Get the free Life Insurance Accidental Death Claim - English - (www.trifund.com).

Show details

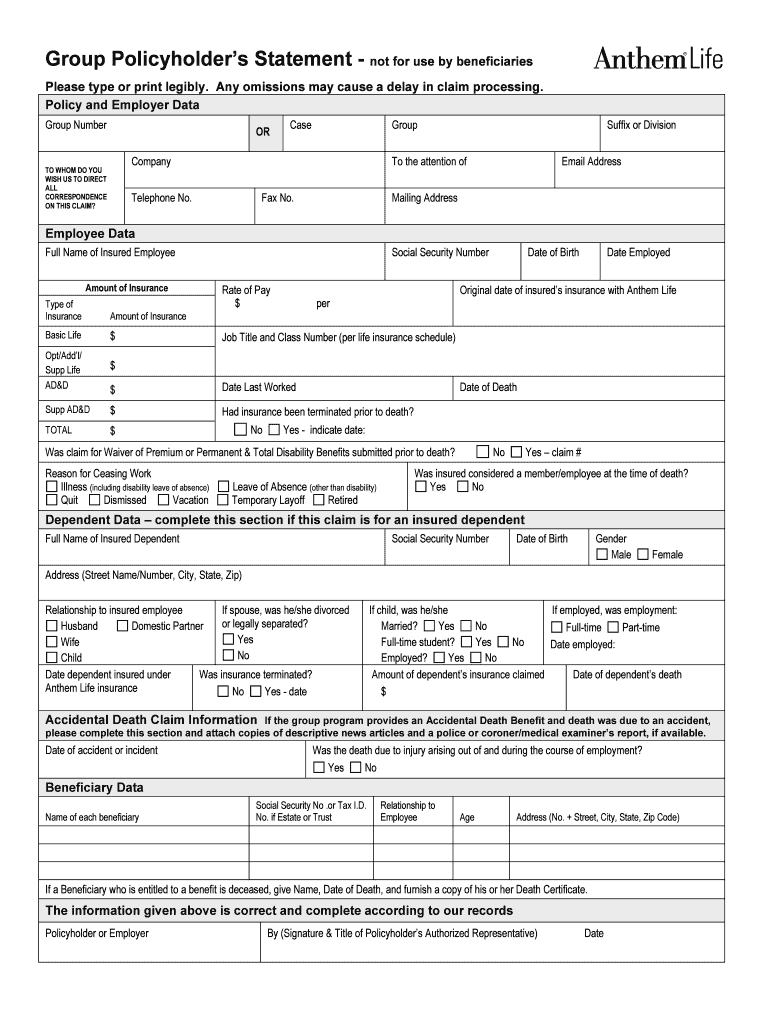

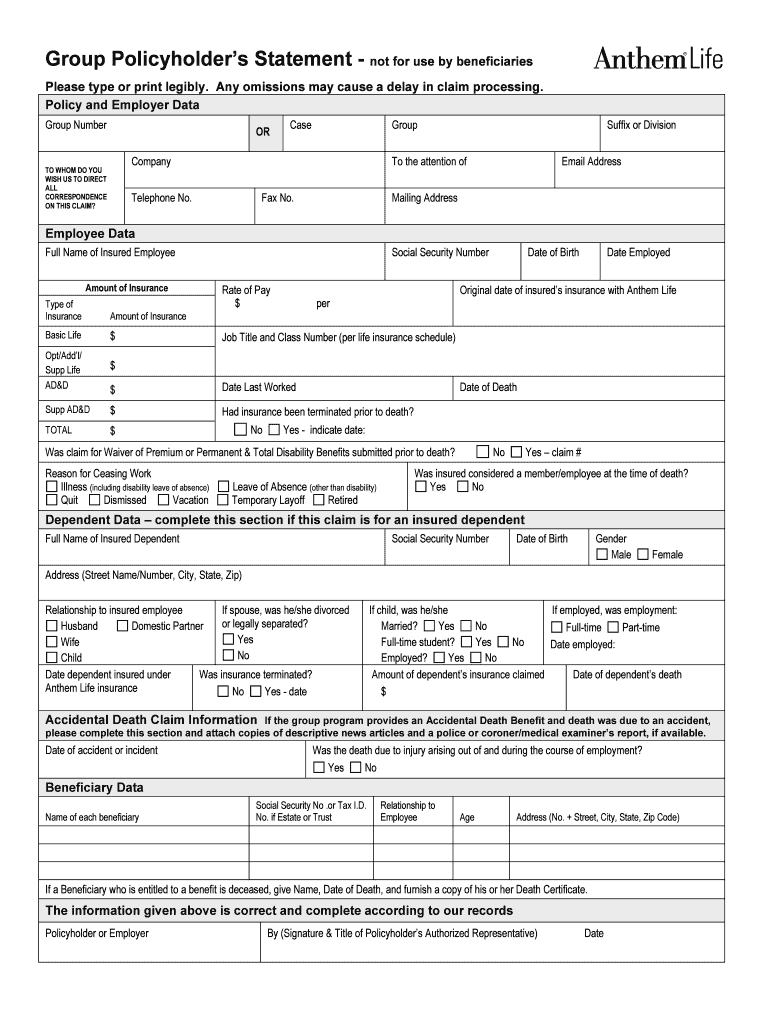

Anthem Life Insurance Company Life Claims Service Center P.O. Box 105448 Atlanta, GA 30348-5448 Phone 800-813-5682 Fax 877-305-3901 Email: lifeanddisabilityclaims anthem.com Employer Instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance accidental death

Edit your life insurance accidental death form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance accidental death form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance accidental death online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance accidental death. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance accidental death

How to Fill out Life Insurance Accidental Death:

01

Gather necessary information: Start by collecting all relevant personal information such as your full name, date of birth, social security number, and contact details. You may also need to provide information about any pre-existing medical conditions.

02

Determine the coverage amount: Evaluate your financial needs and decide on the appropriate coverage amount that would adequately protect your loved ones in the event of an accidental death. Consider factors such as outstanding debts, future expenses, and income replacement requirements.

03

Research insurance providers: Research and compare different insurance companies that offer accidental death coverage. Consider factors such as reputation, financial stability, policy features, and customer reviews. Obtain quotes from multiple providers to ensure you get the best possible rates.

04

Understand the policy terms: Read the terms and conditions of the policy carefully. Pay attention to details such as coverage limitations, exclusions, premium payments, and the claims process. Seek clarification from the insurance provider or an expert if you have any doubts or questions.

05

Complete the application form: Fill out the life insurance accidental death application form accurately and truthfully. Provide all requested information, including personal details, medical history, occupation, and lifestyle habits. Double-check the form for any errors or missing information before submitting it.

06

Undergo a medical examination (if required): Depending on the insurer and the coverage amount, you may be required to undergo a medical examination to assess your health condition. Follow any instructions provided by the insurance company and schedule the examination at a convenient time.

07

Review and sign the policy: Once your application is approved, carefully review the policy document. Ensure that the coverage amount, policy term, and other details match what you applied for. If everything is in order, sign the policy and make the necessary premium payments to activate the coverage.

Who Needs Life Insurance Accidental Death:

01

Individuals with dependents: If you have family members or loved ones who rely on your income to meet their financial obligations, having accidental death insurance can provide them with financial security in case of your untimely demise.

