PA TRCF-1000 2022-2025 free printable template

Show details

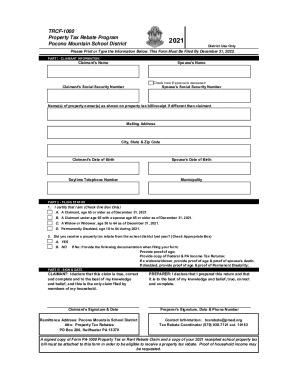

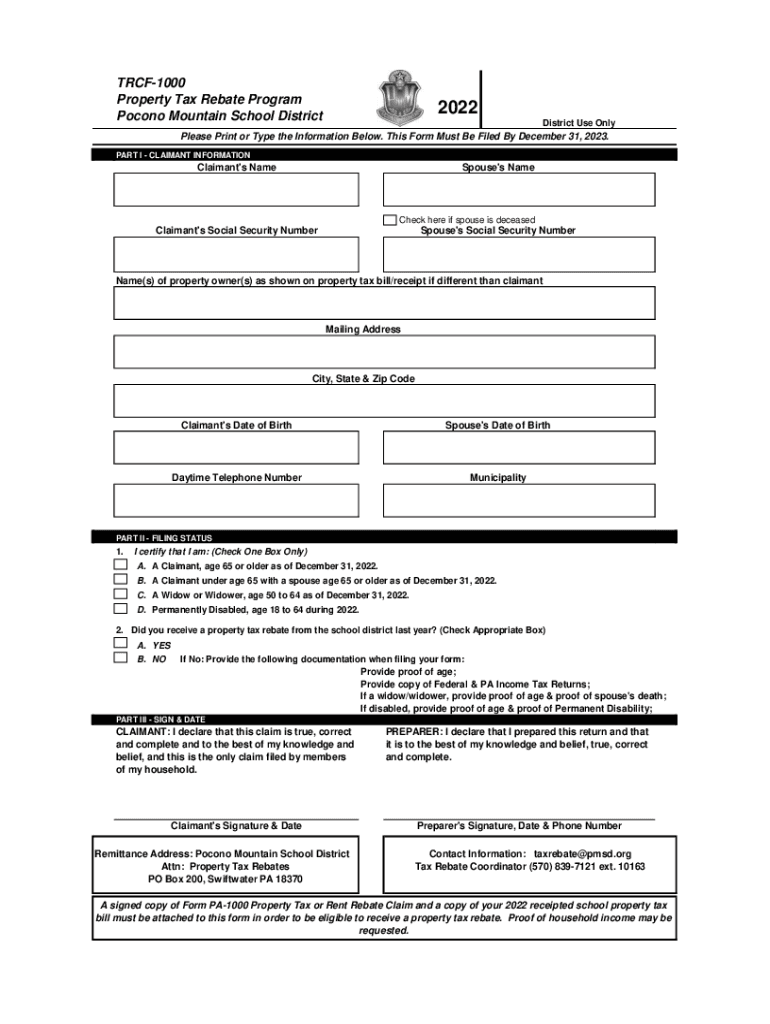

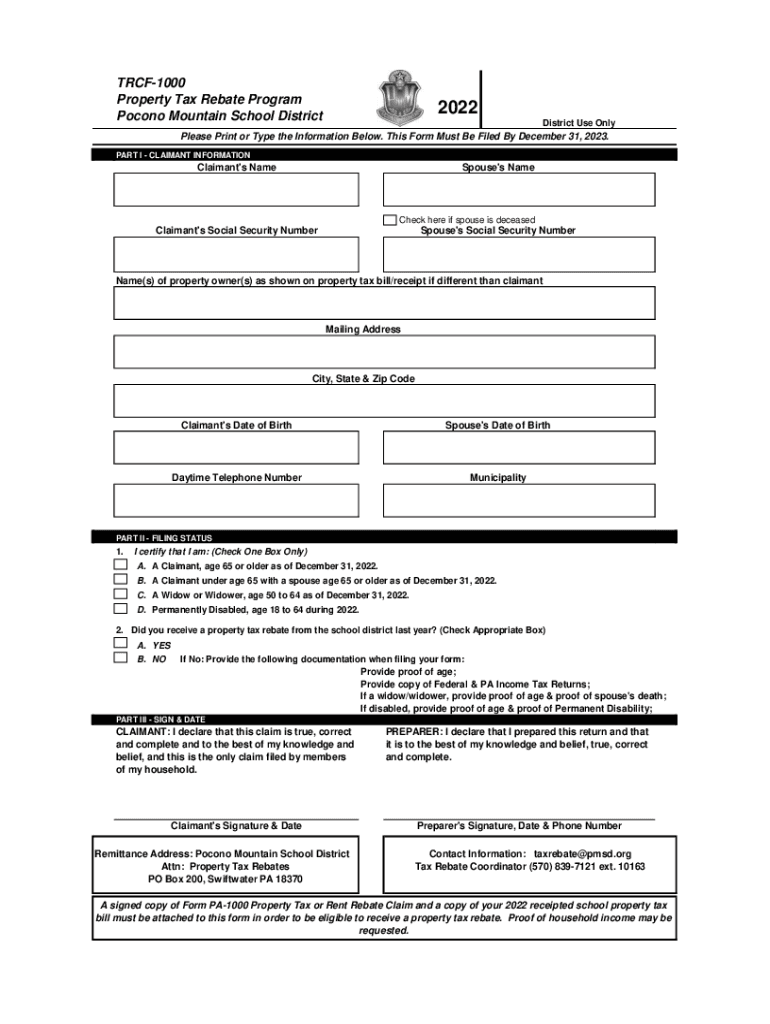

TRCF1000 Property Tax Rebate Program Pocono Mountain School District2022 District Use OnlyPlease Print or Type the Information Below. This Form Must Be Filed By December 31, 2023. PART I CLAIMANT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign trcf 1000 tax form

Edit your trcf 1000 tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trcf 1000 tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trcf 1000 tax form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit trcf 1000 tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA TRCF-1000 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out trcf 1000 tax form

How to fill out PA TRCF-1000

01

Obtain the PA TRCF-1000 form from the official website or local office.

02

Fill out the personal information section with your name, address, and contact details.

03

Provide the required financial information as prompted by the form.

04

Ensure to include any relevant documentation required for processing your form.

05

Review the form for accuracy and completeness.

06

Submit the form according to the instructions provided, either online or by mail.

Who needs PA TRCF-1000?

01

Individuals applying for tax credits in Pennsylvania.

02

Businesses seeking tax refunds or adjustments.

03

Tax professionals and accountants handling client accounts involving tax credits.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for Pennsylvania property tax rebate?

The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

Where to get pa rent rebate forms?

Property Tax/Rent Rebate Program Filing Options After checking eligibility requirements, you can file your rebate application online by visiting myPATH, the Department of Revenue's user-friendly online filing system.

At what age do seniors stop paying property taxes near Pennsylvania?

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

What is the pa rebate for 2023?

