MN MNP 1225 2020-2025 free printable template

Show details

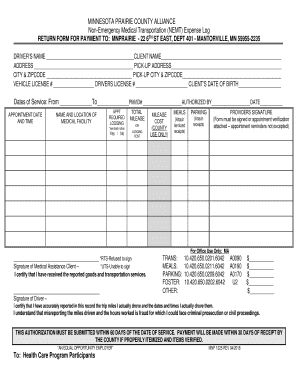

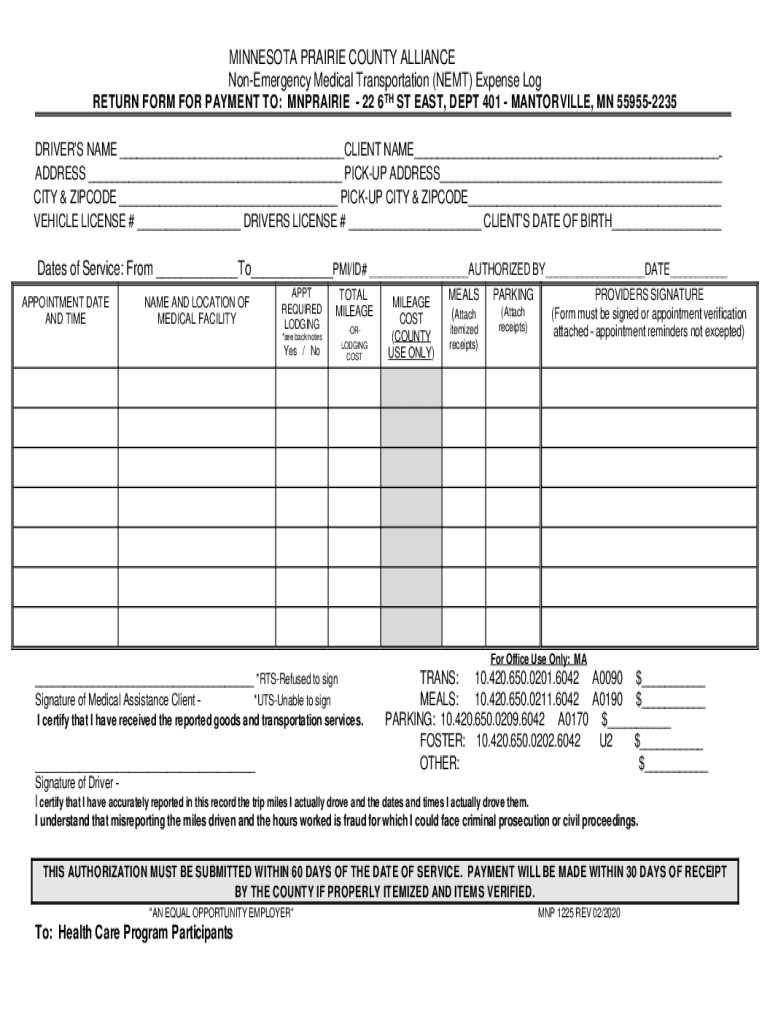

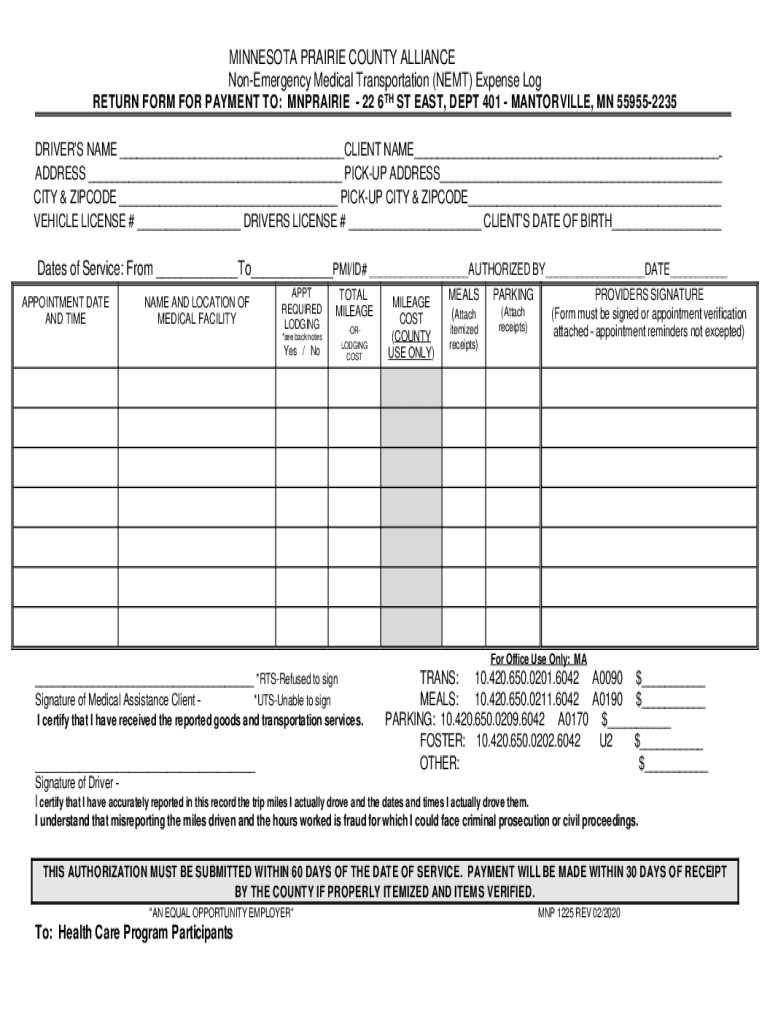

MINNESOTA PRAIRIE COUNTY ALLIANCE Emergency Medical Transportation (NEXT) Expense Log RETURN FORM FOR PAYMENT TO: PRAIRIE 22 6TH ST EAST, DEPT 401 MANDEVILLE, MN 559552235 DRIVERS NAME ___CLIENT NAME___

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign non-emergency medical transportation expense

Edit your non-emergency medical transportation expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-emergency medical transportation expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-emergency medical transportation expense online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-emergency medical transportation expense. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN MNP 1225 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out non-emergency medical transportation expense

How to fill out MN MNP 1225

01

Begin by gathering all necessary personal information, including your full name, address, and Social Security number.

02

Locate the section for your income information and accurately report your total income for the specified period.

03

Provide details regarding any deductions or credits you may be eligible for, ensuring that all calculations are correct.

04

Fill out the additional required sections based on your particular circumstances, such as filing status and dependent information.

05

Review the form for accuracy, ensuring all information is complete and legible.

06

Submit the form to the appropriate tax authority by the specified deadline, either by mail or electronically if available.

Who needs MN MNP 1225?

01

Individuals or families applying for or maintaining eligibility for various state assistance programs in Minnesota.

02

Taxpayers who need to report their income and deductions for the applicable tax period.

03

Anyone who is required to submit financial information for government assistance or tax benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the mileage rate for work comp in Minnesota?

How to Get Medical Mileage Reimbursement. As of July 1, 2022, the medical mileage reimbursement rate is 62.5 cents per mile. This also includes reimbursement for: Parking.

How to start a non emergency medical transportation business in Minnesota?

8 Steps to Start a Medical Transportation Business File for Legal Status. Prepare Legal Documents. Sign Up for Insurance. The Сost of Starting Your NEMT Business. Establish Your Fleet. Set Your Rates. Find Your Passengers. Choose the Best NEMT Software.

Does MN medical assistance cover transportation?

Minnesota Health Care Programs (MHCP) covers nonemergency and emergency medical transportation services. Select the links in the Covered Services section for service-specific coverage policies and billing procedures.

