Get the free Analysis of shareholders - Clicks Group Limited

Show details

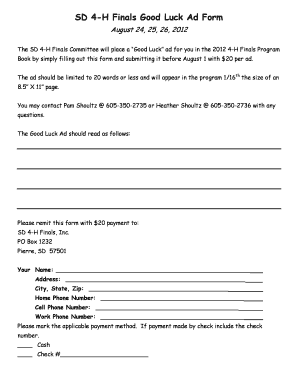

T4IB00722 Clicks AR06 Fin 12/11/06 2:39 PM Page 104 analysis of shareholders annual report 2006 New Clicks Holdings 104 at 31 August 2006 Number of holders Percentage of holders Number of shares Percentage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign analysis of shareholders

Edit your analysis of shareholders form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your analysis of shareholders form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing analysis of shareholders online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit analysis of shareholders. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out analysis of shareholders

How to fill out analysis of shareholders:

01

Begin by compiling a list of all shareholders of the company. This includes both individual shareholders and institutional investors.

02

Gather background information about each shareholder, such as their name, contact details, and the number of shares they hold. This information can be obtained from the company's shareholder register or through communication with the shareholders themselves.

03

Analyze the ownership structure of the company. This involves determining the percentage of shares held by each shareholder and categorizing them as majority shareholders, minority shareholders, or significant shareholders.

04

Assess the voting power of each shareholder. This involves determining the number of voting rights associated with the shares held by each shareholder. It is important to consider any special voting rights or restrictions that may apply to certain shareholders.

05

Evaluate the influence and impact of each shareholder on the company. This includes analyzing any direct or indirect control that they may have over the decision-making process and their potential influence on corporate governance.

06

Examine the financial interests and motivations of each shareholder. This includes assessing their investment objectives, risk tolerance, and potential conflicts of interest.

07

Consider any legal or regulatory obligations associated with the analysis of shareholders. This may include compliance with securities laws, disclosure requirements, or any specific rules or guidelines issued by regulatory authorities.

08

Create a comprehensive report summarizing the analysis of shareholders. This report should provide an overview of the ownership structure, voting power, influence, and financial interests of each shareholder. It should also highlight any key findings or insights that can help the company make informed strategic decisions.

Who needs analysis of shareholders:

01

Companies and organizations conducting mergers and acquisitions or considering significant changes to their corporate structure often need an analysis of shareholders. This helps them understand the impact of such changes on existing shareholders and to identify any potential conflicts or issues that may arise.

02

Investors and shareholders themselves may require an analysis of shareholders to gain insights into the overall ownership structure and the influence of different shareholders. This can help them make informed investment decisions or exercise their rights as shareholders.

03

Regulatory authorities and government agencies may request an analysis of shareholders to ensure compliance with securities laws, prevent market manipulation, or monitor the concentration of ownership in certain industries.

04

Legal and financial advisors may need an analysis of shareholders to provide guidance to their clients on matters such as corporate governance, shareholder rights, or potential disputes among shareholders.

05

Researchers and analysts studying corporate governance, ownership structures, or investor behavior may rely on an analysis of shareholders to advance their understanding of these topics and to contribute to the academic literature in these fields.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is analysis of shareholders?

Analysis of shareholders is a report that provides information on the ownership structure of a company, including details on who the shareholders are and how much of the company they own.

Who is required to file analysis of shareholders?

Companies are required to file analysis of shareholders to regulatory authorities, such as the SEC, in order to comply with reporting requirements.

How to fill out analysis of shareholders?

Analysis of shareholders can be filled out by collecting information on shareholders, their ownership percentage, and relevant details, then submitting the report to the appropriate regulatory body.

What is the purpose of analysis of shareholders?

The purpose of analysis of shareholders is to provide transparency and accountability regarding the ownership structure of a company, which can be important for investors, regulators, and other stakeholders.

What information must be reported on analysis of shareholders?

Information such as the names of shareholders, their ownership percentage, any changes in ownership, and any relationships between shareholders must be reported on analysis of shareholders.

How do I fill out analysis of shareholders using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign analysis of shareholders and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out analysis of shareholders on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your analysis of shareholders. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out analysis of shareholders on an Android device?

Use the pdfFiller app for Android to finish your analysis of shareholders. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your analysis of shareholders online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Analysis Of Shareholders is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.