Get the free LLP-1 - sos nh

Show details

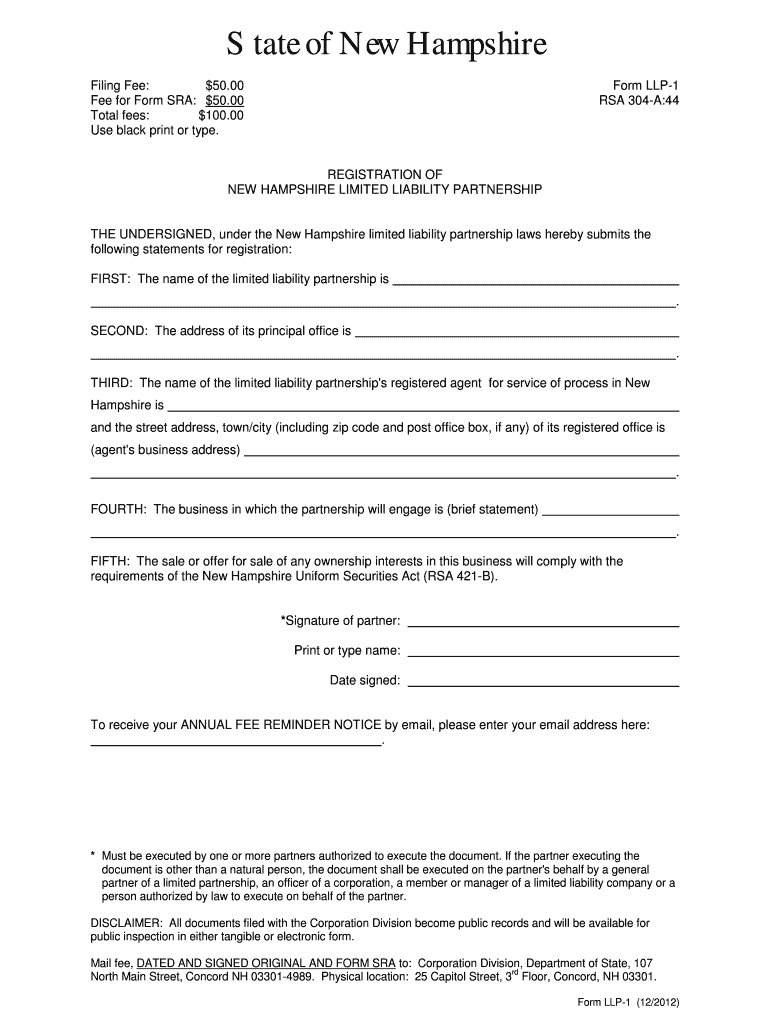

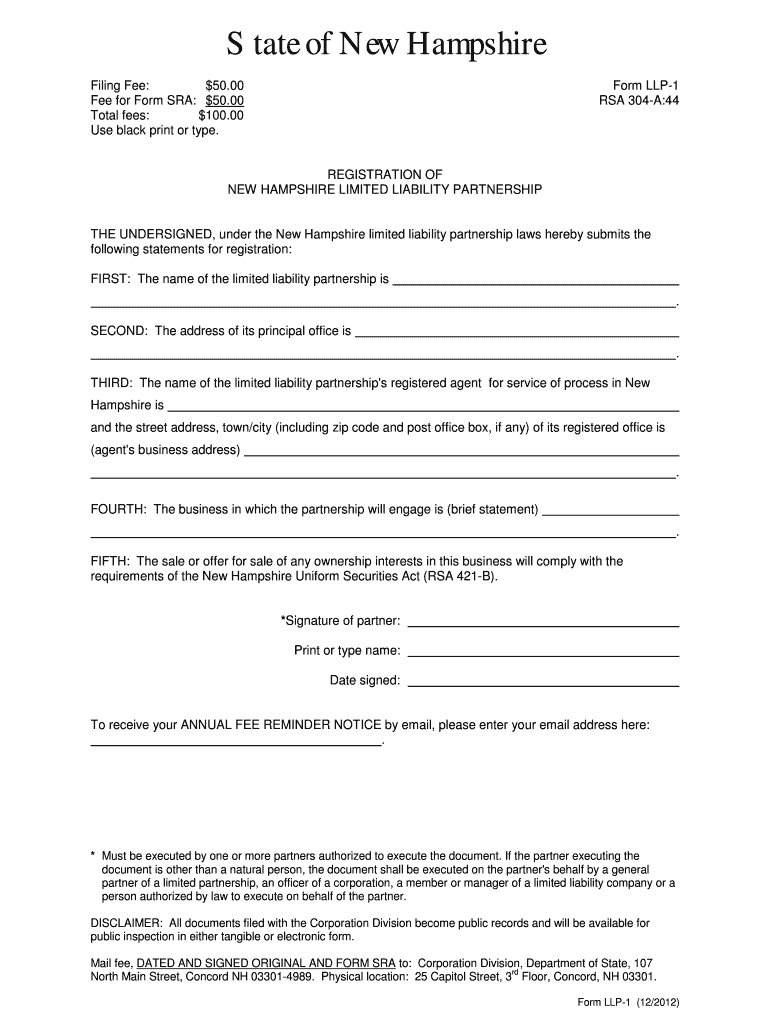

State of New Hampshire REGISTRATION OF NEW HAMPSHIRE LIMITED LIABILITY PARTNERSHIP INSTRUCTIONS FOR COMPLETING FORM LLP-1 RSA 304-A 44 1. NAME Name must contain the words Limited Liability Partnership or the abbreviation L*L*P. or LLP as the last words or letters of its name. 2. REGISTERED AGENT/REGISTERED OFFICE Each registered limited liability partnership shall have and maintain in New Hampshire a A registered office that may be the same as any of its places of business and b A...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign llp-1 - sos nh

Edit your llp-1 - sos nh form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your llp-1 - sos nh form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit llp-1 - sos nh online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit llp-1 - sos nh. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out llp-1 - sos nh

How to fill out LLP-1

01

Obtain the LLP-1 form from the relevant authority's website or office.

02

Fill in the name of the Limited Liability Partnership (LLP) at the top of the form.

03

Provide the designated partners' details including name, address, and identification number.

04

Include the registered office address of the LLP.

05

Specify the business activities the LLP will engage in.

06

Double-check the information for accuracy.

07

Sign the declaration section of the form.

08

Submit the completed form along with any required fees to the appropriate authority.

Who needs LLP-1?

01

Individuals or groups looking to form a Limited Liability Partnership (LLP).

02

Existing partnerships wishing to register as an LLP.

03

Businesses wanting to formalize their structure for limited liability benefits.

Fill

form

: Try Risk Free

People Also Ask about

What does LLP stand for after a lawyers name?

You can form a business surrounding your professional services by forming a limited liability partnership (LLP). You must be licensed as either a(n): Lawyer.

What is the downside of an LLP?

Disadvantages of an LLP Public disclosure is the main disadvantage of an LLP. Financial accounts have to be submitted to Companies House for the public record. The accounts may declare income of the members which they may not wish to be made public. Income is personal income and is taxed ingly.

What does LLP mean for an attorney?

The State Bar of California's Limited Liability Partnership (LLP) program certifies professional partnerships to allow partners to limit their vicarious liability for the acts tortious or otherwise of their partners and employees in ance with statutes and the State Bar's Limited Liability Partnership Rules and

