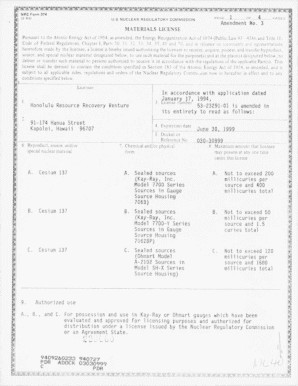

Get the free Application for Business Use of Unit

Show details

This application outlines the requirements and procedures for property owners in the Lake Shastina community to request a permit for a home-based business. It details the non-refundable processing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for business use

Edit your application for business use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for business use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

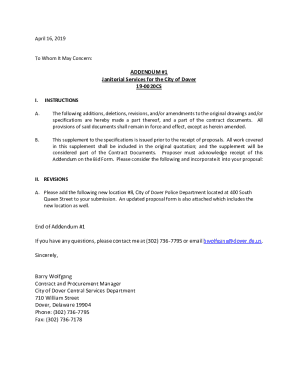

Editing application for business use online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for business use. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for business use

How to fill out Application for Business Use of Unit

01

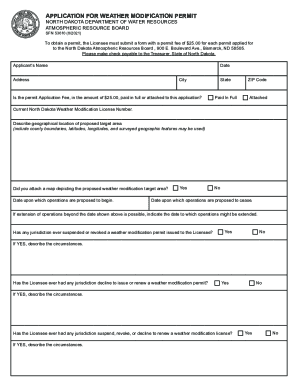

Obtain the application form for Business Use of Unit from the relevant authority or website.

02

Fill in your personal details such as name, address, and contact information at the top of the form.

03

Specify the details of the unit you intend to use for business purposes.

04

Provide a brief description of the type of business activities you plan to conduct in the unit.

05

Include any required documentation, such as proof of business registration or relevant licenses.

06

Review all the information entered to ensure accuracy and completeness.

07

Sign and date the application form.

08

Submit the completed application to the designated office or through the provided submission method.

Who needs Application for Business Use of Unit?

01

Any individual or business entity looking to use a residential or commercial unit for business activities.

02

Entrepreneurs seeking to register their business operations in a specific location.

03

Small business owners requiring approval for a home-based business.

Fill

form

: Try Risk Free

People Also Ask about

Can I deduct living expenses if I work away from home?

No, you cannot deduct any expense for living costs while you are waiting to find a permanent home, it is simply not a moving cost, or temporary living cost that is eligible for deduction. It's just a personal expense as far as tax laws go.

Can I write off my rent as a business expense if I work from home?

You can claim a percentage of expenses such as rent, mortgage interest, utilities, insurance, and repairs. Depreciation is also an allowable expense for a home that you own. For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25).

What is the $2500 expense rule?

Adopting the de minimis safe harbor provides several advantages: Simplified tax recordkeeping: Property owners can immediately deduct expenses for purchases like appliances or minor upgrades if they cost $2,500 or less per item. This ease of documentation aids in maintaining straightforward tax records.

Can I write off my rent if I run my business from home?

Unless your business is renting the entire space in its own name, no you cannot write off your rent.

Can I deduct the rent I pay for my home?

States offering renter tax deductions California: Offers a tax credit to renters who paid rent for at least half of the year and meet income thresholds. Single filers earning less than $50,746 and married filers earning less than $101,492 may qualify for a credit of $60–$120.

Can I deduct my rent from taxes if I work from home?

You can claim a percentage of expenses such as rent, mortgage interest, utilities, insurance, and repairs. Depreciation is also an allowable expense for a home that you own. For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25).

How much can I deduct for business use of a home?

Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction: The simplified option has a rate of $5 a square foot for business use of the home. The maximum size for this option is 300 square feet. The maximum deduction under this method is $1,500.

Can I use my garage for business?

The garage could be used for various business-related purposes, such as storing business inventory, parking business vehicles, or even as a workspace for certain types of businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Business Use of Unit?

The Application for Business Use of Unit is a form used to request permission or approval to utilize a specific unit or property for business-related activities.

Who is required to file Application for Business Use of Unit?

Individuals or businesses that intend to use a unit for commercial purposes are required to file the Application for Business Use of Unit.

How to fill out Application for Business Use of Unit?

To fill out the Application for Business Use of Unit, provide necessary details such as the applicant's information, specifics about the unit, intended business activities, and any supporting documentation as required.

What is the purpose of Application for Business Use of Unit?

The purpose of the Application for Business Use of Unit is to ensure that the proposed business activities comply with zoning regulations and to assess the potential impact on the community.

What information must be reported on Application for Business Use of Unit?

The Application for Business Use of Unit must report the applicant's contact details, type of business, description of intended use, location of the unit, and any relevant licenses or permits.

Fill out your application for business use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Business Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.