OK OTC 921 - Tulsa County 2022 free printable template

Show details

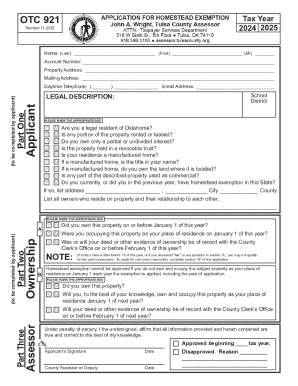

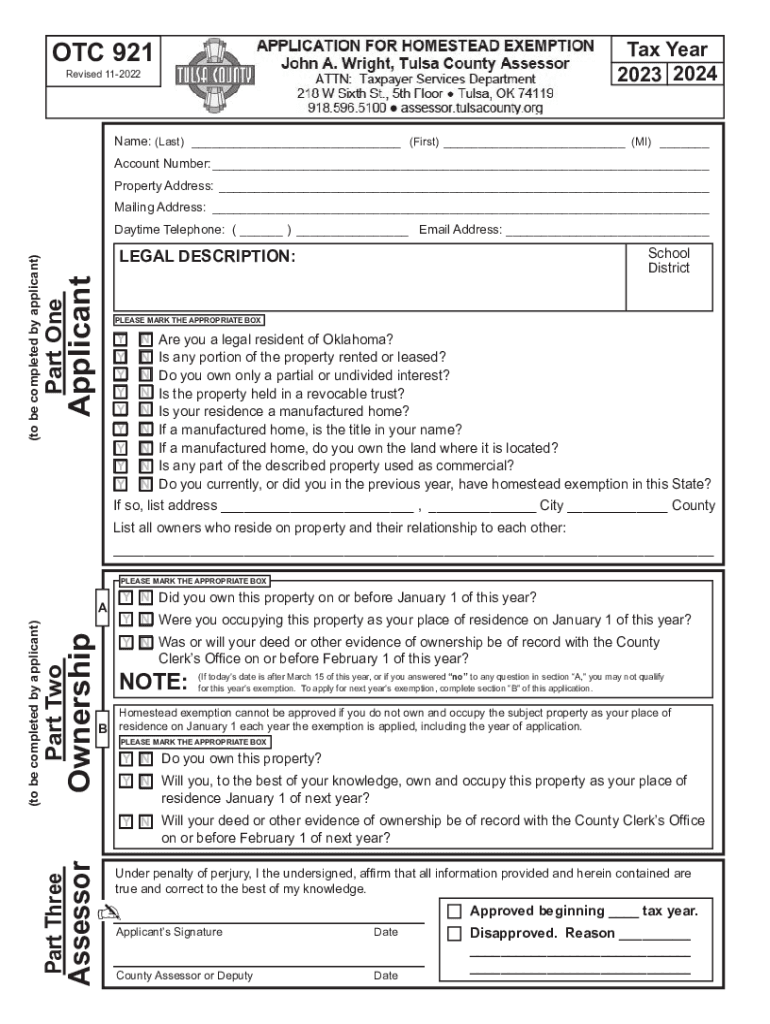

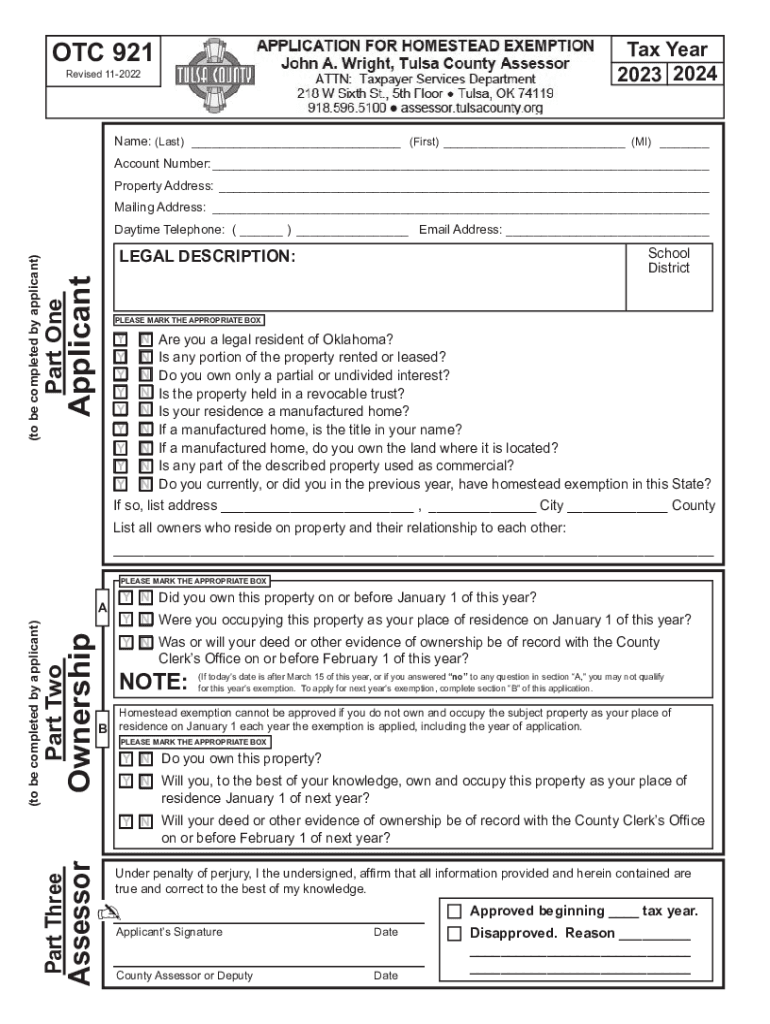

OTC 921 Tax Year 2023 2024 Revised 11-2022 Name: (Last) _______________________________ (First)___________________________ (MI) ________ Account Number:________________________________________________________________________

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 921 - Tulsa County

Edit your OK OTC 921 - Tulsa County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 921 - Tulsa County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OTC 921 - Tulsa County online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK OTC 921 - Tulsa County. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 921 - Tulsa County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 921 - Tulsa County

How to fill out OK OTC 921 - Tulsa County

01

Obtain the OK OTC 921 form from the Tulsa County official website or local office.

02

Fill in the required personal information at the top of the form, including your name, address, and contact details.

03

Provide details about the transaction, including the type of tax you are reporting and the amount owed.

04

Attach any necessary documentation that supports your claims or calculations.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the form to the appropriate Tulsa County office by the deadline, either in person or via mail.

Who needs OK OTC 921 - Tulsa County?

01

Individuals or businesses in Tulsa County who are reporting a tax obligation or seeking a tax credit.

02

Tax professionals assisting clients with Oklahoma tax compliance.

03

Property owners who are making adjustments or corrections to their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

When can I file homestead exemption Oklahoma?

How do I apply for a Homestead Exemption? Application for Homestead Exemption is made with the County Assessor at any time. However, the homestead application must be filed on or before March 15th of the current tax year for the homestead to be granted for the current year. Download the Homestead Exemption Form (PDF).

Is there a property tax freeze for seniors in Tulsa County?

Head-of-Household The Senior Valuation Limitation locks in the Taxable Fair Cash Valuation, but does not freeze taxes. The tax amount could increase each year under these three specific situations: Additional millage or levy is added by the Tulsa County Excise Board; Judgment is taken against the County; or.

How do I file for homestead exemption in Tulsa?

