Get the free Trustee if applicable - Frontdesk

Show details

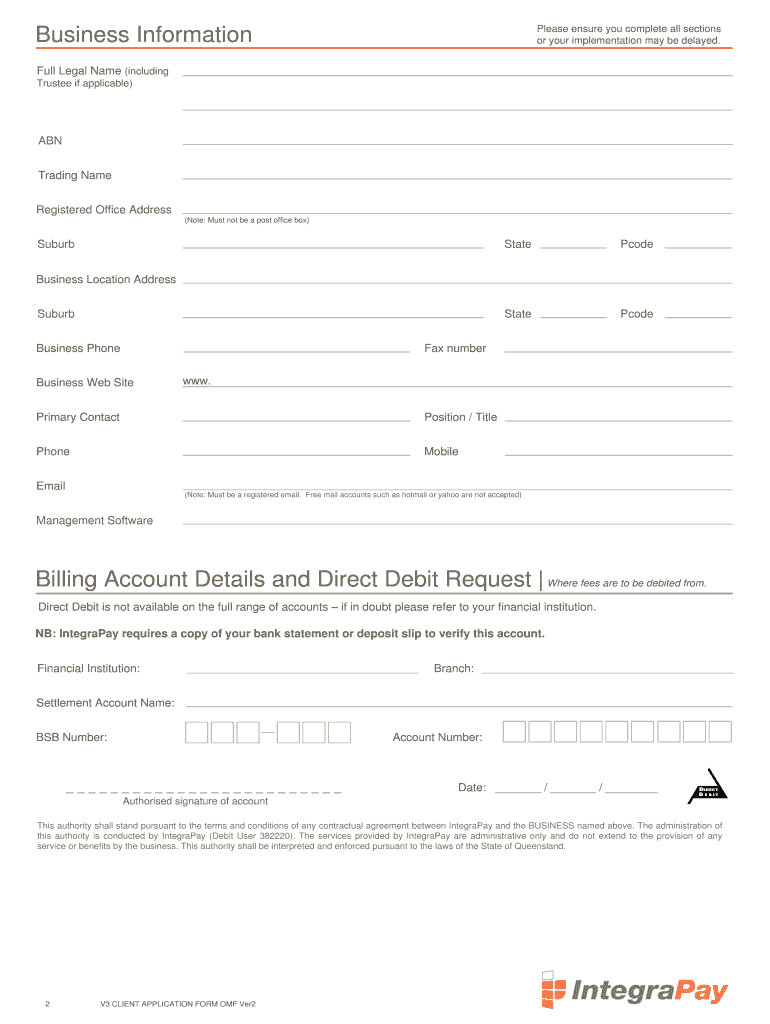

Application Form ABN: 63 135 196 397 PO Box 6290 Upper Mt Gravity, Queensland 4122 pH: 07 3040 4320 Fax: 07 3343 8590 Email: admin integrapay.com.AU Australian Financial Services License No. 418105

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trustee if applicable

Edit your trustee if applicable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trustee if applicable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trustee if applicable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit trustee if applicable. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trustee if applicable

How to fill out trustee if applicable:

01

Start by gathering all the necessary information about the trustee. This includes their full name, contact information, and any other relevant details.

02

Ensure that you have a clear understanding of why a trustee is applicable in your situation. This could be due to legal requirements, specific instructions in a will or trust document, or the need for a designated individual to manage certain assets or decision-making processes.

03

Ensure that you have the correct legal forms or documents to fill out. These may vary depending on your jurisdiction and the specific requirements of your situation. It is advisable to consult with a legal professional to ensure you are using the correct forms.

04

Begin filling out the trustee information on the designated forms. Provide accurate and complete information to avoid any potential complications or issues in the future.

05

Double-check all the information you have provided to ensure accuracy and completeness. This is crucial as any mistakes or omissions may cause delays or legal complications.

06

If required, make sure to have the trustee sign the forms in the presence of a witness or as per the legal requirements of your jurisdiction.

07

Once the forms are filled out and signed, submit them to the relevant authorities or parties involved. Follow any additional instructions or procedures provided to ensure the proper processing of your trustee appointment.

Who needs a trustee if applicable:

01

Individuals who have established a trust and wish to ensure that their assets are managed and distributed according to their wishes.

02

People who are unable or unwilling to manage their own assets and require someone to make financial or legal decisions on their behalf.

03

Parents or guardians who want to designate a trusted person to manage assets or make decisions for their minor children.

04

Businesses or organizations that require a designated individual or group to handle financial, administrative, or operational matters.

Overall, the need for a trustee is determined by individual circumstances and legal requirements, varying from case to case. It is always recommended to seek professional advice to understand whether a trustee is applicable in your particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my trustee if applicable directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your trustee if applicable and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete trustee if applicable online?

Easy online trustee if applicable completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete trustee if applicable on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your trustee if applicable by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is trustee if applicable?

Trustee is a person or entity appointed to manage assets on behalf of a beneficiary as specified in a trust agreement.

Who is required to file trustee if applicable?

The trustee of a trust is required to file trustee if applicable.

How to fill out trustee if applicable?

To fill out trustee, the trustee must provide information about the trust assets, income, and expenses, among other details. It is recommended to consult a tax professional for assistance.

What is the purpose of trustee if applicable?

The purpose of trustee is to report the financial activity of a trust to the relevant tax authorities.

What information must be reported on trustee if applicable?

Information such as trust income, expenses, distributions, and any capital gains must be reported on trustee.

Fill out your trustee if applicable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trustee If Applicable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.