Get the free CP 575 G Notice - WordPresscom

Show details

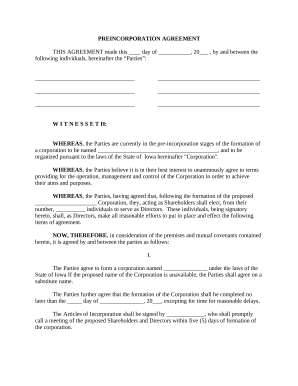

DEPARTMENT OF THE TREASURY INTERNAL REVENUE SERVICE CINCINNATI OH 459990023 Date of this notice: 06042010 Employer Identification Number: 272785498 Form: SS4 Number of this notice: BLUE DIAMOND FALLS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cp 575 g notice

Edit your cp 575 g notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cp 575 g notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cp 575 g notice online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cp 575 g notice. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cp 575 g notice

How to fill out the CP 575 G notice:

01

Obtain the CP 575 G notice form from the Internal Revenue Service (IRS) website or request a copy by mail.

02

Provide your business information in the designated fields, including the legal name, address, and Employer Identification Number (EIN).

03

Verify that all the information provided is accurate and up-to-date. Any errors or inconsistencies may result in delays or incorrect processing.

04

Sign and date the form to certify the accuracy of the information provided.

05

Submit the completed CP 575 G notice to the IRS through mail or electronically, depending on the instructions provided.

Who needs the CP 575 G notice:

01

Individuals or entities who have recently established a new business and need to obtain an Employer Identification Number (EIN) from the IRS.

02

Taxpayers who are expanding their existing business and require a separate EIN for the newly added entity.

03

Certain trusts, estates, non-profit organizations, government agencies, and other entities that are required to have an EIN for tax reporting purposes.

Overall, the CP 575 G notice is necessary for individuals or entities that are establishing or expanding a business and need to obtain a unique Employer Identification Number from the IRS for tax compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is Medicare CP 575 form?

The IRS Form CP 575 is an Internal Revenue Service (IRS) computer generated letter you receive from the IRS granting your Employer Identification Number (EIN). WPS GHA may require a copy of your CP 575 to verify the provider or supplier's legal business name and EIN.

How do I get my CP 575 letter online?

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

Can I get a copy of my CP 575 online?

This EIN confirmation letter is called CP 575, and the IRS only mails the letter to the mailing address listed on line 4 of the SS-4 application. Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online.

How do I get a CP565 notice?

A CP565 notice is a document you receive when the IRS has given you an Individual Taxpayer Identification Number (ITIN). ID.me will need to see this notice to verify your identity with an ITIN. Note: You can read more about CP565 notices on this IRS support page.

What is notice number CP 575 G?

The CP-575 is a notice from the Internal Revenue Service confirming that you have been granted an EIN (Employer Identification Number). The EIN is sometimes also referred to as FEIN, or Federal Employer Identification Number.

Where can I find my IRS CP 575?

If you do not have access to the Internet, call 1-800-829-3676 (TTY/TDD 1-800-829-4059) or visit your local IRS office. IMPORTANT REMINDERS: * Keep a copy of this notice in your permanent records. This notice is issued only one time and the IRS will not be able to generate a duplicate copy for you.

What is IRS Notice Number CP 575 G?

A CP 575 EIN Confirmation Letter is a document issued by the Internal Revenue Service (IRS) to confirm the unique Employer Identification Number (EIN) they have issued to a new business.

Can I get my CP 575 online?

This EIN confirmation letter is called CP 575, and the IRS only mails the letter to the mailing address listed on line 4 of the SS-4 application. Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online.

How do I get my EIN confirmation letter CP 575?

Where Can I Find My EIN Verification Letter? An Employer Identification Number (EIN) verification letter (CP-575) is sent by the IRS when an EIN application is processed. Call the IRS Business & Specialty Tax Line at 1-800-829-4933 (toll-free) between 7:00 a.m. and 7:00 p.m. local time, Monday through Friday.

How can I get a copy of my CP 575?

What if I lost my (CP 575) form? If you need it for any reason but you did not find it where you left it. Don't worry, you can always contact IRS directly at (267) 941-1099. If you are outside of United States then you may reach IRS at 800-829-4933 to request a copy in order produce a confirmation letter.

How do I get proof of my EIN number?

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced EIN. Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cp 575 g notice in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your cp 575 g notice and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit cp 575 g notice from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like cp 575 g notice, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I fill out cp 575 g notice on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your cp 575 g notice from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is cp 575 g notice?

CP 575 G notice is a form issued by the IRS to inform taxpayers of their tax ID numbers.

Who is required to file cp 575 g notice?

Employers and entities who have employees or contractors are required to file CP 575 G notice.

How to fill out cp 575 g notice?

CP 575 G notice can be filled out online or by mail using the information provided by the IRS.

What is the purpose of cp 575 g notice?

The purpose of CP 575 G notice is to verify tax ID numbers and ensure accurate reporting of income.

What information must be reported on cp 575 g notice?

CP 575 G notice requires reporting of tax ID numbers, entity names, and contact information.

Fill out your cp 575 g notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cp 575 G Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.