Get the free Farm & Rural Risk Conference Agenda - Micaindiana.org - micaindiana

Show details

Farm & Rural Risk Conference April 24, 2014, Submitted for 6 CE Hours $110 per person (includes lunch) IAI Conference Center 3435 W. 96th Street Indianapolis, IN INDEPENDENT INSURANCE AGENTS OF INDIANA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign farm amp rural risk

Edit your farm amp rural risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm amp rural risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing farm amp rural risk online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit farm amp rural risk. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out farm amp rural risk

How to fill out farm amp rural risk:

01

Gather all necessary information: Start by collecting the necessary details and documentation related to your farm or rural property. This may include property ownership documents, details about any livestock or crops, as well as information about any equipment or machinery used on the farm.

02

Assess the risks: Next, carefully evaluate the potential risks and hazards associated with farming or rural activities. Consider factors such as natural disasters, accidents, livestock health, crop failure, and liability concerns. This step will help you identify the types of coverage you may need.

03

Review insurance options: Research different insurance providers and policies that offer farm amp rural risk coverage. Compare the coverage options, limits, deductibles, and premiums to find the most suitable policy for your specific needs. Consider seeking professional advice from insurance agents or brokers specializing in agricultural insurance.

04

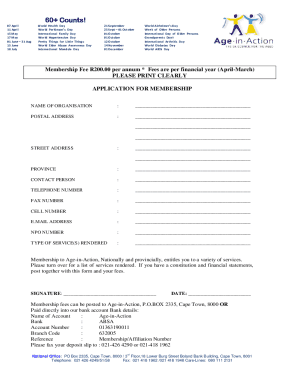

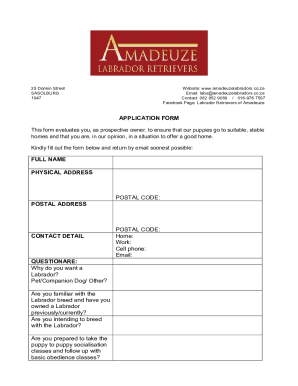

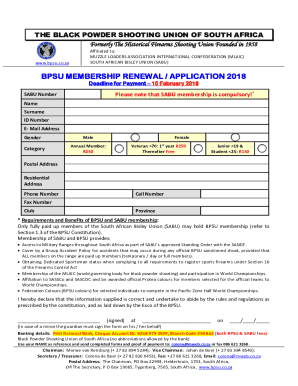

Fill out the application form: Once you have chosen an insurance provider and policy, fill out the application form with accurate and detailed information. It is crucial to provide all the necessary details as accurately as possible to avoid any potential issues or discrepancies in the future.

05

Attach supporting documents: Depending on the insurance company's requirements, you may need to attach supporting documents, such as property ownership proof, livestock inventory, equipment valuation reports, or any other relevant paperwork. Make sure to double-check the requirements and include all the necessary documents to complete the application process.

06

Review and submit: Before submitting the application, review all the information provided for accuracy and completeness. Ensure that you have answered all the questions correctly and attached all the required documents. Once you are confident that everything is in order, submit the application as instructed by the insurance provider.

Who needs farm amp rural risk:

01

Farmers and livestock owners: Individuals involved in agricultural activities, including crop farming, livestock raising, or poultry farming, may need farm amp rural risk coverage. This insurance can help protect against the risks associated with these activities, such as crop failure, livestock diseases, or accidents involving farm machinery.

02

Rural property owners: Owners of rural properties, whether used for residential purposes or agricultural activities, can benefit from farm amp rural risk coverage. This insurance can provide protection against property damage, liability claims, or other risks specific to rural areas.

03

Agribusinesses and agricultural professionals: Agribusinesses, such as farm cooperatives, agricultural product manufacturers, or agricultural consultants, may require farm amp rural risk coverage. This insurance can help protect their assets, operations, and mitigate potential risks associated with their services or products.

In summary, anyone involved in farming, rural property ownership, or agribusiness may need farm amp rural risk coverage. It is essential to assess the risks, choose a suitable insurance policy, and fill out the application accurately and completely to ensure adequate protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my farm amp rural risk directly from Gmail?

farm amp rural risk and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send farm amp rural risk to be eSigned by others?

Once you are ready to share your farm amp rural risk, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete farm amp rural risk online?

Filling out and eSigning farm amp rural risk is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is farm amp rural risk?

Farm & rural risk refers to potential hazards or dangers that could impact agricultural operations or rural areas.

Who is required to file farm amp rural risk?

Farmers, landowners, and operators of rural businesses are typically required to file farm & rural risk assessments.

How to fill out farm amp rural risk?

Farm & rural risk assessments can be filled out by providing detailed information on potential risks, hazards, and mitigation measures in agricultural and rural settings.

What is the purpose of farm amp rural risk?

The purpose of farm & rural risk assessments is to identify, assess, and mitigate potential risks to agricultural operations and rural communities.

What information must be reported on farm amp rural risk?

Information that must be reported on farm & rural risk assessments includes details on hazards, risks, mitigation measures, and emergency response plans.

Fill out your farm amp rural risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farm Amp Rural Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.