Get the free Tax Increment Finance Authority

Show details

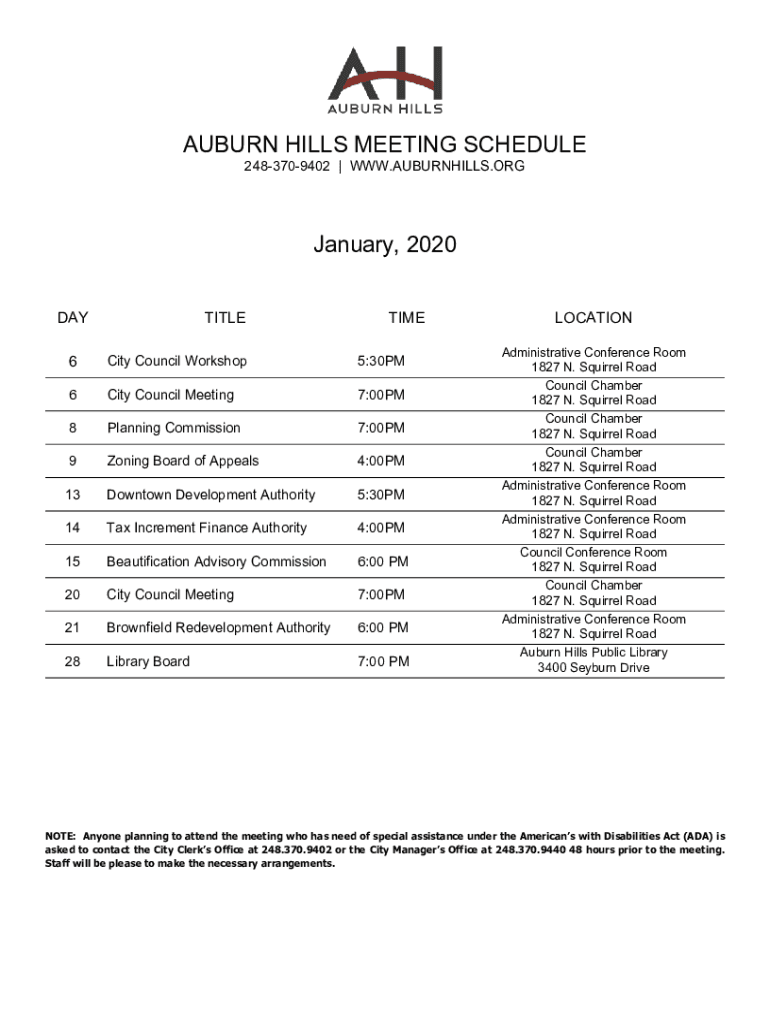

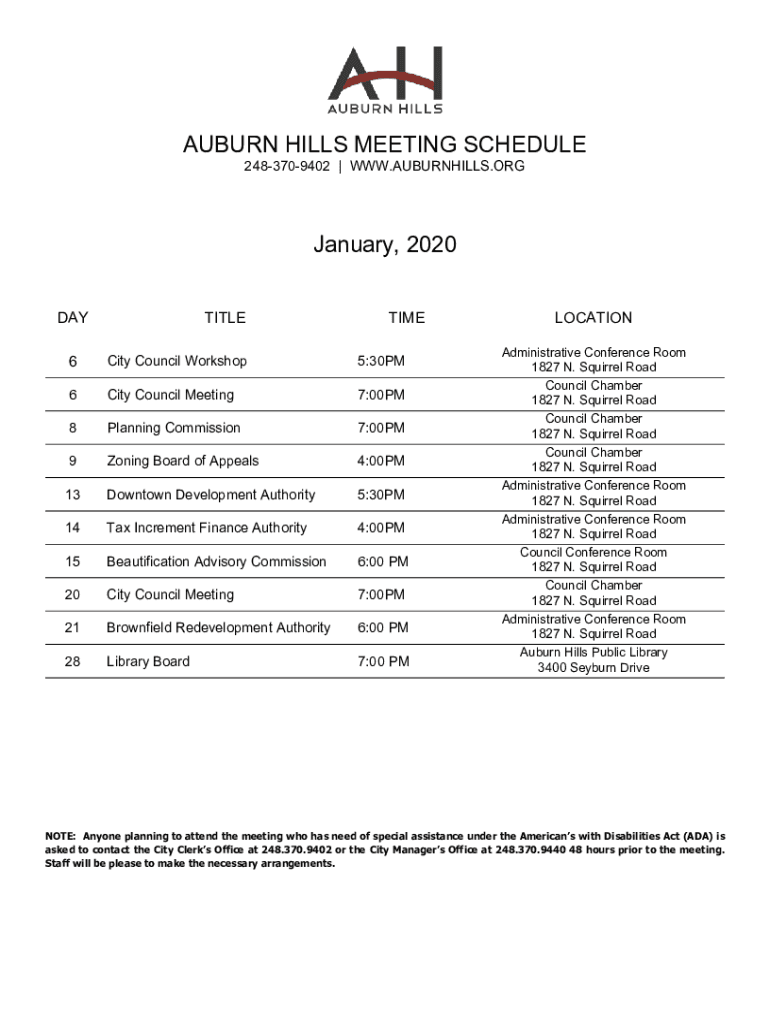

AUBURN HILLS MEETING SCHEDULE 2483709402 | WWW.AUBURNHILLS.ORG January 2020 DAYTITLETIME6City Council Workshop5:30PM6City Council Meeting7:00PM8Planning Commission7:00PM9Zoning Board of Appeals4:00PM13Downtown

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment finance authority

Edit your tax increment finance authority form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment finance authority form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment finance authority online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax increment finance authority. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment finance authority

How to fill out tax increment finance authority

01

Gather all required documents and forms related to the tax increment finance authority.

02

Complete all necessary information accurately on the forms.

03

Submit the filled-out forms to the appropriate governing body or authority for review and approval.

Who needs tax increment finance authority?

01

Developers looking to fund infrastructure improvements in blighted areas.

02

Municipalities seeking to stimulate economic development and job growth.

03

Community development organizations working to revitalize distressed neighborhoods.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax increment finance authority in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tax increment finance authority and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the tax increment finance authority electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my tax increment finance authority in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your tax increment finance authority right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is tax increment finance authority?

Tax Increment Finance Authority (TIFA) is a public financing method used to subsidize redevelopment, infrastructure, and other community-improvement projects.

Who is required to file tax increment finance authority?

Local governments or municipalities are typically required to file TIFA reports.

How to fill out tax increment finance authority?

To fill out TIFA reports, you need to gather financial information related to the tax increment financing district and report it to the appropriate agency.

What is the purpose of tax increment finance authority?

The purpose of TIFA is to promote economic development and revitalization in blighted or underdeveloped areas by using increased property tax revenues to fund projects.

What information must be reported on tax increment finance authority?

TIFA reports typically include information on property tax revenues, expenditures, and project progress within the tax increment financing district.

Fill out your tax increment finance authority online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Finance Authority is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.