Get the free Not-for-Profit Organization Management Liability Application

Show details

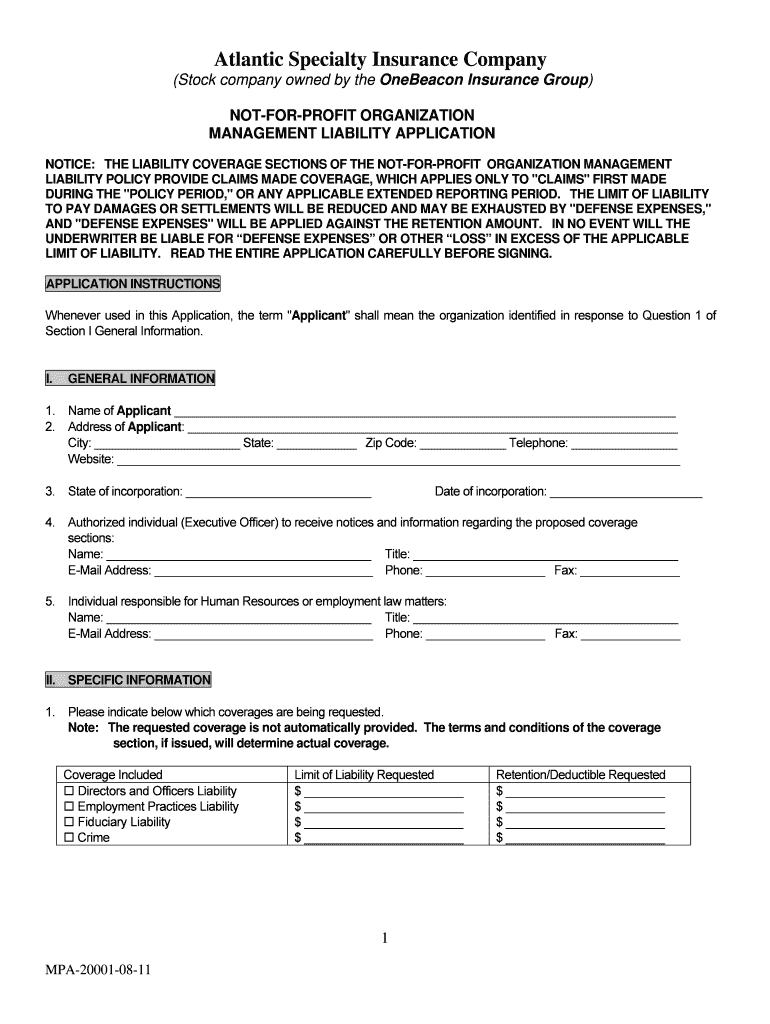

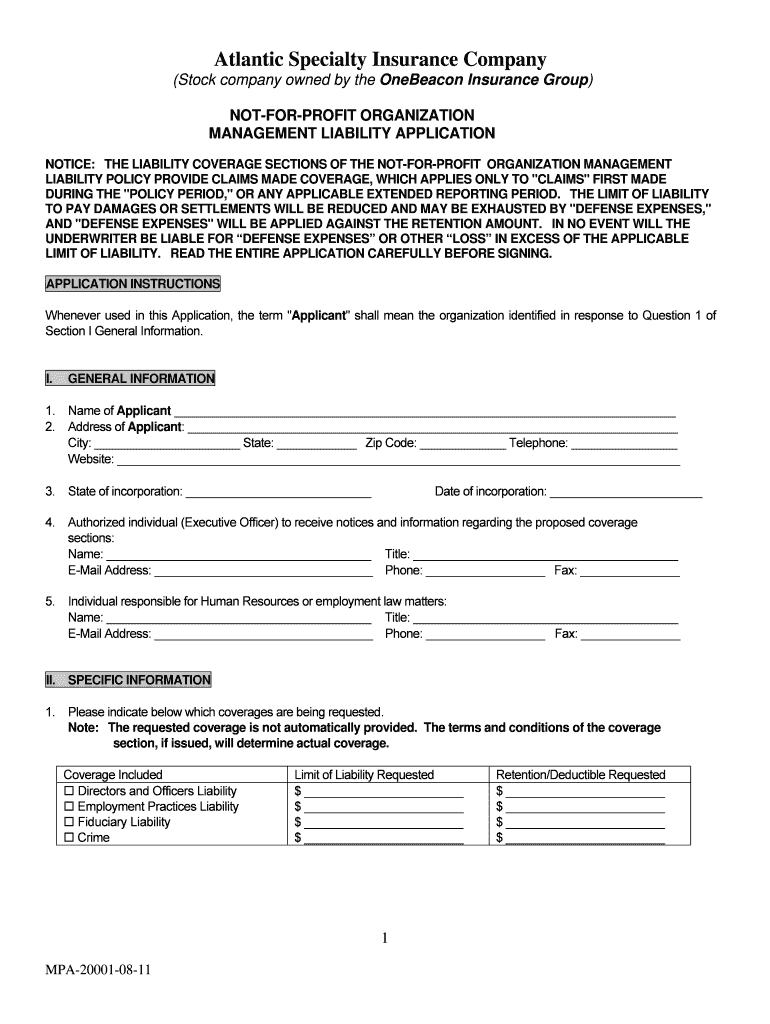

Atlantic Specialty Insurance Company (Stock company owned by the Beacon Insurance Group) NOT-FOR-PROFIT ORGANIZATION MANAGEMENT LIABILITY APPLICATION NOTICE: THE LIABILITY COVERAGE SECTIONS OF THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign not-for-profit organization management liability