02

Breadwinners: If you are the primary earner in your family and responsible for meeting day-to-day expenses, mortgage payments, educational costs, or other financial commitments, accidental death insurance can help ensure that your loved ones are financially protected if you are no longer there to provide for them.

03

Individuals involved in risky occupations or activities: If you work in a high-risk profession or engage in hazardous activities, such as construction work, extreme sports, or frequent travel, accidental death insurance can provide an added layer of protection against unforeseen accidents that may lead to death.

04

Young and healthy individuals: Accidents can happen to anyone, regardless of age or health condition. Having accidental death insurance, even if you are young and healthy, can provide peace of mind knowing that your loved ones will be financially secure in case of an unexpected accident.

05

Individuals with financial responsibilities: If you have financial obligations, such as outstanding debts or loans, having accidental death insurance can help ensure that these liabilities are covered, preventing your loved ones from being burdened with them after your passing.

Remember, it is always advisable to consult with a licensed insurance agent or financial advisor to determine the specific insurance needs based on individual circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute life insurance accidental death online?

pdfFiller has made filling out and eSigning life insurance accidental death easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the life insurance accidental death in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your life insurance accidental death right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out life insurance accidental death using my mobile device?

Use the pdfFiller mobile app to complete and sign life insurance accidental death on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is life insurance accidental death?

Life insurance accidental death is a type of insurance policy that provides coverage in the event of death caused by an accident.

Who is required to file life insurance accidental death?

The beneficiary or the appointed representative of the deceased is required to file the life insurance accidental death claim.

How to fill out life insurance accidental death?

To fill out a life insurance accidental death claim, the beneficiary or representative must provide necessary documentation such as death certificate, police report, and other relevant information.

What is the purpose of life insurance accidental death?

The purpose of life insurance accidental death is to provide financial protection to the beneficiaries in the event of death due to an accident.

What information must be reported on life insurance accidental death?

The information that must be reported on a life insurance accidental death claim includes the details of the accident, the cause of death, and any supporting documents.

Fill out your life insurance accidental death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Accidental Death is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.