Get the free Gross Pay vs. Net Pay: What's the Difference?

Show details

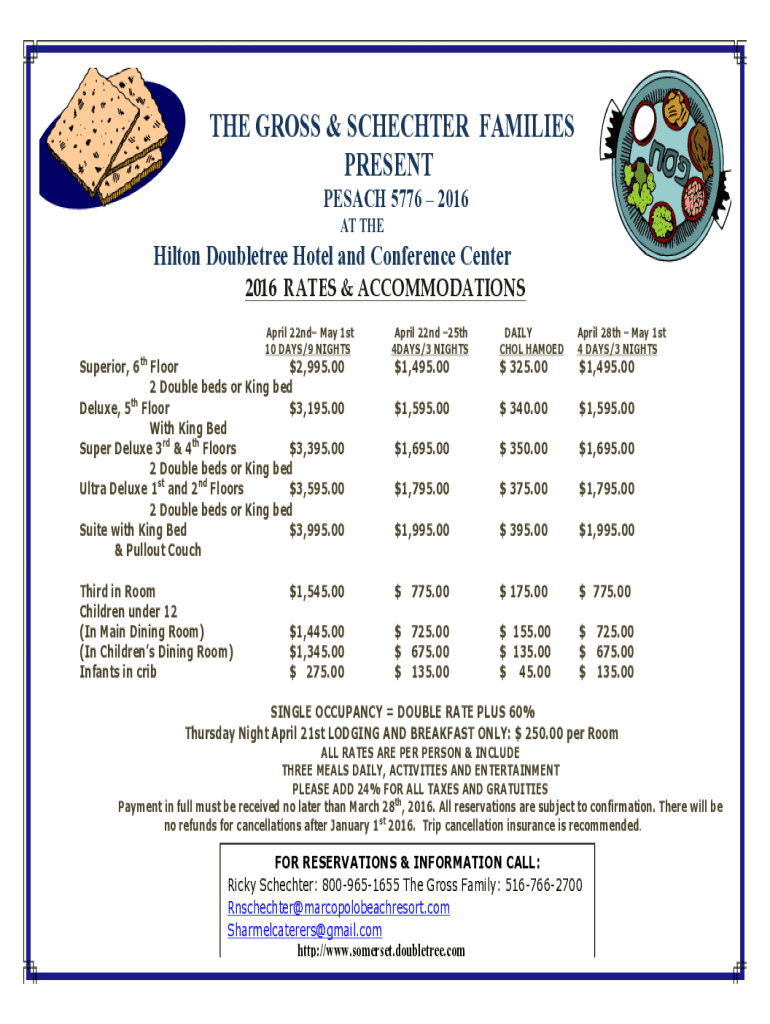

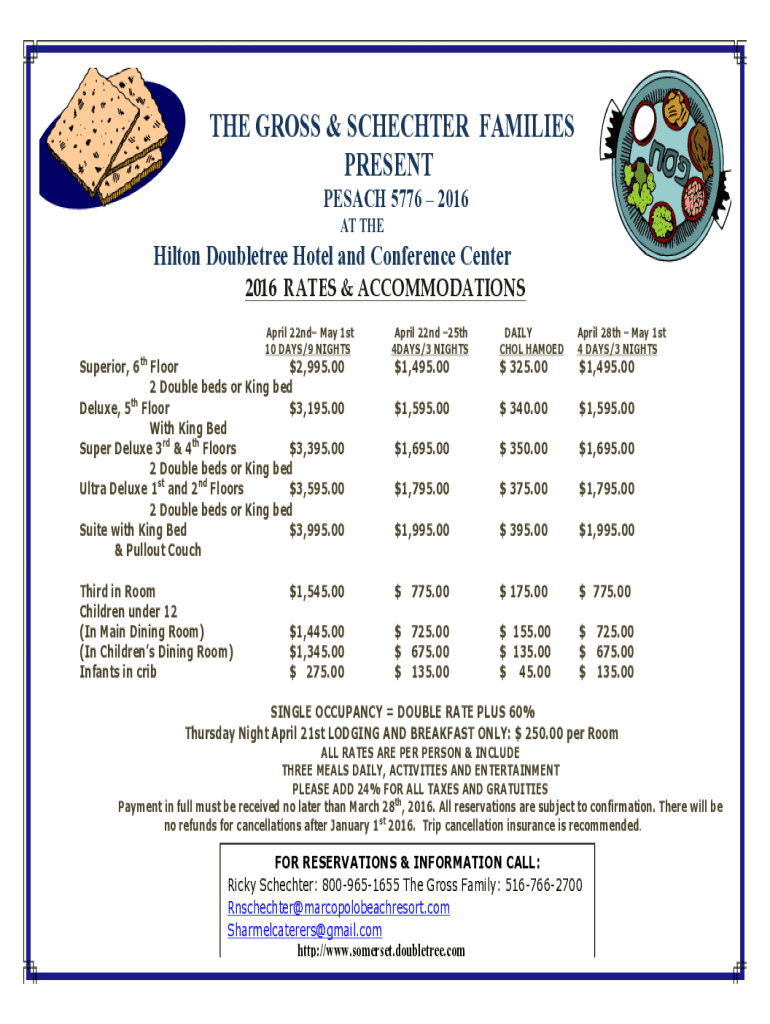

THE GROSS & SHELTER FAMILIES

PRESENT

PEACH 5776 2016

AT THE Hilton Double tree Hotel and Conference Center

2016 RATES & ACCOMMODATIONS

April 22nd May 1st

10 DAYS/9 NIGHTSDAILY

COOL HAMOEDApril 28th

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gross pay vs net

Edit your gross pay vs net form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gross pay vs net form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gross pay vs net online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gross pay vs net. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gross pay vs net

How to fill out gross pay vs net

01

Determine the gross pay amount, which is the total amount of income before any deductions.

02

Identify all deductions that need to be subtracted from the gross pay to calculate the net pay.

03

Subtract the total deductions from the gross pay to calculate the net pay amount.

04

Record the gross pay and net pay amounts in the appropriate sections of the paystub or accounting records.

Who needs gross pay vs net?

01

Employers need to understand gross pay vs net pay to properly calculate wages for employees and withhold the correct amount of taxes.

02

Employees should understand the difference between gross pay and net pay to ensure they are being paid accurately and to have a clear understanding of any deductions being taken from their wages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gross pay vs net without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your gross pay vs net into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the gross pay vs net in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your gross pay vs net.

How do I complete gross pay vs net on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your gross pay vs net, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is gross pay vs net?

Gross pay is the total amount earned by an employee before any deductions such as taxes or health insurance, while net pay is the amount the employee takes home after all deductions have been subtracted.

Who is required to file gross pay vs net?

Employers are required to report gross pay and net pay for all employees on their payroll, typically on tax forms and pay stubs.

How to fill out gross pay vs net?

When filling out payroll forms, list the gross pay first, followed by each deduction item, and then calculate the net pay by subtracting total deductions from the gross pay.

What is the purpose of gross pay vs net?

The purpose of distinguishing between gross pay and net pay is to provide clarity on earnings and deductions, ensuring transparency and accuracy in employee compensation and tax reporting.

What information must be reported on gross pay vs net?

Employers must report the employee's total gross earnings, itemized deductions (such as taxes, retirement contributions, and insurance), and the final net pay on pay statements and tax forms.

Fill out your gross pay vs net online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gross Pay Vs Net is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.