Get the free Lock in application

Show details

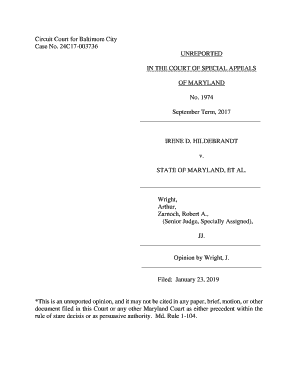

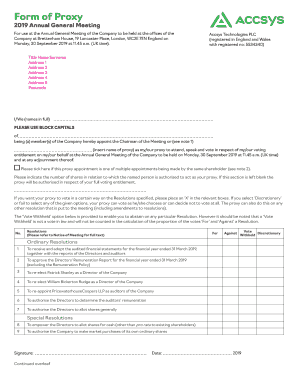

P.O. BOX 192, GARRISON, NY 10524 Phone 845 4243609 Fax 8454244403 CFM Fall Locking November 2122, 2009 The Registration deadline for this retreat is Tuesday, November 18th NAME PARISH ADDRESS CITY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lock in application

Edit your lock in application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lock in application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lock in application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lock in application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lock in application

How to Fill Out a Lock-In Application:

01

Gather all necessary information: Before filling out the lock-in application, make sure you have all the required information handy. This may include personal details, contact information, employment status, and any relevant financial information.

02

Read and understand the instructions: Carefully go through the instructions provided on the lock-in application form. Familiarize yourself with the requirements and any specific guidelines mentioned.

03

Provide accurate personal details: Fill in your personal details accurately, including your full name, date of birth, social security number, address, and contact information. Double-check the information for any errors or omissions.

04

Specify the effective date: The lock-in application will usually ask you to specify the effective date of the lock-in agreement. This is the date when the agreement will come into effect and restrict any changes to your withholding allowances.

05

Determine your withholding allowances: Evaluate your financial circumstances and determine the appropriate number of withholding allowances. This will determine the amount of taxes withheld from your paycheck. If you are unsure, consult a tax professional or refer to the IRS guidelines for assistance.

06

Sign and date the form: Once you have completed all the required information, sign and date the lock-in application form. By signing the form, you certify that the information provided is true and accurate to the best of your knowledge.

Who Needs a Lock-In Application?

01

Individuals with changing financial situations: A lock-in application is beneficial for individuals who experience significant changes in their financial circumstances. This includes changes in employment, income, or deductions that could affect tax withholding. By submitting a lock-in application, individuals can ensure a consistent amount of taxes is withheld from their paycheck, eliminating the need for frequent adjustments.

02

Employees with unexpected tax liabilities: If an employee unexpectedly owes a large amount of taxes at the end of the year, they may choose to submit a lock-in application to prevent similar situations in the future. This can help them avoid financial burdens and plan their tax payments more effectively.

03

Individuals seeking financial stability and certainty: Some individuals prefer to have a predictable and stable tax withholding. By submitting a lock-in application, they can ensure that a fixed amount of taxes is withheld from their paycheck, providing financial stability and eliminating any surprises during tax season.

Please note that the specific eligibility criteria and requirements for a lock-in application may vary depending on your country's tax laws and regulations. It is recommended to consult with a tax professional or refer to the relevant tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lock in application?

A lock in application is a form that grants permission for a specified use of a particular resource or asset.

Who is required to file lock in application?

Any individual or entity that intends to use a resource or asset that requires permission must file a lock in application.

How to fill out lock in application?

The lock in application can be filled out by providing relevant information such as contact details, purpose of use, and any additional documentation as required.

What is the purpose of lock in application?

The purpose of the lock in application is to regulate and monitor the use of specific resources or assets to prevent unauthorized access or misuse.

What information must be reported on lock in application?

The lock in application must include details about the applicant, purpose of use, duration of use, and any other relevant information requested.

How do I execute lock in application online?

Completing and signing lock in application online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the lock in application in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your lock in application in minutes.

How can I fill out lock in application on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your lock in application. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your lock in application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lock In Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.