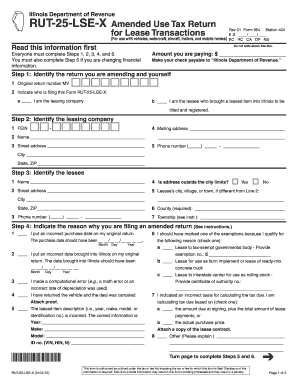

IL RUT-25-LSE-X 2024-2025 free printable template

Get, Create, Make and Sign rut 25 lse form pdf

How to edit il form rut 25 lse printable online

Uncompromising security for your PDF editing and eSignature needs

IL RUT-25-LSE-X Form Versions

How to fill out il form rut 25 lse download

How to fill out IL RUT-25-LSE-X

Who needs IL RUT-25-LSE-X?

Video instructions and help with filling out and completing rut 25 lse form

Instructions and Help about illinois rut 25 lse form

Hi this is TJ lots with pursuit advantage consulting, and today I'm going to run through the standard form 1442 which is the solicitation offer and award document for construction alterations or repair contracts with federal government this is the most important document when doing construction contracts with the federal government if you don't fill it out correctly you will be deemed non-compliant and be thrown out of consideration, so it is pretty important the standard fort form 1442 also called the SF 1442 has 31 boxes on it located on the front and back page, and I'll run through it here the government will fill out the first page boxes 1 to 13, and you see up here box 1 is a solicitation number which is the unique number given to each RFP or IF Bout there the first digits here are the code of the contracting agency which is now fact Southwest in this case the next numbers are the year the fiscal year that this contract is out are represents it is an RFP if it were invitation to bid it would be an ABI and then this is a four digit unique number assigned to each contract box two it is an RFP, so it is per far 15 of best value selection and the date issued here then you got number seven issued by and their contracting code box 8 it says see item seven, but you got to be careful here because a lot of times they'll have this address here and this has a peel box which is he shipping USPS it's fine but if you ship it through FedEx or UPS they do not ship to peel boxes, so I'll often times in this solicitation they'll have a different address for hand-carried proposals, so that's what you'll want to use if you're shipping or hand carrying this is okay if you're using the US Postal Service the name here is the contact person and the phone number which usually they'll answer the phone they won't know a lot about it, but questions will usually go through progeny at or through an email, so it can be documented, but you can call and talk to this person here it tells a little about the contract the value the bid bond amount box 11 here they will issue notice to proceed within 15 days, and then you'll have eight hundred and seventy days to complete the contract, and it is a mandatory performance period which is typical does require payment and performance bonds within 15 days, so you'll have to get that in before notice to proceed as issued then box 13 they do want an original and five copies so six total by two o'clock on this date to the address up here offer guarantee a bid bond is required, and you must give them 90 days to review the RFP before award, so they've they've calculated that for you, we'll go to the next page here, and I filled this out as an example a name and address that's self-explanatory the code here is your cage code which is a five-digit number and letter code that you get when you sign up through Sam which used to be CCR central contractor registration and the Duns number you don't have that you'll have to register with don't...

People Also Ask about rut 25 lse tax lease form

How do I know if I owe Illinois use tax?

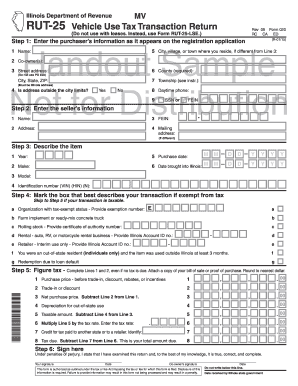

What is a rut 25 form?

What is the tax rate for Rut 25 in Illinois?

What is my tax rate Illinois?

What is Rut 25 tax Illinois?

Do you want to report use tax on your IL 1040?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form rut 25 lse pdf directly from Gmail?

How do I execute il form rut 25 lse pdf online?

How do I edit form rut 25 lse printable straight from my smartphone?

What is IL RUT-25-LSE-X?

Who is required to file IL RUT-25-LSE-X?

How to fill out IL RUT-25-LSE-X?

What is the purpose of IL RUT-25-LSE-X?

What information must be reported on IL RUT-25-LSE-X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.