You may file in person at the Tulsa County Assessor's Office, Tulsa County Headquarters, 5th floor, 218 W. Sixth St., Tulsa, OK 74119. You may also file by mail by downloading the Additional Homestead Exemption and/or Senior Valuation Limitation Form (available from Jan. 1st - March 15th only).

What is a homestead exemption Tulsa County Oklahoma?

A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence.

What are the requirements for Oklahoma Homestead Exemption?

You must be the homeowner who resides in the property on January 1. The deed must be executed on or before January 1 and filed with the County Clerks Office on or before February 1. You must be a resident of Oklahoma.

What is the purpose of Homestead Exemption Oklahoma?

What are the benefits of Homestead Exemption? As noted above, the Homestead Exemption of $1,000 assessed valuation reduces the real property tax by the amount of the millage levy effective in your area. This is $60 to $114 depending on your area of the county.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OK OTC 921 - Tulsa County without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including OK OTC 921 - Tulsa County, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send OK OTC 921 - Tulsa County to be eSigned by others?

Once your OK OTC 921 - Tulsa County is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit OK OTC 921 - Tulsa County on an Android device?

The pdfFiller app for Android allows you to edit PDF files like OK OTC 921 - Tulsa County. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is OK OTC 921 - Tulsa County?

OK OTC 921 is a form used for reporting specific tax information to the Oklahoma Tax Commission related to Tulsa County.

Who is required to file OK OTC 921 - Tulsa County?

Individuals and businesses that have taxable transactions in Tulsa County are required to file OK OTC 921.

How to fill out OK OTC 921 - Tulsa County?

To fill out OK OTC 921, individuals need to provide accurate financial information, including details of transactions and applicable tax rates, following the instructions provided on the form.

What is the purpose of OK OTC 921 - Tulsa County?

The purpose of OK OTC 921 is to ensure proper reporting and collection of taxes owed to Tulsa County and to comply with state tax regulations.

What information must be reported on OK OTC 921 - Tulsa County?

Information required on OK OTC 921 includes details such as the taxpayer's identification, transaction amounts, tax calculations, and any deductions or credits applicable.

Fill out your OK OTC 921 - Tulsa County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 921 - Tulsa County is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.