PG Nambawan Savings and Loan Society Withdrawal Application Form 2021-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

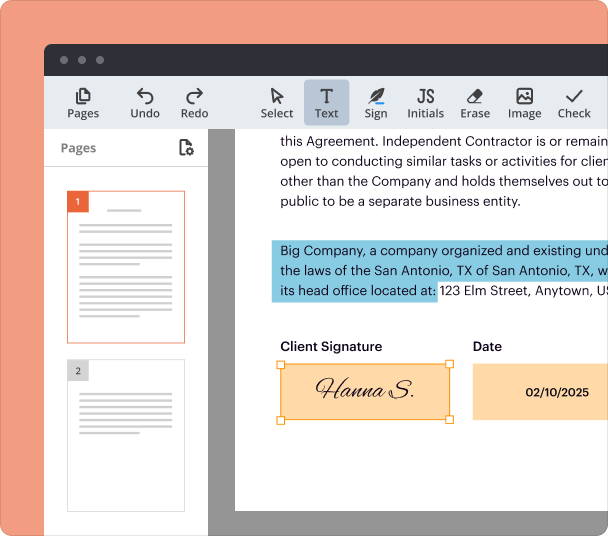

Edit and sign in one place

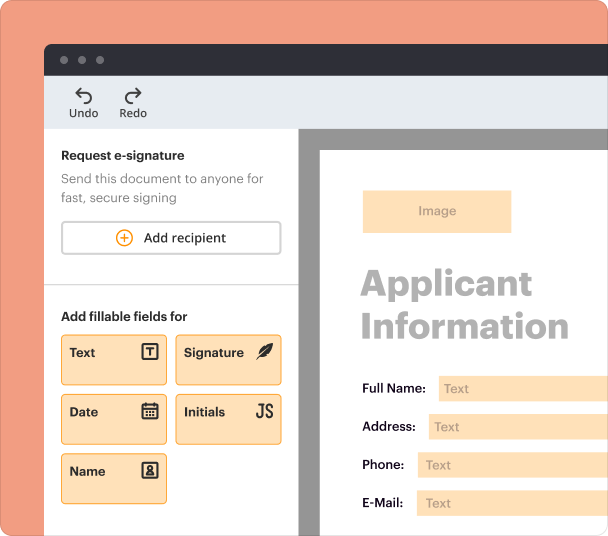

Create professional forms

Simplify data collection

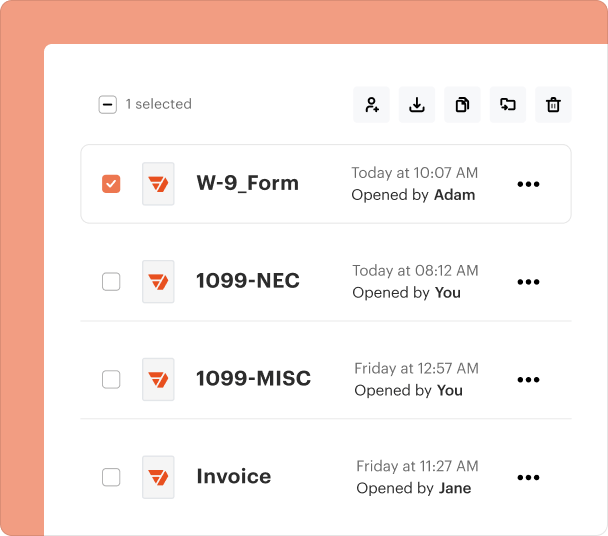

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

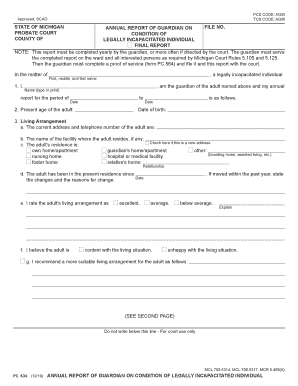

Exploring the pg Nambawan Savings and Form

Understanding the pg Nambawan Savings and Form

The pg Nambawan Savings and Form is an essential document used for managing savings and loans within the Nambawan framework. This form allows individuals to apply for or manage their savings accounts, loans, and related financial services. It streamlines the process of accessing financial support and can be used in various scenarios such as applying for loans or making withdrawals.