What is the difference between LLP and PC lawyers?

An LLP allows partners to share liability for their actions while protecting them from the actions of others, making it a flexible choice for law firms. A PC law firm operates under a corporate structure, offering liability protection at the corporate level but with stricter formalities and compliance requirements.

How do I file an LLP 1?

Form LLP – I is to be filed by the Limited Liability Partnership Firm through the LLP's Authorised Dealer Category – I bank, with the Regional Office of the Reserve Bank under whose jurisdiction the Registered Office of the Limited Liability Partnership making the declaration is situated.

What is the equivalent of an LLP in the US?

Unlike a limited liability company (LLC), which requires only one member to get off the ground, an LLP is required by law to consist of at least two members or corporate entities - although neither is required to be resident in the US, making Delaware LLPs popular for foreign-based companies hoping to break the US

What does LLP mean after a name?

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit aspects of both partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence.

What is the English of LLP?

abbreviation for Limited Liability Partnership: a form of company in the US whose owners manage the business directly, but are not legally responsible for the company's debts under some circumstances: The announcement was made by a partner at Deloitte & Touche LLP, one of the large public accounting firms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LLP-1?

LLP-1 is a form used for incorporating a Limited Liability Partnership (LLP) in India. It captures essential details about the partnership and its partners.

Who is required to file LLP-1?

The designated partners of an LLP, proposing to register their partnership, are required to file LLP-1 with the Registrar of Companies.

How to fill out LLP-1?

To fill out LLP-1, provide details such as the name of the LLP, partners’ personal details, business activities, and the registered office address. Ensure all mandatory fields are completed accurately.

What is the purpose of LLP-1?

The purpose of LLP-1 is to formally register a Limited Liability Partnership and to provide a legal recognition to the entity, allowing it to operate lawfully.

What information must be reported on LLP-1?

LLP-1 must report information including the name of the LLP, the address of the registered office, details of designated partners, and the nature of the business.

Fill out your llp-1 - sos nh online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llp-1 - Sos Nh is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.