Get the free Replacement of life insurance or annuities - Zenith Marketing Group ...

Show details

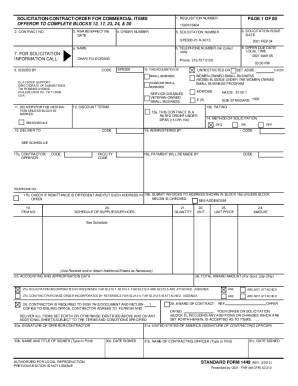

Please check appropriate underwriting company: ? The Lincoln National Life Insurance Company, Life Service Of?CE: PO Box 21008, Greensboro, NC 27420-1008 ? The Lincoln National Life Insurance Company,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign replacement of life insurance

Edit your replacement of life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your replacement of life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit replacement of life insurance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit replacement of life insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out replacement of life insurance

How to fill out replacement of life insurance:

01

Gather necessary documents: Start by collecting all the required documents such as the original life insurance policy, beneficiary information, and any supporting documents for the replacement policy.

02

Understand the terms and conditions: Read through the replacement policy's terms and conditions thoroughly. Make sure you understand the coverage, premiums, and any limitations or exclusions that may apply.

03

Consult with a financial advisor or insurance agent: If you have any doubts or concerns about replacing your life insurance policy, it is always a good idea to consult with a financial advisor or insurance agent. They can offer guidance, help you analyze your current and future insurance needs, and make appropriate recommendations.

04

Complete the replacement application: Fill out the replacement application form accurately and honestly. Ensure all the details provided match the information on your current life insurance policy.

05

Review the replacement policy: Before submitting the application, carefully review the replacement policy's terms, coverage, and any additional benefits it may offer compared to your existing policy. Assess if the replacement policy aligns with your needs and goals.

06

Consider the cost: Evaluate the premium costs associated with the replacement policy. Compare it with your current life insurance policy's cost to ensure you are comfortable with the financial commitment.

07

Submit the application: Once you are satisfied with the replacement policy, submit the completed application along with any required supporting documents to the insurance company or agent.

08

Review the policy documents: After your application is processed, carefully review the replacement policy documents provided. Make sure all the terms, coverage, and beneficiary information are accurately reflected.

09

Notify beneficiaries: If necessary, inform your beneficiaries about the new replacement policy. Ensure they have the necessary information to file a claim in the event of your passing.

10

Cancel the old policy (if applicable): If you have decided to fully replace your existing life insurance policy, contact your old insurance provider to cancel it. Be aware of any cancellation fees or procedures that may apply.

Who needs replacement of life insurance?

01

Individuals with changing insurance needs: If your current life insurance policy no longer adequately meets your needs or if your circumstances have significantly changed, you may require a replacement policy. This could include individuals who have experienced major life events such as marriage, divorce, the birth of a child, or significant changes in income or assets.

02

Those seeking better coverage or lower premiums: If you have found a replacement policy that offers more comprehensive coverage or lower premiums compared to your current policy, it may be beneficial to consider making the switch.

03

Individuals dissatisfied with their current policy: If you are not satisfied with the service, coverage, or benefits offered by your current life insurance policy, exploring replacement options could be a viable solution.

04

Those looking to improve their financial planning: If your financial goals or plans have evolved since obtaining your initial life insurance policy, it may be advantageous to review and potentially replace your existing coverage to align with your current needs.

05

Individuals seeking to take advantage of new policy features: Replacement of life insurance can also be attractive if a new policy offers features or riders that were previously unavailable or if it provides additional benefits that better suit your circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute replacement of life insurance online?

Filling out and eSigning replacement of life insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in replacement of life insurance?

With pdfFiller, the editing process is straightforward. Open your replacement of life insurance in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete replacement of life insurance on an Android device?

Use the pdfFiller mobile app to complete your replacement of life insurance on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is replacement of life insurance?

Replacement of life insurance is when a policyholder chooses to terminate their existing life insurance policy and purchase a new one.

Who is required to file replacement of life insurance?

Any policyholder who is looking to replace their existing life insurance policy must file a replacement of life insurance form.

How to fill out replacement of life insurance?

To fill out a replacement of life insurance form, the policyholder must provide information about their existing policy, details of the new policy they plan to purchase, and reasons for the replacement.

What is the purpose of replacement of life insurance?

The purpose of replacement of life insurance is to allow policyholders to upgrade their coverage, change beneficiaries, or take advantage of better premiums or benefits.

What information must be reported on replacement of life insurance?

Policyholders must report details of their existing policy, information about the new policy, reasons for the replacement, and any benefits or features of the new policy.

Fill out your replacement of life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Replacement Of Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.