Get the free Property Tax Payment Scam AlertSan Bernardino County ...

Show details

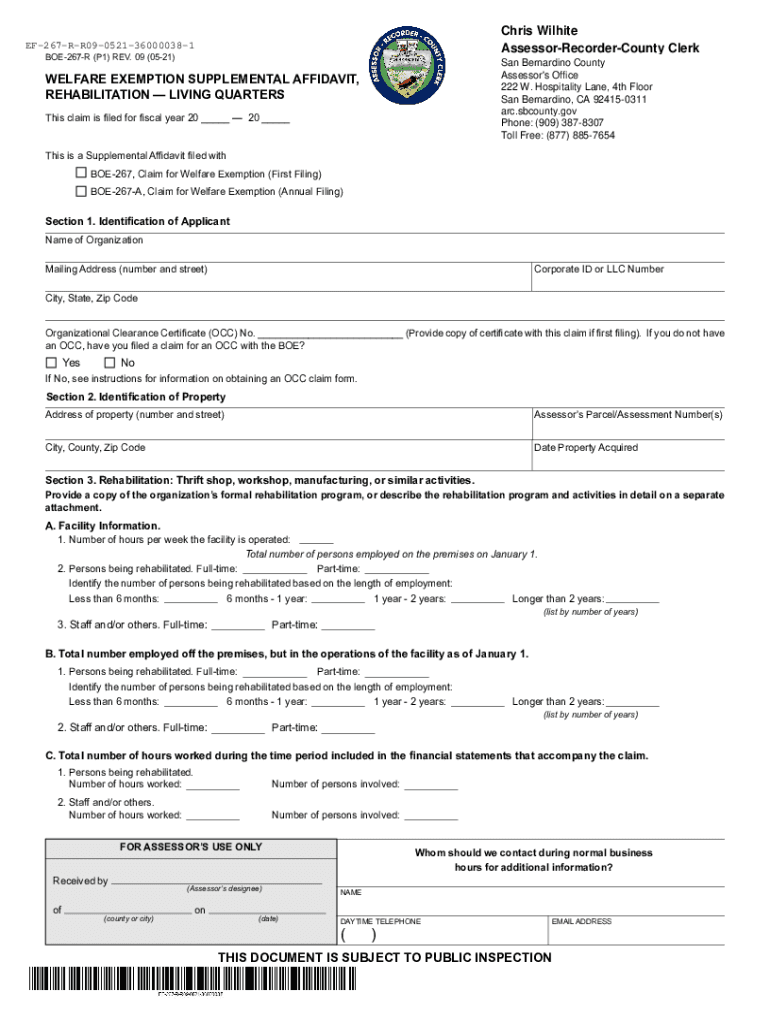

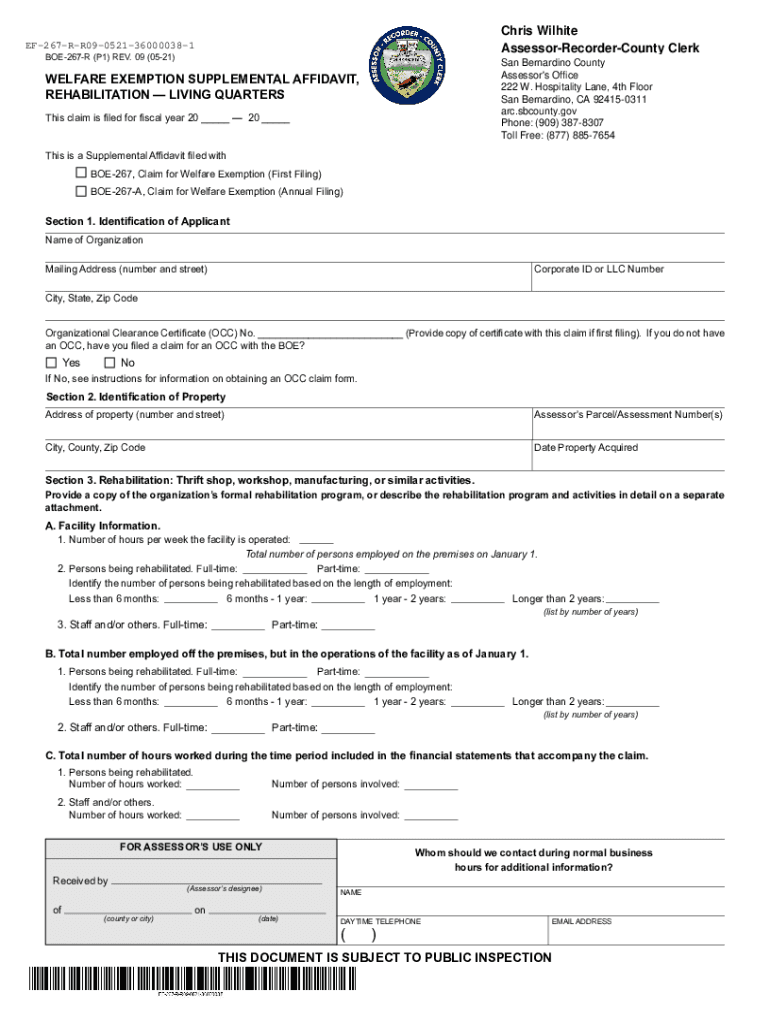

Chris White AssessorRecorderCounty ClerkEF267RR090521360000381 BOE267R (P1) REV. 09 (0521)San Bernardino County Assessor\'s Office 222 W. Hospitality Lane, 4th Floor San Bernardino, CA 924150311 arc.county.gov

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax payment scam

Edit your property tax payment scam form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax payment scam form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax payment scam online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax payment scam. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax payment scam

How to fill out property tax payment scam

01

Be cautious of unsolicited emails or phone calls claiming to be from a government agency regarding property taxes.

02

Verify the legitimacy of the request by contacting your local tax assessor's office directly.

03

Never provide personal information or payment details over the phone or email.

04

Report any suspicious activity to the authorities or the Federal Trade Commission.

05

Educate yourself and others about common scams and how to protect against them.

Who needs property tax payment scam?

01

No one needs a property tax payment scam as it is a fraudulent activity designed to deceive and steal from unsuspecting victims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property tax payment scam for eSignature?

When you're ready to share your property tax payment scam, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit property tax payment scam in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your property tax payment scam, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit property tax payment scam on an Android device?

The pdfFiller app for Android allows you to edit PDF files like property tax payment scam. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is property tax payment scam?

Property tax payment scam is a fraudulent scheme where individuals or companies deceive property owners into making payments for property taxes that are not actually owed.

Who is required to file property tax payment scam?

Property owners who have been targeted or fallen victim to a property tax payment scam are required to report the incident to the appropriate authorities.

How to fill out property tax payment scam?

To report a property tax payment scam, individuals can contact their local law enforcement agency, the state attorney general's office, or the Federal Trade Commission (FTC). They may also consider seeking legal assistance.

What is the purpose of property tax payment scam?

The purpose of a property tax payment scam is to deceive property owners into making fraudulent payments for property taxes that they do not owe, ultimately resulting in financial loss for the victim.

What information must be reported on property tax payment scam?

When reporting a property tax payment scam, individuals should provide details of the fraudulent communication, such as the name of the scammer, contact information, and any documentation or evidence of the scam.

Fill out your property tax payment scam online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Payment Scam is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.