NY IT-272 2003-2025 free printable template

Show details

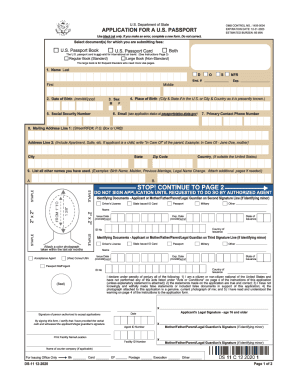

For office use only New York State Department of Taxation and Finance Claim for College Tuition Credit For New York State Residents Name as shown on return IT-272 Your social security number Spouse's

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new york tax form

Edit your it 272 tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tuition credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ny tax form online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxation ny form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state ny form

How to fill out NY IT-272

01

Obtain a copy of the NY IT-272 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the IT-272.

04

Complete Part I of the form, which requires you to provide information regarding your New York State income and any relevant adjustments.

05

In Part II, specify your eligibility for the tax credit by answering the questions and providing any required documentation.

06

Calculate your tax credit in Part III based on the information provided.

07

Review the information for accuracy and correctness before signing the form.

08

Submit the completed form to the appropriate address as indicated in the instructions.

Who needs NY IT-272?

01

Residents of New York State who have income from a qualified business or partnership and wish to claim the tax credit available through the NY IT-272 form.

02

Taxpayers who have paid New York State taxes and are eligible to receive credits for certain tax reliefs due to their income or specific circumstances.

Fill

tuition credit residents

: Try Risk Free

People Also Ask about it 272 tuition form

Does New York State require you to file a tax return?

If you had any income during your resident period or if you had New York source income during your nonresident period, you are required to file a New York State return.

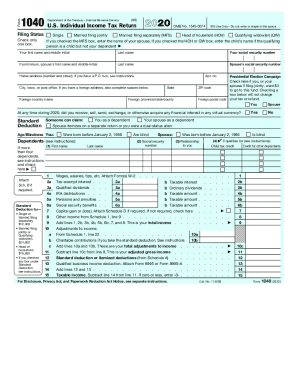

What documents do I need to file taxes NY?

a driver license or state-issued nondriver ID (for you and your spouse, if filing jointly) birth dates and Social Security numbers for you, your spouse, and your dependents. proof of income and tax withheld (wages, interest, and dividend statements): Forms W-2, 1098, 1099.

How do I get New York State tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

What form do I need to file NY state tax return?

Form IT-201, Resident Income Tax Return.

What is the difference between NY IT-201 and 203?

Form IT-201 can be used only by resident New York taxpayers who want to file their New York income tax returns. If you are a part-year resident or a nonresident, you may use Form IT-203 instead to file your income tax return.

How do I fill out a tax?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

What is the NYS sales tax rate for 2022?

Introduction. Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

How do I write a New York State tax check?

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment. Make your check or money order payable in U.S. funds to New York State Income Tax. Be sure to write the last four digits of your Social Security number (SSN), the tax year, and Income Tax on it.

How much is state income tax in NY?

The state income tax rate ranges from 4% to 8.82%, and the sales tax rate is 4%.

How much is NY state tax?

New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my claim ny directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form 206 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit state claim on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign ny tax credit. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit ny college tuition credit on an Android device?

You can make any changes to PDF files, like college tuition credit new york, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NY IT-272?

NY IT-272 is a New York State tax form used by individuals and businesses to claim a credit for certain eligible expenses related to the hiring of qualified employees.

Who is required to file NY IT-272?

Businesses and individuals who have hired qualified employees and wish to claim the related credit are required to file NY IT-272.

How to fill out NY IT-272?

To fill out NY IT-272, taxpayers must provide information about their business, the qualified employees hired, and the appropriate expenses incurred, following the instructions outlined on the form.

What is the purpose of NY IT-272?

The purpose of NY IT-272 is to facilitate the claiming of tax credits for employers who hire qualifying employees, thereby encouraging job creation in New York State.

What information must be reported on NY IT-272?

On NY IT-272, taxpayers must report their identifying information, details of the qualified employees, the total expenses incurred, and any other relevant information as specified in the form's instructions.

Fill out your ny tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 Residents Credit is not the form you're looking for?Search for another form here.

Keywords relevant to it 272 claim residents

Related to college tuition ny

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.