Get the free Corporate Risk Assessment

Show details

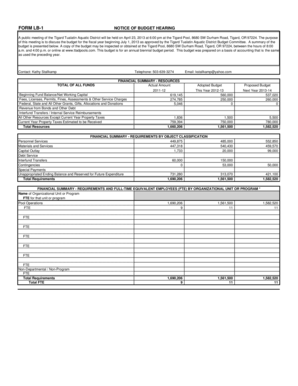

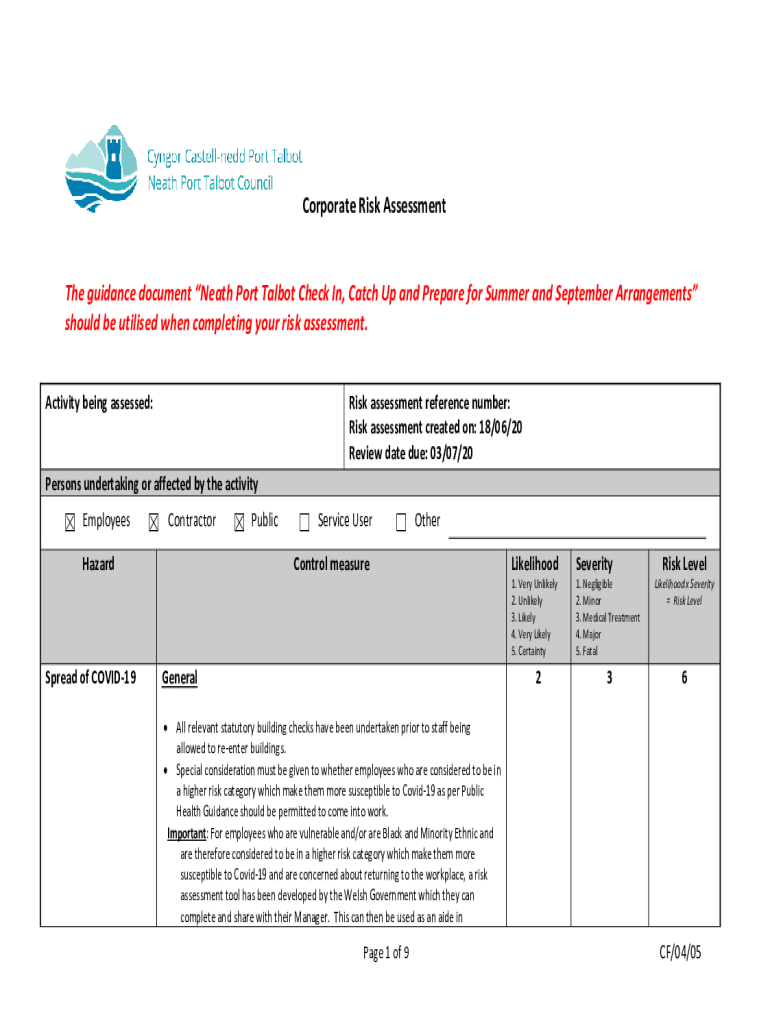

Corporate Risk Assessment guidance document Neath Port Talbot Check In, Catch Up and Prepare for Summer and September Arrangements should be utilized when completing your risk assessment. Activity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate risk assessment

Edit your corporate risk assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate risk assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate risk assessment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit corporate risk assessment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate risk assessment

How to fill out corporate risk assessment

01

Identify and prioritize potential risks that could impact the company

02

Gather relevant data and information to assess the likelihood and impact of each risk

03

Evaluate existing control measures and identify gaps or areas for improvement

04

Develop a risk mitigation plan to address high priority risks

05

Implement the risk mitigation plan and monitor its effectiveness over time

Who needs corporate risk assessment?

01

Companies of all sizes and industries can benefit from conducting a corporate risk assessment

02

It is particularly important for organizations in high-risk industries such as finance, healthcare, and manufacturing

03

Executive management, boards of directors, and stakeholders may also need corporate risk assessments to make informed decisions and prioritize resources

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate risk assessment to be eSigned by others?

Once you are ready to share your corporate risk assessment, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get corporate risk assessment?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific corporate risk assessment and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute corporate risk assessment online?

pdfFiller has made it simple to fill out and eSign corporate risk assessment. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is corporate risk assessment?

Corporate risk assessment is the process of identifying, analyzing, and evaluating potential risks that may affect a company's operations, assets, finances, or reputation.

Who is required to file corporate risk assessment?

Certain companies are required by law or regulations to conduct and file corporate risk assessments. This requirement may vary depending on the industry, size of the company, and jurisdiction.

How to fill out corporate risk assessment?

To fill out a corporate risk assessment, companies typically use risk assessment tools, templates, or software to identify and evaluate potential risks, assess their likelihood and impact, and develop risk mitigation strategies.

What is the purpose of corporate risk assessment?

The purpose of corporate risk assessment is to help companies understand and manage their risks effectively, protect their assets and reputation, and make informed decisions to achieve their business objectives.

What information must be reported on corporate risk assessment?

Corporate risk assessments typically include information on identified risks, their likelihood and impact, risk mitigation strategies, responsible parties, and monitoring and review processes.

Fill out your corporate risk assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Risk Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.