Get the free Petition for Redetermination of Tax Deficiency - glad

Show details

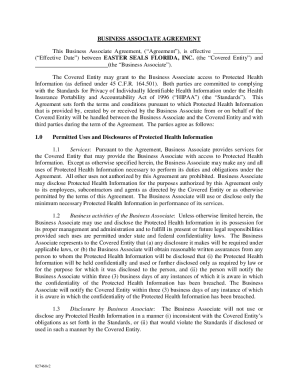

This document is a petition submitted by Rhiannon G. O’Donnabhain seeking a redetermination of a tax deficiency determined by the Commissioner of Internal Revenue, specifically regarding the deductibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petition for redetermination of

Edit your petition for redetermination of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petition for redetermination of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petition for redetermination of online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit petition for redetermination of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petition for redetermination of

How to fill out Petition for Redetermination of Tax Deficiency

01

Obtain the Petition for Redetermination of Tax Deficiency form from the appropriate tax authority.

02

Read the instructions carefully to understand the requirements.

03

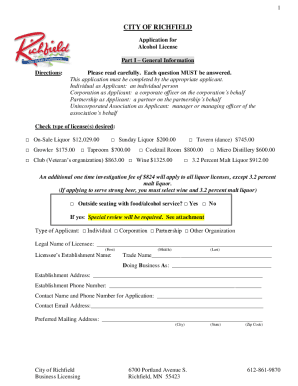

Fill out your personal information accurately, including your name, address, and tax identification number.

04

Provide detailed information about the tax deficiency in question, including the tax year and the amount in dispute.

05

Attach any relevant documentation that supports your claim, such as receipts, records, or previous correspondence.

06

Sign and date the petition to certify that the information provided is true and correct.

07

Submit the completed petition to the designated office by the deadline specified in the instructions.

Who needs Petition for Redetermination of Tax Deficiency?

01

Individuals or businesses who have received a notice of tax deficiency from the tax authority.

02

Taxpayers who believe the tax amount assessed is incorrect and wish to challenge it.

03

Those seeking to resolve disputes related to additional taxes owed or underpayment determinations.

Fill

form

: Try Risk Free

People Also Ask about

How do you write an effective protest letter?

The body of your letter should present your compelling arguments in a coherent and logical way. Use clear language and provide evidence and examples to support your points. Use headings and subheadings to break up the text and make it easier to read.

How much does it cost to petition the tax court?

Filing fees are required to submit a petition. The Court's filing fee is $60 and may be paid online, by mail, or in person. The fee may be waived by filing an Application for Waiver of Filing Fee.

How to write a tax grievance letter?

ing to the IRS, your letter should include the following: Taxpayer's name, address, and contact information. A statement expressing your desire to appeal IRS's findings to the Office of Appeals. The tax period in question. A list of the items you do not agree with and the corresponding reasons.

How to write a tax protest letter?

In your formal protest, include a statement that you want to appeal the changes proposed by the IRS and include all of the following: ∎ Your name, address, and a daytime telephone number. ∎ List of all disputed issues, tax periods or years involved, proposed changes, and reasons you disagree with each issue.

How do I write a letter of forgiveness to the IRS?

IRS Penalty Abatement Request Letter State the type of penalty you want removed. Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control. Attach documents that will prove your case.

How to write a good appeal letter?

Content and Tone Opening Statement. The first sentence or two should state the purpose of the letter clearly. Be Factual. Include factual detail but avoid dramatizing the situation. Be Specific. Documentation. Stick to the Point. Do Not Try to Manipulate the Reader. How to Talk About Feelings. Be Brief.

Does notice of deficiency mean I owe money?

This is a notice that the IRS has made the legal determination that you owe additional income taxes beyond what you reported on your federal income tax return. The notice includes information that they will propose a change to your tax return based on the other records they've received for that tax year.

How do I resolve a notice of deficiency in the IRS?

You may be able to resolve the issue(s) in the notice of deficiency without going to court by responding to the letter, even if you disagree with the information in the letter. If you disagree, send the IRS a letter explaining what information you think is in error.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Petition for Redetermination of Tax Deficiency?

A Petition for Redetermination of Tax Deficiency is a formal request filed by a taxpayer to contest a tax deficiency determined by a tax authority, seeking a review or reassessment of the amount owed.

Who is required to file Petition for Redetermination of Tax Deficiency?

Any taxpayer who disagrees with a tax deficiency notice issued by the tax authority is required to file a Petition for Redetermination of Tax Deficiency.

How to fill out Petition for Redetermination of Tax Deficiency?

To fill out a Petition for Redetermination of Tax Deficiency, a taxpayer should provide their personal information, detail the tax deficiency they are contesting, explain the grounds for the dispute, and submit any supporting documentation as required.

What is the purpose of Petition for Redetermination of Tax Deficiency?

The purpose of the Petition for Redetermination of Tax Deficiency is to formally challenge the tax authority's determination of a tax deficiency, allowing the taxpayer to present their case for a lower or corrected amount.

What information must be reported on Petition for Redetermination of Tax Deficiency?

The Petition must report the taxpayer's identification details, the tax year in question, the specific deficiency being contested, the reasons for contesting the deficiency, and any evidence or documentation supporting the taxpayer's claim.

Fill out your petition for redetermination of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petition For Redetermination Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.