Get the free boe 58 g p1 rev 13 06 11 san mateo county form

Show details

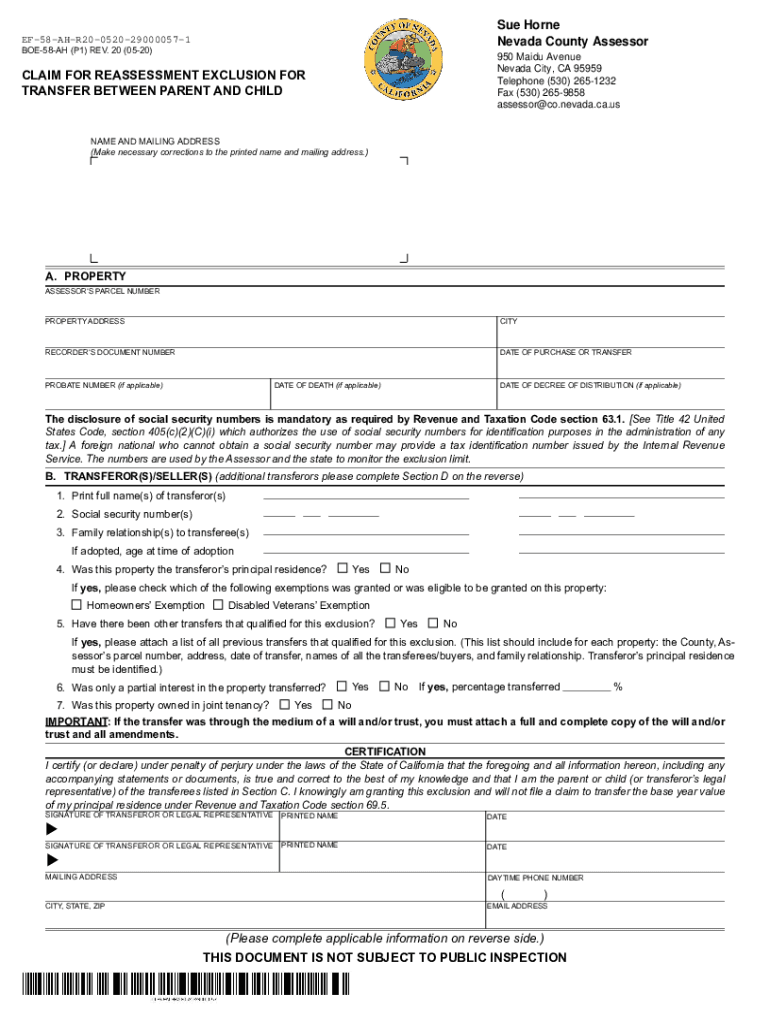

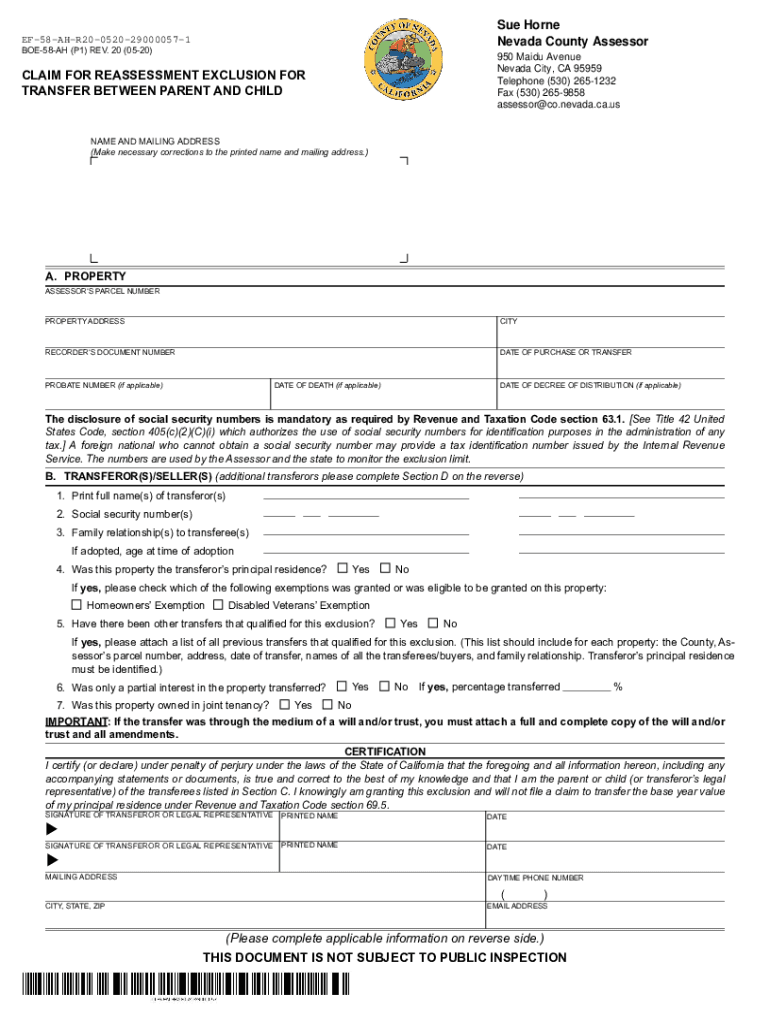

Sue Horne Nevada County AssessorEF58AHR200520290000571 BOE58AH (P1) REV. 20 (0520)950 Maid Avenue Nevada City, CA 95959 Telephone (530) 2651232 Fax (530) 2659858 assessor@co.nevada.ca.usCLAIM FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe 58 g p1

Edit your boe 58 g p1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe 58 g p1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe 58 g p1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit boe 58 g p1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe 58 g p1

How to fill out boe 58 g p1

01

Start by entering the requested information in Section A, which includes the date of the change, name of the assessee, the account number, and contact information.

02

Fill out Section B if there are multiple properties affected by the change, providing the necessary details for each property.

03

Proceed to Section C if the change involves a reassessment event, such as a new construction or change in ownership. Enter the required information accordingly.

04

Complete Section D if there are any attachments to be included with the form, providing a brief description of each attachment.

05

Sign and date the form in Section E to certify the accuracy of the information provided.

06

Submit the completed BOE 58-G P1 form to the appropriate tax assessor's office for processing.

Who needs boe 58 g p1?

01

Individuals or businesses who have undergone changes in property ownership, construction, or other events that may impact their property taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get boe 58 g p1?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific boe 58 g p1 and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my boe 58 g p1 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your boe 58 g p1 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit boe 58 g p1 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share boe 58 g p1 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is boe 58 g p1?

BOE-58-G/P1 is a Statement of Installment Account Activity used by taxpayers to report and pay their quarterly sales and use tax liabilities.

Who is required to file boe 58 g p1?

Any business or individual that is registered with the California Department of Tax and Fee Administration (CDTFA) and has a sales and use tax account is required to file BOE-58-G/P1.

How to fill out boe 58 g p1?

To fill out BOE-58-G/P1, taxpayers need to provide information about their sales and use tax activities for the quarter, including total sales, taxable sales, and any credits or deductions that apply.

What is the purpose of boe 58 g p1?

The purpose of BOE-58-G/P1 is to report and remit sales and use tax liabilities in a timely manner to the CDTFA.

What information must be reported on boe 58 g p1?

Taxpayers must report their total sales, taxable sales, exemptions claimed, credits or deductions, and the total amount due on BOE-58-G/P1.

Fill out your boe 58 g p1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe 58 G p1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.