PA Houston & Associates Consent to Disclosure of Tax Return Information 2019-2025 free printable template

Show details

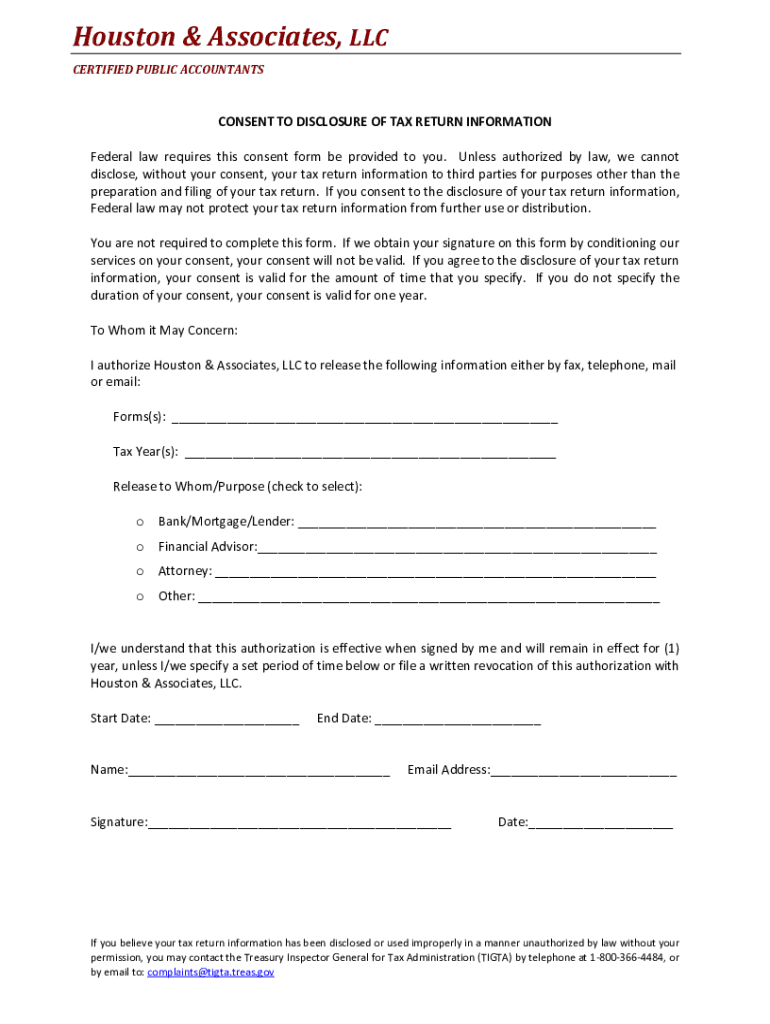

Houston & Associates, LLC CERTIFIED PUBLIC ACCOUNTANTSCONSENT TO DISCLOSURE OF TAX RETURN INFORMATION Federal law requires this consent form be provided to you. Unless authorized by law, we cannot

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Houston Associates Consent to Disclosure of Tax

Edit your PA Houston Associates Consent to Disclosure of Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Houston Associates Consent to Disclosure of Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA Houston Associates Consent to Disclosure of Tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA Houston Associates Consent to Disclosure of Tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Houston & Associates Consent to Disclosure of Tax Return Information Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (135 Votes)

4.0 Satisfied (25 Votes)

How to fill out PA Houston Associates Consent to Disclosure of Tax

How to fill out PA Houston & Associates Consent to Disclosure of Tax

01

Obtain the PA Houston & Associates Consent to Disclosure of Tax form from their website or office.

02

Fill in your personal information including your full name, address, and contact details.

03

Specify the tax years for which the disclosure is authorized.

04

Identify the parties that are authorized to receive the tax information.

05

Sign and date the form to confirm your consent.

06

Submit the completed form to PA Houston & Associates or the specified parties.

Who needs PA Houston & Associates Consent to Disclosure of Tax?

01

Clients of PA Houston & Associates who need to authorize the disclosure of their tax information.

02

Individuals seeking tax assistance or representation who need to share tax records with third parties.

Fill

form

: Try Risk Free

People Also Ask about

Do you want to allow another person to discuss this return with the IRS?

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person

Should I consent for use of tax return information?

The IRS requires us to provide this consent to you. Unless authorized by law, we cannot use your tax return information for purposes other than preparing and filing your tax return without your consent.

What is consent to disclosure?

You may disclose personal information with the explicit consent of the individual to whom the information relates as long as the disclosure is for a lawful purpose. While implied consent is acceptable for collection and use of information in some cases, consent for disclosure must be explicit.

What are the different types of consent?

The 4 types of consent are: express consent, implied consent, opt in consent and opt out consent.

Who can talk to IRS on my behalf?

Who You Can Authorize. You can authorize your tax preparer, a friend, a family member, or any other person you choose to receive oral disclosure during a conversation with the IRS.

What does consent to disclosure of tax return information mean?

A consent to “disclose” allows the partner to disclose the taxpayer's tax return information to determine whether the taxpayer will benefit from services offered such as financial advisory and asset planning.

What is the tax consent letter?

It is a No Objection Certificate (NOC) from the owner of the premises stating that he doesn't have any objection to the taxpayer using the premises for carrying out business. Under GST, there is no specific format for the consent letter. It can be any written document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA Houston Associates Consent to Disclosure of Tax to be eSigned by others?

When you're ready to share your PA Houston Associates Consent to Disclosure of Tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit PA Houston Associates Consent to Disclosure of Tax online?

With pdfFiller, it's easy to make changes. Open your PA Houston Associates Consent to Disclosure of Tax in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I fill out PA Houston Associates Consent to Disclosure of Tax on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your PA Houston Associates Consent to Disclosure of Tax. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is PA Houston & Associates Consent to Disclosure of Tax?

PA Houston & Associates Consent to Disclosure of Tax is a legal document that allows the authorized parties to share tax information between PA Houston & Associates and specified entities, such as clients or third parties.

Who is required to file PA Houston & Associates Consent to Disclosure of Tax?

Individuals or businesses seeking to share their tax information with PA Houston & Associates or those who wish to authorize PA Houston & Associates to disclose their tax information to external parties are required to file this consent.

How to fill out PA Houston & Associates Consent to Disclosure of Tax?

To fill out the consent form, provide necessary personal or business information, specify the parties authorized to receive the tax information, and ensure a signed acknowledgment to verify consent.

What is the purpose of PA Houston & Associates Consent to Disclosure of Tax?

The purpose of the consent form is to facilitate the sharing of tax information legally, ensuring compliance with privacy regulations and providing clarity on who can access the information.

What information must be reported on PA Houston & Associates Consent to Disclosure of Tax?

Required information typically includes the individual's or business's identification details, the tax years applicable, the names of the individuals or entities authorized to receive the information, and the signature of the person granting the consent.

Fill out your PA Houston Associates Consent to Disclosure of Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Houston Associates Consent To Disclosure Of Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.