Get the free Chapter 11 Planning in Alberta - mgareview alberta

Show details

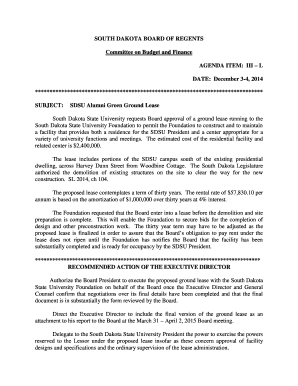

Chapter 11: Planning in Alberta

Municipal planning tools and requirements

The Municipal Government Act (MGA) identifies the planning tools and

resources Alberta communities use to build and grow sustainably.

This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 11 planning in

Edit your chapter 11 planning in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 11 planning in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 11 planning in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 11 planning in. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 11 planning in

Point by point, here's how to fill out chapter 11 planning:

01

Begin by gathering all relevant financial information: This includes your company's financial statements, tax returns, balance sheets, income statements, and cash flow statements. It's crucial to have a clear understanding of your current financial situation before proceeding with Chapter 11 planning.

02

Assess your debts and liabilities: Identify all outstanding debts and liabilities that your company has. This includes loans, mortgages, leases, and any other financial obligations. It's important to have a comprehensive understanding of your financial obligations before moving forward.

03

Evaluate your assets: Determine the value of your company's assets, including property, inventory, equipment, and intellectual property. An accurate assessment of your assets will help determine the viability of Chapter 11 bankruptcy and the potential for restructuring.

04

Create a detailed budget and cash flow projection: Develop a comprehensive budget that outlines your expected income and expenses during the Chapter 11 process. This projection will help you understand the financial feasibility of your restructuring plans and guide your decision-making process.

05

Develop a reorganization plan: Work with legal and financial professionals to create a reorganization plan that outlines how you will repay your debts, restructure your company, and regain financial stability. This plan should address creditors' concerns and include proposed changes to operations, sales strategies, and cost reduction measures.

06

Engage creditors and stakeholders: Communicate with your creditors and other relevant stakeholders throughout the Chapter 11 process. Maintain open lines of communication to negotiate repayment terms, solicit support for your reorganization plan, and address any concerns or objections.

Who needs chapter 11 planning in?

01

Companies facing financial distress: Chapter 11 planning is typically relevant for companies that are struggling financially and need to reorganize their operations, debts, and financial obligations to regain stability and avoid liquidation.

02

Businesses with significant debt: Companies with a substantial amount of debt that they are unable to repay may need to consider Chapter 11 planning as a potential solution. This can apply to businesses across various industries and sizes.

03

Organizations seeking to restructure: Chapter 11 planning is necessary for businesses that require a comprehensive restructuring plan to improve their financial position. It allows for the reorganization of assets, debts, and operations to create a more sustainable business model.

04

Companies seeking legal protection: Chapter 11 planning provides companies with legal protection from creditors' actions, such as lawsuits, foreclosure, or repossession. This protection allows businesses to continue operations while working on their financial recovery.

In summary, individuals who need chapter 11 planning are usually companies facing financial difficulties, having significant debts, needing to restructure operations, and seeking legal protection from creditors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is chapter 11 planning in?

Chapter 11 planning is typically related to bankruptcy reorganization for businesses.

Who is required to file chapter 11 planning in?

Businesses or individuals who are seeking bankruptcy protection under Chapter 11 are required to file a reorganization plan.

How to fill out chapter 11 planning in?

Chapter 11 planning can be filled out with the assistance of legal and financial professionals who specialize in bankruptcy reorganization.

What is the purpose of chapter 11 planning in?

The purpose of chapter 11 planning is to create a plan for reorganizing and restructuring debts in order to repay creditors and continue business operations.

What information must be reported on chapter 11 planning in?

Chapter 11 planning must include detailed financial information, proposed repayment plans, and strategies for business restructuring.

How can I manage my chapter 11 planning in directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your chapter 11 planning in and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit chapter 11 planning in from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including chapter 11 planning in, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I fill out chapter 11 planning in on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your chapter 11 planning in. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your chapter 11 planning in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 11 Planning In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.