WV IT-104.1 2023-2026 free printable template

Show details

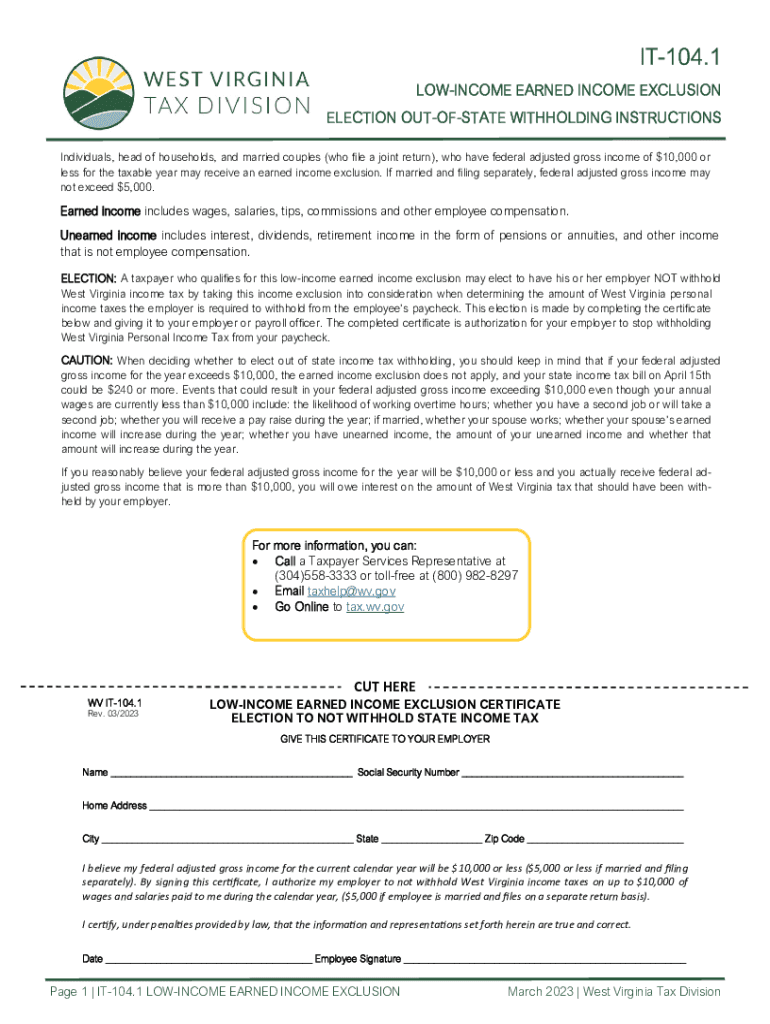

IT104.1 INCOME EARNED INCOME EXCLUSION ELECTION OUTOFSTATE WITHHOLDING INSTRUCTIONS Individuals, head of households, and married couples (who LE a joint return), who have federal adjusted gross income

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV IT-1041

Edit your WV IT-1041 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV IT-1041 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WV IT-1041 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WV IT-1041. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV IT-104.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV IT-1041

How to fill out tax revenue forecasting documentation

01

Gather all relevant financial data from previous years.

02

Analyze economic factors that may influence tax revenue.

03

Use forecasting techniques such as trend analysis or regression analysis.

04

Consider any policy changes or new legislation that may impact revenue.

05

Make projections for future tax revenue based on the information gathered.

Who needs tax revenue forecasting documentation?

01

Government agencies responsible for budget planning

02

Financial analysts evaluating the fiscal health of a jurisdiction

03

Tax professionals assisting businesses or individuals with tax planning

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out WV IT-1041 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your WV IT-1041, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit WV IT-1041 on an Android device?

You can make any changes to PDF files, like WV IT-1041, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete WV IT-1041 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your WV IT-1041. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is tax revenue forecasting documentation?

Tax revenue forecasting documentation is a report that predicts the expected revenue from taxes over a specific period of time.

Who is required to file tax revenue forecasting documentation?

Government agencies, tax authorities, and organizations responsible for financial planning are required to file tax revenue forecasting documentation.

How to fill out tax revenue forecasting documentation?

Tax revenue forecasting documentation is filled out by entering projected revenue figures based on historical data, economic trends, and other relevant factors.

What is the purpose of tax revenue forecasting documentation?

The purpose of tax revenue forecasting documentation is to help government agencies and organizations plan their budgets, allocate resources effectively, and make informed financial decisions.

What information must be reported on tax revenue forecasting documentation?

Information reported on tax revenue forecasting documentation includes projected revenue figures, tax rates, economic indicators, and assumptions used in the forecasting process.

Fill out your WV IT-1041 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV IT-1041 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.