Get the free NOT FOR PROFIT ORGANIZATION VOLUNTEER APPLICATION PLEASE PRINT Organization Name: Ad...

Show details

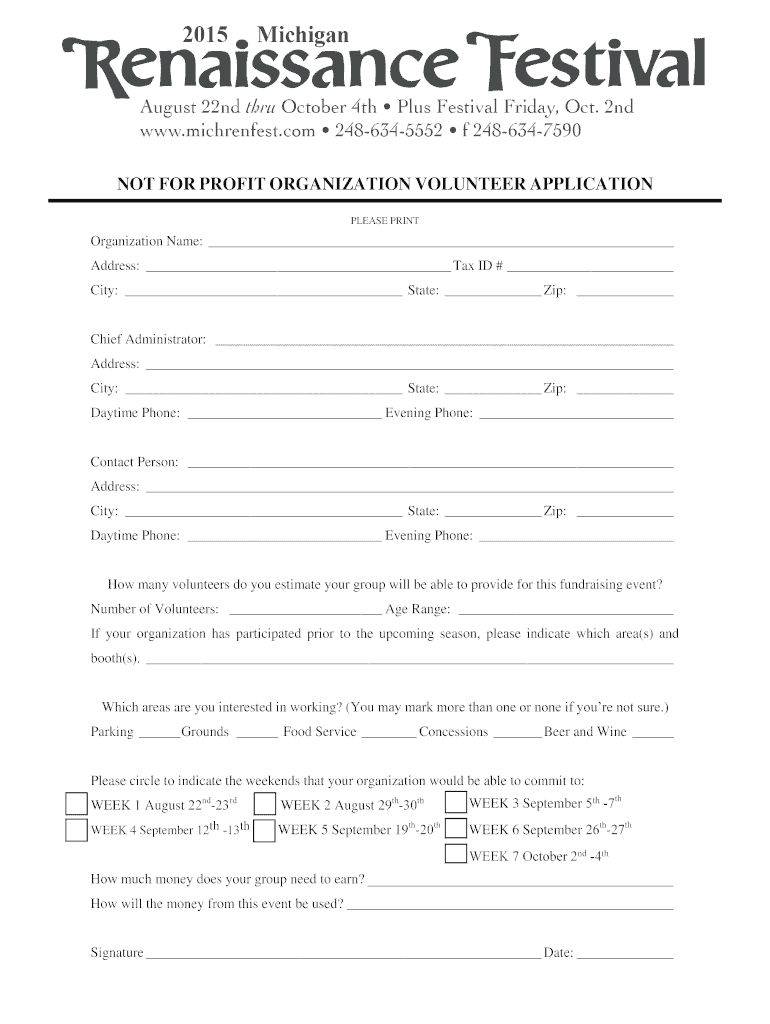

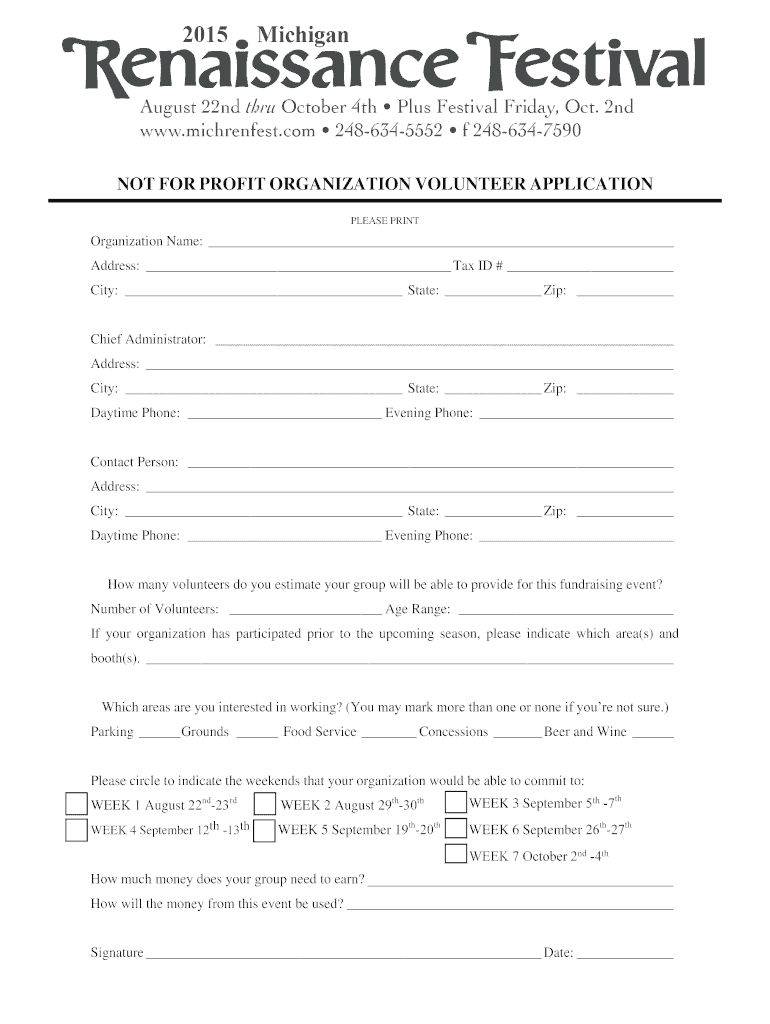

NOT FOR PROFIT ORGANIZATION VOLUNTEER APPLICATION PLEASE PRINT Organization Name: Address: Tax ID # City: State: Zip: Chief Administrator: Address: City: State: Zip: Daytime Phone: Evening Phone:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign not for profit organization

Edit your not for profit organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your not for profit organization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit not for profit organization online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit not for profit organization. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out not for profit organization

How to fill out not for profit organization:

01

Research and understand the legal requirements: Before filling out the paperwork, it is crucial to familiarize yourself with the specific legal requirements for forming a not-for-profit organization in your jurisdiction. This may include obtaining tax-exempt status, registering with the appropriate government agencies, and fulfilling any filing obligations.

02

Determine the purpose and mission of your organization: Clearly define the purpose and mission of your not-for-profit organization. This will help you in completing the necessary paperwork and also guide your organization's activities and operations in the future.

03

Choose a suitable organizational structure: Determine the appropriate legal structure for your not-for-profit organization, be it a trust, corporation, or association. Each structure comes with its own set of requirements and benefits, so make sure to choose one that aligns with your organization's goals and objectives.

04

Draft your governing documents: Prepare the necessary governing documents for your organization, including articles of incorporation or association, bylaws, and any other required policies or agreements. These documents outline the structure, rules, and procedures by which your organization will operate and govern itself.

05

File the necessary paperwork: Once you have prepared all the required documentation, file it with the relevant government authorities or departments responsible for regulating not-for-profit organizations. This may involve submitting forms, paying any applicable fees, and providing additional supporting documents as required.

06

Obtain tax-exempt status: If you intend to seek tax-exempt status for your not-for-profit organization, you will need to complete and submit the appropriate forms to the tax authorities. Consult with a legal or tax professional to ensure you meet all the criteria and properly apply for tax-exempt status.

07

Establish internal policies and procedures: Develop internal policies and procedures that govern the day-to-day operations of your organization. This may include financial management protocols, board governance guidelines, volunteer management procedures, and any other policies relevant to your organization's activities.

Who needs not for profit organization:

01

Charitable or humanitarian causes: Non-profit organizations are particularly beneficial for individuals or groups looking to address societal or community needs, such as providing healthcare services, supporting education, alleviating poverty, or promoting social justice.

