Get the free Check your health plan for

Show details

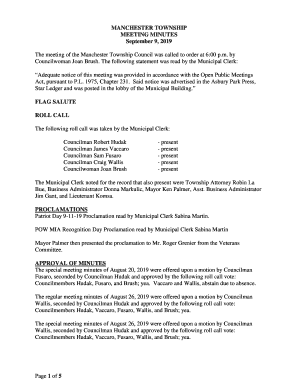

30 y ears eenseventythre net e NI two thou sandbar EE SERVING ANTHONY, HINTON, CASTILLO, EAST MONTANA, HORIZON, SOCORRO, CLINT, FAB ENS, SAN LIZARD AND TORTILLA VOL. 30, No. 32 Check your health plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check your health plan

Edit your check your health plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check your health plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing check your health plan online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit check your health plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check your health plan

How to fill out your health plan:

01

Start by reviewing your health plan documents and familiarizing yourself with the coverage and benefits it offers. Look for details such as deductibles, copayments, and out-of-pocket maximums.

02

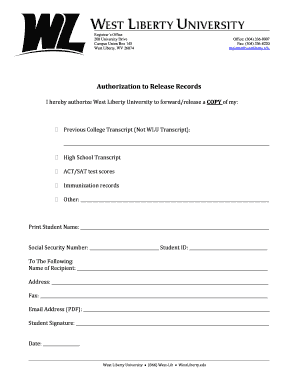

Take note of any specific instructions or requirements for filling out your health plan. This may include submitting certain forms or providing documentation to verify eligibility.

03

Begin by providing your personal information, such as your full name, date of birth, and contact information. Make sure to enter this information accurately to avoid any issues with claims processing.

04

Next, indicate any dependents or family members who are covered under your health plan. Include their names, dates of birth, and relationship to you.

05

Review the list of available coverage options and select the ones that best meet your healthcare needs. This may include choosing a primary care physician, selecting a preferred network of healthcare providers, or opting for additional coverage such as dental or vision.

06

Consider any specific healthcare needs or conditions that require special attention. Ensure that your health plan provides the necessary coverage and consider enrolling in any additional programs or services that may be beneficial.

07

If required, complete any additional forms or documentation related to your health plan. This may include consent forms, financial disclosure statements, or medical history questionnaires.

08

Once you have filled out all the necessary information, review it carefully to ensure accuracy and completeness. Double-check for any errors or missing details that may cause delays or complications in the future.

09

Finally, submit your completed health plan application as instructed by your insurance provider. Keep a copy of the application for your records and follow up to confirm that it has been received and processed.

Who needs to check their health plan:

01

Individuals who have recently enrolled in a new health plan or made changes to their existing coverage should check their health plan. This ensures that all the correct information is on file and that coverage is active.

02

Those who have experienced any major life events, such as marriage, divorce, or the birth of a child, should review their health plan to ensure that the necessary modifications have been made to reflect the new circumstances.

03

Anyone who wants to understand their healthcare coverage in detail, including benefits, services, and costs, should check their health plan. This helps in making informed decisions about healthcare and budgeting for medical expenses.

04

Individuals with specific healthcare needs or conditions should regularly check their health plan to ensure that the coverage meets their requirements. It is essential to be aware of any changes in the plan's network of providers or drug formularies that may affect access to necessary care or medications.

05

Individuals nearing retirement or transitioning to Medicare should carefully review their health plan options, comparing Medicare plans and private insurance to determine the best coverage for their needs.

06

Employer-sponsored health plan participants should check their health plan annually during open enrollment periods to review any changes in coverage, costs, or network providers. This helps in selecting the most suitable plan and ensuring continuity of coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

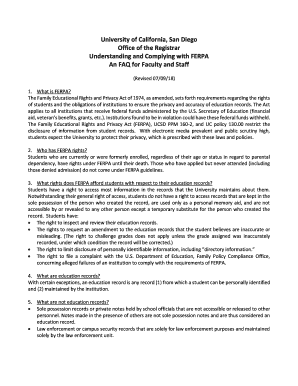

What is check your health plan?

Check your health plan is a form or document that individuals or companies fill out to evaluate the health coverage they currently have.

Who is required to file check your health plan?

Both individuals and companies with health insurance coverage are required to file a check your health plan.

How to fill out check your health plan?

Check your health plan can be filled out online through a secure portal provided by the health insurance provider, or it can be submitted by mail.

What is the purpose of check your health plan?

The purpose of check your health plan is to assess the adequacy of health insurance coverage and make any necessary adjustments.

What information must be reported on check your health plan?

Information such as current health insurance coverage details, any changes in personal information, and any additional coverage needed must be reported on check your health plan.

How can I send check your health plan to be eSigned by others?

When you're ready to share your check your health plan, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete check your health plan on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your check your health plan, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit check your health plan on an Android device?

You can edit, sign, and distribute check your health plan on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your check your health plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Your Health Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.