Get the free HOP Program Homebuyer / Homeowner Assistance Agreement - floridahousing

Show details

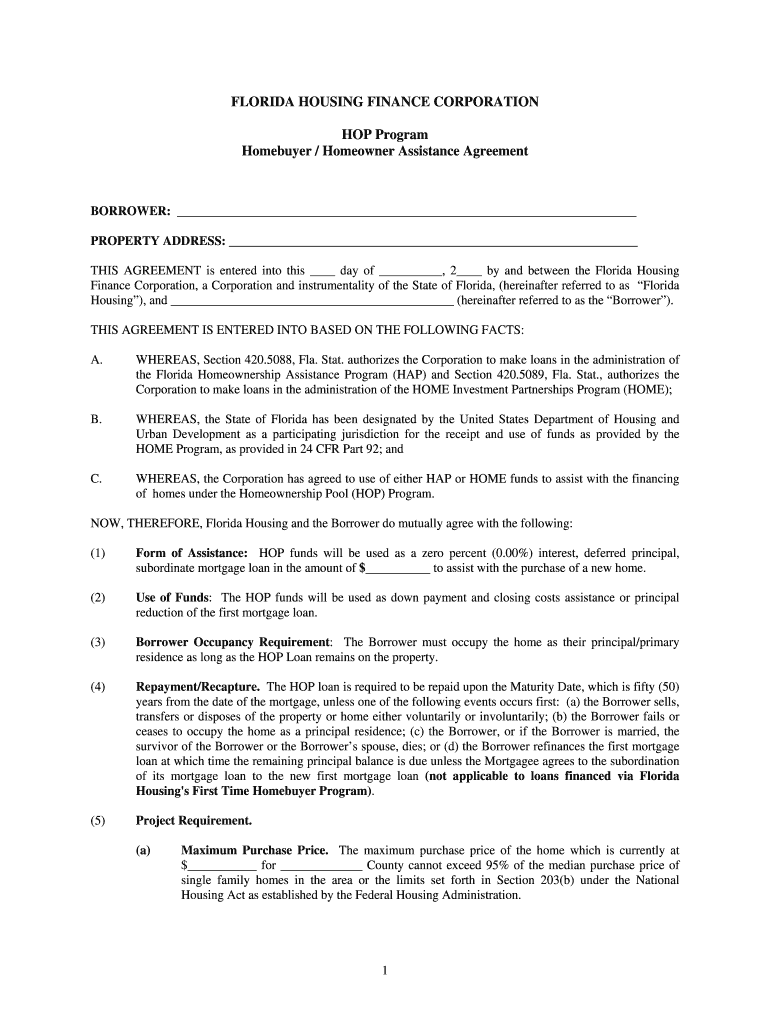

Este acuerdo se celebra entre la Corporación de Finanzas de Vivienda de Florida y el prestatario para proporcionar asistencia financiera en la compra de viviendas a través del Programa HOP, que

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hop program homebuyer homeowner

Edit your hop program homebuyer homeowner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hop program homebuyer homeowner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hop program homebuyer homeowner online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hop program homebuyer homeowner. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hop program homebuyer homeowner

How to fill out HOP Program Homebuyer / Homeowner Assistance Agreement

01

Read the program guidelines thoroughly to understand eligibility requirements.

02

Gather necessary documentation, including proof of income, credit history, and employment status.

03

Fill out the application form with accurate personal information.

04

Provide details about the home you wish to purchase or the assistance needed for your current home.

05

Review the agreement for any specific terms and conditions.

06

Sign and date the agreement to confirm your acceptance of the terms.

07

Submit the completed agreement and required documents to the relevant program office.

Who needs HOP Program Homebuyer / Homeowner Assistance Agreement?

01

First-time homebuyers seeking financial assistance.

02

Low to moderate-income individuals or families needing support for home purchase.

03

Current homeowners facing challenges with home repairs or mortgage payments.

04

Individuals with financial difficulties looking for resources to maintain homeownership.

Fill

form

: Try Risk Free

People Also Ask about

Does being on food stamps affect buying a house?

1:49 2:59 To learn more check out these links which you can click in the description. Below. And feel free toMoreTo learn more check out these links which you can click in the description. Below. And feel free to comment your questions. We're here to help. Want the inside scoop on your neighborhood.

Does financial aid affect buying a house?

Having student loan payments can also make it challenging to save for a down payment on a home. Loan options that require low or no down payment can provide a path to home ownership if you have student loan debt. However, no down payment can increase other costs, such as interest rate, fees, and the total mortgage.

Does government assistance affect buying a house?

0:19 3:11 Resources. If you receive government assistance such as food stamps it is treated like any otherMoreResources. If you receive government assistance such as food stamps it is treated like any other income. Source lenders can consider whether this income is stable.

What income do banks look at when buying a house?

You can use many different income sources to qualify for a mortgage, including: Employment income: Base pay or wages, bonuses, commissions, overtime payments and self-employment income. Schedule K-1: Income and distributions from partnerships, S corporations and estates.

Do food stamps count as income for housing?

0:19 2:29 They are not treated as taxable income. And they are not usually counted when calculating your totalMoreThey are not treated as taxable income. And they are not usually counted when calculating your total income for housing purposes. For example if you're applying for an apartment.

Can you buy a house while on government assistance?

0:44 3:11 If you're on government assistance. And have a low income there are still options. Available. ThereMoreIf you're on government assistance. And have a low income there are still options. Available. There are various loan programs designed for low-income. And disabled individuals.

What is the first time home buyer program in Montgomery County Maryland?

Montgomery Homeownership Program MMP first mortgage comes with a second mortgage equal to 40% of the qualifying borrower income with a maximum amount of $25,000 for down payment and closing cost assistance. Any funds not needed for down payment or closing costs will be applied to principal curtailment (no cash-out).

Do food stamps affect your future?

0:51 2:50 So you don't need to report them on your tax. Return this means they won't affect your tax bill orMoreSo you don't need to report them on your tax. Return this means they won't affect your tax bill or refund. Either in summary getting food stamps does not affect your credit score.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOP Program Homebuyer / Homeowner Assistance Agreement?

The HOP Program Homebuyer / Homeowner Assistance Agreement is a formal contract that outlines the terms and conditions under which assistance is provided to eligible homebuyers or homeowners as part of the Housing Opportunities Program (HOP).

Who is required to file HOP Program Homebuyer / Homeowner Assistance Agreement?

Homebuyers or homeowners who are receiving assistance under the HOP Program are required to file the HOP Program Homebuyer / Homeowner Assistance Agreement.

How to fill out HOP Program Homebuyer / Homeowner Assistance Agreement?

To fill out the HOP Program Homebuyer / Homeowner Assistance Agreement, individuals must provide personal information, details about the property, the type of assistance being sought, and any required documentation as specified by the program guidelines.

What is the purpose of HOP Program Homebuyer / Homeowner Assistance Agreement?

The purpose of the HOP Program Homebuyer / Homeowner Assistance Agreement is to ensure that both the assistance provider and the recipient understand their rights and responsibilities, and to establish a formal framework for the assistance being provided.

What information must be reported on HOP Program Homebuyer / Homeowner Assistance Agreement?

The information that must be reported on the HOP Program Homebuyer / Homeowner Assistance Agreement includes identification details of the parties involved, specifics about the assistance, property information, and any financial information as required by the program.

Fill out your hop program homebuyer homeowner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hop Program Homebuyer Homeowner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.