Key Features of the pg Nambawan Savings and Form

This form includes several key features designed to enhance user experience and efficiency. It allows for digital completion, which expedites the process of submitting applications. Users can enter relevant personal and financial details securely. Additionally, the form supports e-signatures, ensuring that documents are legally binding without the need for physical presence.

Eligibility Criteria for the pg Nambawan Savings and Form

To use the pg Nambawan Savings and Form, applicants must meet certain eligibility criteria. This typically includes being a verified member of the Nambawan Savings and Loans Society. Applicants must also provide valid identification and proof of income to facilitate the assessment process. Meeting these requirements ensures that users can effectively access the financial benefits of the services offered.

How to Fill the pg Nambawan Savings and Form

Filling out the pg Nambawan Savings and Form involves a few straightforward steps. First, users should gather necessary documents like identification and income proof. Next, they will enter personal information such as their name, address, and contact details into the form. Then, financial details, including savings or loan amounts, should be accurately filled in. Finally, users must review the information for accuracy before submitting the form electronically for processing.

Common Errors and Troubleshooting

Errors in the pg Nambawan Savings and Form can delay application processing. Common mistakes include incorrect personal information, submission of incomplete forms, and failure to provide required documentation. Users are encouraged to double-check all entries and ensure that all fields are filled out completely. If issues arise, they may consult the help section on the pdfFiller platform for guidance on troubleshooting.

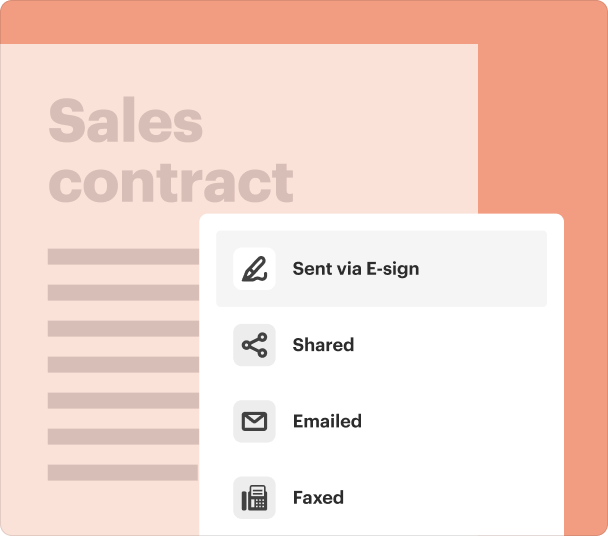

Submission Methods and Delivery

The pg Nambawan Savings and Form can be submitted digitally through pdfFiller’s secure platform. Once completed, users simply click to submit, and the form is automatically routed to the appropriate department for review. This method ensures quick processing times and reduces the risk of misplaced documents typically associated with traditional paper forms.

Benefits of Using the pg Nambawan Savings and Form

Utilizing the pg Nambawan Savings and Form offers numerous advantages. The digital nature of the form accelerates processing times compared to traditional paper submissions. Users benefit from greater convenience, as they may complete and submit the form from anywhere at any time. Additionally, the platform’s secure infrastructure protects personal information, providing peace of mind throughout the process.

Frequently Asked Questions about nambawan super savings and loans withdrawal form

What types of applications can be submitted with the pg Nambawan Savings and Form?

The form can be used for submitting applications related to savings accounts, loans, and withdrawals within the Nambawan framework.

Can I save my progress on the form before submission?

Yes, users can save their progress and return to complete the form later without losing any entered information.

pdfFiller scores top ratings on review platforms