Edit your not-for-profit organization management liability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your not-for-profit organization management liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit not-for-profit organization management liability online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit not-for-profit organization management liability. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out not-for-profit organization management liability

Point by point how to fill out not-for-profit organization management liability:

01

Identify the specific risks faced by your organization: Before filling out the form, it is important to understand the potential risks that your not-for-profit organization faces. This can include risks related to management decisions, employment practices, financial mismanagement, and other potential liabilities unique to your organization.

02

Assess your coverage needs: Review your existing insurance policies to determine if they provide adequate coverage for the specific risks faced by your not-for-profit organization. Consider the potential financial consequences of different types of lawsuits and liabilities to ensure that you choose a management liability policy that provides appropriate coverage limits.

03

Gather necessary information: When filling out the not-for-profit organization management liability form, you will likely need to provide information about your organization's structure, operations, financials, and governance. This may include details about your board of directors, officers, employees, volunteers, financial statements, and any previous claims or lawsuits. Ensure that you have all the necessary information readily available before beginning the form.

04

Complete the form accurately and thoroughly: Take your time to carefully fill out each section of the form. Provide accurate and complete information to help the insurance provider understand your organization's risk profile and coverage needs. Be sure to answer all questions honestly and be prepared to provide any supporting documentation or additional details that may be required.

05

Seek professional assistance if needed: If you are unsure about any aspect of filling out the not-for-profit organization management liability form, consider seeking professional advice. An insurance broker or attorney with experience in the field of not-for-profit insurance can help you navigate the form and ensure that you have adequate coverage for your organization's specific needs.

Who needs not-for-profit organization management liability?

01

Non-profit organizations with a board of directors and officers: Not-for-profit organizations that have a board of directors and officers should consider obtaining management liability coverage. This includes organizations such as charities, religious institutions, educational institutions, social service agencies, and cultural organizations.

02

Organizations that handle donor funds or financial assets: Not-for-profit organizations that handle significant amounts of money, such as donor funds or other financial assets, should consider management liability coverage. This can help protect against claims related to financial mismanagement, embezzlement, or mishandling of funds.

03

Organizations with employees or volunteers: If your not-for-profit organization has employees or utilizes volunteers, it can benefit from management liability coverage. This can provide protection against claims related to employment practices, such as wrongful termination, discrimination, or harassment.

04

Organizations that have contracts or agreements with third parties: Not-for-profit organizations that enter into contracts or agreements with third parties, such as vendors, partners, or service providers, may need management liability coverage. This can help protect against claims arising from contractual disputes or other legal issues.

05

Organizations that engage in advocacy or lobbying activities: Not-for-profit organizations that engage in advocacy or lobbying activities should consider management liability coverage. This can help protect against claims related to defamation, libel, or slander arising from their advocacy efforts.

Overall, not-for-profit organization management liability coverage is essential for any organization that wants to protect its directors, officers, employees, and volunteers from potential lawsuits or financial losses resulting from their management decisions and actions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out not-for-profit organization management liability using my mobile device?

Use the pdfFiller mobile app to complete and sign not-for-profit organization management liability on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit not-for-profit organization management liability on an Android device?

You can make any changes to PDF files, like not-for-profit organization management liability, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out not-for-profit organization management liability on an Android device?

Use the pdfFiller mobile app to complete your not-for-profit organization management liability on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is not-for-profit organization management liability?

Not-for-profit organization management liability refers to the coverage that protects the directors, officers, and board members of a non-profit organization from lawsuits alleging mismanagement or wrongful acts.

Who is required to file not-for-profit organization management liability?

Non-profit organizations with a board of directors or officers are typically required to have not-for-profit organization management liability insurance.

How to fill out not-for-profit organization management liability?

You can fill out not-for-profit organization management liability insurance application forms provided by insurance companies that specialize in this type of coverage.

What is the purpose of not-for-profit organization management liability?

The purpose of not-for-profit organization management liability insurance is to protect the personal assets of directors, officers, and board members in case they are sued for their actions while serving the organization.

What information must be reported on not-for-profit organization management liability?

Information such as the organization's name, structure, activities, number of directors/officers, and any past legal claims or history of misconduct must be reported on not-for-profit organization management liability applications.

Fill out your not-for-profit organization management liability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not-For-Profit Organization Management Liability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.