Get the free Community Development Revolving Loan Application

Show details

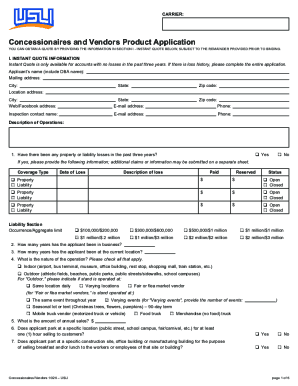

This application is for requesting a loan for community development purposes, including details about household composition, income, assets, expenses, property characteristics, and certification of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign community development revolving loan

Edit your community development revolving loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your community development revolving loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing community development revolving loan online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit community development revolving loan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out community development revolving loan

How to fill out Community Development Revolving Loan Application

01

Obtain a copy of the Community Development Revolving Loan Application form from the appropriate agency or website.

02

Carefully read the instructions provided with the application to understand the requirements.

03

Provide your organization's basic information, including the name, address, and contact details.

04

Clearly define the purpose of the loan and how it will benefit the community.

05

Prepare and include a detailed budget that outlines how the loan funds will be used.

06

Gather necessary documents, such as financial statements, organizational charts, and any other supporting materials.

07

Complete the application form section by section, ensuring all required fields are filled accurately.

08

Review the completed application for accuracy and completeness before submission.

09

Submit the application by the deadline specified, either online or by mail as instructed.

Who needs Community Development Revolving Loan Application?

01

Local community organizations seeking funding for projects that promote community development.

02

Non-profit organizations looking to enhance services within their communities.

03

Small businesses aiming to expand their operations that serve the community.

04

Government entities needing to finance community improvement projects.

Fill

form

: Try Risk Free

People Also Ask about

What is a revolving loan program?

Revolving loan funds (RLFs) use a source of capital, typically offered by a local or state government, to make direct loans to borrowers for clean energy projects. Proceeds from loan repayments flow back into the fund and become available to lend again.

What is the difference between a term loan and a revolving loan?

Any debt could be good or bad, depending on how it's managed. But revolving credit can have many benefits. For instance, you can use a revolving credit line to cover unexpected expenses. Some revolving credit accounts may also offer cash back or other rewards.

Are revolving loans good?

A revolving loan is more flexible as there are no term limits, and your minimum monthly repayments are usually set at a percentage of the outstanding balance. Funds can be borrowed again if you keep up with the minimum repayments - there's no need to reapply for credit.

How does a revolving loan work?

A revolving loan facility is a loan, just like any other term loan. The difference is that instead of receiving borrowed money in a lump sum, the money can be used as needed, repaid, and then used again.

What are the disadvantages of a revolving loan?

If you don't manage the loan facility well, you could end up with more debt than you can pay off. This could have a negative impact on your credit score. These types of loans generally have a high interest rate, which can make them more costly than other credit solutions.

What is a community development loan fund?

Community development loan funds (CDLFs) provide financing and development services to businesses, organizations, and individuals in low-income communities. There are four main types of loan funds: microenterprise, small business, housing, and community service organizations.

What is better, a revolving loan or a personal loan?

Personal loans are installment debt because there repaid in fixed monthly payments based on the lender's repayment terms. Borrowers choose this type of financing over revolving credit because of the lower interest rates and fixed payment schedule.

Do credit unions get federal funding?

“Many credit unions access capital through federal grant programs to put dollars to work in communities. The CDFI Fund and CDRLF have long been essential to supporting low- to moderate-income households across the country,” said America's Credit Unions Chief Advocacy Officer Carrie Hunt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Community Development Revolving Loan Application?

The Community Development Revolving Loan Application is a formal request for financial assistance provided through a revolving loan fund designed to support community development initiatives and projects.

Who is required to file Community Development Revolving Loan Application?

Organizations, local government entities, or individuals seeking funding for community development projects are typically required to file the Community Development Revolving Loan Application.

How to fill out Community Development Revolving Loan Application?

To fill out the Community Development Revolving Loan Application, applicants need to complete the necessary forms by providing detailed information about the proposed project, financial data, and organizational background.

What is the purpose of Community Development Revolving Loan Application?

The purpose of the Community Development Revolving Loan Application is to facilitate funding for projects that improve community infrastructure, foster economic development, and enhance the quality of life in underprivileged areas.

What information must be reported on Community Development Revolving Loan Application?

The application must report information such as the project description, total budget, funding sources, demographic data about the community served, and projected outcomes of the project.

Fill out your community development revolving loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Community Development Revolving Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.