housing expenses, and calculations for deductions or credits. It is essential for filers to complete each component accurately to avoid delays in processing.

What are the penalties for not issuing the form?

Failing to issue Schedule NRH 1040ME 2014 when required can result in penalties imposed by the IRS. These penalties may include fines or interest on unpaid taxes, as well as a potential audit of your tax return. It is crucial to understand your obligations and submit the form accordingly.

What information do you need when you file the form?

When filing Schedule NRH 1040ME 2014, you will need specific information including your full name, Social Security number, details of housing expenses, and any other pertinent financial data. Collecting this information beforehand can streamline the filing process and improve accuracy.

Is the form accompanied by other forms?

Schedule NRH 1040ME 2014 may need to be submitted along with other tax forms, depending on individual circumstances. For instance, if you are reporting additional income or deductions, you might also need to include standard tax forms like the 1040 or specific schedules related to your financial situation.

Where do I send the form?

You should send Schedule NRH 1040ME 2014 to the address specified by the IRS based on your residence or the nature of your tax return. It's important to review the filing instructions to identify the correct mailing address to ensure your form is processed correctly and promptly.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.