The Pennsylvania Property Tax/Rent Rebate program, offered to residents of the Keystone State annually, will give eligible applicants a rebate worth up to $650, with supplemental rebates for qualifying homeowners worth up to $975.

Do senior citizens get a discount on property taxes in Pennsylvania?

Optional Information: Offers qualified senior citizen homeowners a flat 30% discount on the real estate tax on their primary residence. County Treasurer's Office provides assistance in completing the application for individuals who require help.

Can I still apply for rent rebate in PA?

Check if you qualify for Pennsylvania's Property Tax/Rent Rebate Program. The deadline to apply is Friday, June 30, 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute trcf 1000 tax form online?

pdfFiller has made it easy to fill out and sign trcf 1000 tax form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit trcf 1000 tax form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing trcf 1000 tax form.

How do I complete trcf 1000 tax form on an Android device?

Complete your trcf 1000 tax form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is PA TRCF-1000?

PA TRCF-1000 is a form used by the Commonwealth of Pennsylvania for reporting information related to tax credits and other financial activities.

Who is required to file PA TRCF-1000?

Any entity or individual who is claiming certain tax credits or participating in programs that require reporting these credits must file PA TRCF-1000.

How to fill out PA TRCF-1000?

To fill out PA TRCF-1000, gather required information such as identifying details, credit amounts, and any other supporting documentation, and complete the form as instructed in the accompanying guidelines.

What is the purpose of PA TRCF-1000?

The purpose of PA TRCF-1000 is to report tax credits claimed by individuals or businesses to ensure compliance with Pennsylvania tax laws.

What information must be reported on PA TRCF-1000?

The information that must be reported on PA TRCF-1000 includes the taxpayer's identification details, the specific tax credits being claimed, and any relevant financial information related to those credits.

Fill out your trcf 1000 tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trcf 1000 Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.