What is the mileage rate for medical expenses?

How much does the IRS allow for medical mileage? The 2023 medical mileage rate is 22 cents per mile. For the first six months of 2022, the IRS allowed 18 cents per mile for medical purposes. From July 1, 2022, the medical rate increased to 22 cents per mile.

How much is medical mileage reimbursement in Minnesota?

Reimbursement For Medical-Related Travel Expenses The law states that travel reimbursements will be calculated using the rate their employer reimburses them for travel expenses or whatever is lower than that permitted under state legislation. As of July 1, 2022, Minnesota provides 62.5 cents per mile as compensation.

How to start a non medical transportation business in PA?

How to start an NEMT business Step 1: Legally form your NEMT business. Step 2: Gather licensing and insurance. Step 3: Get the necessary transport equipment. Step 4: Hire NEMT employees. Step 5: Market your NEMT business. Step 6: Optimize driver schedules and routes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my non-emergency medical transportation expense in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your non-emergency medical transportation expense and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit non-emergency medical transportation expense on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit non-emergency medical transportation expense.

How do I complete non-emergency medical transportation expense on an Android device?

On Android, use the pdfFiller mobile app to finish your non-emergency medical transportation expense. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is MN MNP 1225?

MN MNP 1225 is a tax form used in Minnesota for reporting nonresident sales or use tax.

Who is required to file MN MNP 1225?

Individuals and businesses that make taxable sales in Minnesota but do not have a physical presence in the state are required to file MN MNP 1225.

How to fill out MN MNP 1225?

To fill out MN MNP 1225, follow the instructions provided on the form, entering your business details, the total sales amount, and the applicable tax rates, along with any deductions.

What is the purpose of MN MNP 1225?

The purpose of MN MNP 1225 is to help nonresidents report and remit sales or use tax owed to the state of Minnesota for taxable goods or services sold.

What information must be reported on MN MNP 1225?

The information that must be reported on MN MNP 1225 includes the total sales amount, taxable sales amount, the sales tax collected, and any applicable exemptions or deductions.

Fill out your non-emergency medical transportation expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Emergency Medical Transportation Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.