Get the free and ending JUN 30, - thehouseofmercy

Show details

Form Return of Organization Exempt From Income Tax 990 OMB No. 1545-0047 Do not enter Social Security numbers on this form as it may be made public. Open to Public Inspection 2013 Under section 501(c),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign and ending jun 30

Edit your and ending jun 30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your and ending jun 30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing and ending jun 30 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit and ending jun 30. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out and ending jun 30

How to fill out an ending Jun 30:

01

Gather all relevant financial data: Before filling out an ending Jun 30 report, collect all the necessary financial information such as income, expenses, assets, liabilities, and any other relevant data for the specific period ending on June 30.

02

Review the previous financial statements: It's essential to review the previous financial statements to ensure accuracy and consistency. Compare the current data with the previous period to identify any discrepancies or trends.

03

Organize the data: Organize the financial data in a structured manner, such as using spreadsheets or accounting software. This will help in creating a clear and concise ending Jun 30 report.

04

Calculate net income or loss: Determine the net income or loss for the period ending on June 30 by subtracting total expenses from total revenue. This will provide an overview of the financial performance during that specific period.

05

Analyze financial ratios and key performance indicators: Use financial ratios and key performance indicators to analyze the overall financial health of the business. Ratios like profitability ratios, liquidity ratios, and solvency ratios can provide valuable insights into the company's financial position.

06

Prepare the financial statements: Based on the gathered data and calculations, prepare the necessary financial statements, such as the income statement, balance sheet, and cash flow statement. These statements should accurately represent the financial activities and performance of the business during the period ending on June 30.

07

Review and verify the accuracy: Once the financial statements are prepared, review them thoroughly to ensure accuracy and completeness. Verify that all the calculations and numbers are correct and consistent.

08

Seek professional assistance if needed: If you are unsure about certain aspects of filling out the ending Jun 30 report or if you encounter complex financial transactions, it is advisable to seek the assistance of a professional accountant or financial advisor.

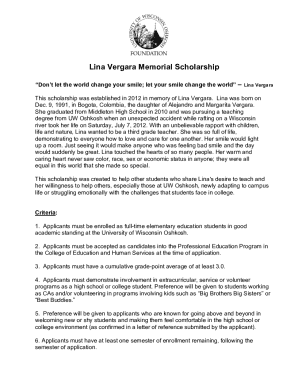

Who needs an ending Jun 30 report:

01

Businesses and corporations: All types of businesses, whether small, medium, or large, usually need to create an ending Jun 30 report to assess their financial performance during that specific period. This report is crucial for the management team to make informed decisions and plan for the future.

02

Non-profit organizations: Non-profit organizations also require an ending Jun 30 report to evaluate their financial activities in a particular period. This report helps them demonstrate transparency and accountability to their stakeholders and donors.

03

Individuals and households: While not as common as for businesses or organizations, individuals and households might find it necessary to create an ending Jun 30 report for personal finance purposes. This report can help in tracking expenses, monitoring savings, and assessing financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is and ending jun 30?

June 30 is the end of the financial year or reporting period.

Who is required to file an ending jun 30?

All businesses and organizations with a fiscal year ending on June 30 are required to file financial reports.

How to fill out an ending jun 30?

Financial reports for an ending June 30 can be filled out using accounting software or manually on the required forms.

What is the purpose of an ending jun 30?

The purpose of an ending June 30 report is to provide a summary of the organization's financial activities for the fiscal year.

What information must be reported on an ending jun 30?

The financial report for an ending June 30 must include income, expenses, assets, liabilities, and equity.

How do I modify my and ending jun 30 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign and ending jun 30 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify and ending jun 30 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like and ending jun 30, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I fill out and ending jun 30 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your and ending jun 30, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your and ending jun 30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

And Ending Jun 30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.