Get the free Application For Homeowner Rehabilitation Loan Program - appleton

Show details

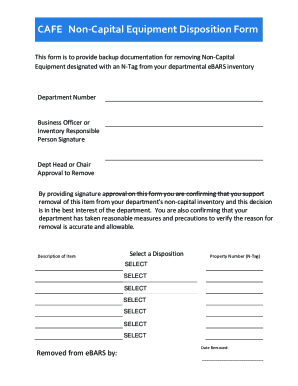

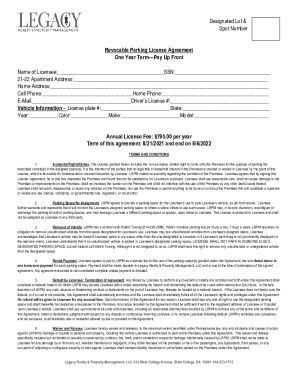

This application is required to determine eligibility for the Homeowner Rehabilitation Loan Program in the City of Appleton. It includes a checklist for qualifying criteria, an overview of required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for homeowner rehabilitation

Edit your application for homeowner rehabilitation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for homeowner rehabilitation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for homeowner rehabilitation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for homeowner rehabilitation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for homeowner rehabilitation

How to fill out Application For Homeowner Rehabilitation Loan Program

01

Obtain the Application Form from your local housing authority or agency managing the program.

02

Carefully read the instructions provided with the application to understand the requirements.

03

Fill in your personal information, including name, address, and contact details.

04

Provide details about your property, including the address and condition of the home.

05

Include information about your financial situation, such as income, expenses, and any existing debts.

06

List the specific repairs or improvements you plan to make with the loan funds.

07

Attach any required documentation, such as proof of income, tax returns, and property ownership.

08

Review the entire application for accuracy and completeness before submission.

09

Submit the application to your local housing authority or designated program office.

Who needs Application For Homeowner Rehabilitation Loan Program?

01

Homeowners who are unable to afford necessary repairs or renovations to their homes.

02

Individuals or families living in low to moderate-income households.

03

Homeowners looking to improve the safety, accessibility, or energy efficiency of their homes.

04

Those living in homes that are in disrepair and may pose health or safety risks.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for the ADU grant in California?

The best way to fund a home renovation is to consider a combination of options, such as using cash, home equity lines of credit, personal loans, and government-backed loans, depending on your financial situation and credit score.

Who is eligible for a government home improvement grant in California?

Be the homeowner and occupy the house. Be unable to obtain affordable credit elsewhere. Have a household income that does not exceed the very low limit by county. For grants, be age 62 or older.

Who qualifies for homeowner stimulus in California?

Your household income must be at or below 80% of the area median income. Your property must be a single-family home zoned for ADUs. Your property should be free of any outstanding liens or judgments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application For Homeowner Rehabilitation Loan Program?

The Application For Homeowner Rehabilitation Loan Program is a formal request submitted by homeowners seeking financial assistance for repairs and improvements to their properties, aimed at enhancing safety and livability.

Who is required to file Application For Homeowner Rehabilitation Loan Program?

Homeowners whose properties require rehabilitation or repair and who seek funding from the program are required to file this application.

How to fill out Application For Homeowner Rehabilitation Loan Program?

To fill out the application, homeowners need to gather necessary documentation, complete the provided forms accurately, and submit them along with any required supporting materials to the designated program office.

What is the purpose of Application For Homeowner Rehabilitation Loan Program?

The purpose of the program is to provide financial support to homeowners for necessary repairs and improvements, ensuring safe and decent housing conditions.

What information must be reported on Application For Homeowner Rehabilitation Loan Program?

The application must include personal information about the homeowner, details about the property, a description of the rehabilitation work needed, estimated costs, and any other information required by the program guidelines.

Fill out your application for homeowner rehabilitation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Homeowner Rehabilitation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.