02

Advocacy and activism: Not-for-profit organizations play a crucial role in advocating for specific causes or issues, such as environmental protection, civil rights, animal welfare, or cultural preservation. These organizations help amplify voices and create positive change in society.

03

Community development: Non-profit organizations often focus on enhancing community development initiatives, such as promoting economic growth, fostering local entrepreneurship, providing youth programs, or improving access to essential services like housing and transportation.

04

Arts and culture: Many not-for-profit organizations are dedicated to supporting and promoting artistic and cultural activities. These organizations often run museums, theaters, galleries, or music festivals, providing a platform for artists, preserving cultural heritage, and enriching society's cultural fabric.

05

Sports and recreation: Non-profit organizations can also be formed to promote sports and recreational activities, especially in underserved communities. These organizations aim to improve access to physical activities, promote healthy lifestyles, and support the development of young athletes.

In conclusion, understanding the process of filling out not-for-profit organization paperwork and assessing who can benefit from forming such organizations helps potential founders navigate the legal requirements and ensures that their organizations can have a positive impact in their chosen fields.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify not for profit organization without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your not for profit organization into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send not for profit organization to be eSigned by others?

Once you are ready to share your not for profit organization, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute not for profit organization online?

With pdfFiller, you may easily complete and sign not for profit organization online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is not for profit organization?

A not for profit organization is a type of entity that is formed for purposes other than making a profit, such as charitable, religious, educational, or scientific purposes.

Who is required to file not for profit organization?

Not for profit organizations are typically required to file with the appropriate government agency, such as the IRS in the United States, in order to maintain their tax-exempt status and comply with other legal requirements.

How to fill out not for profit organization?

Filing requirements for not for profit organizations vary by jurisdiction, but typically involve completing the necessary forms and providing information about the organization's finances, activities, and governance structure.

What is the purpose of not for profit organization?

The purpose of a not for profit organization is to serve a public benefit or charitable purpose, rather than generating profit for its owners or members.

What information must be reported on not for profit organization?

Not for profit organizations are typically required to report information such as their income, expenses, assets, liabilities, and activities to the relevant government agency or regulatory body.

Fill out your not for profit organization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not For Profit Organization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.